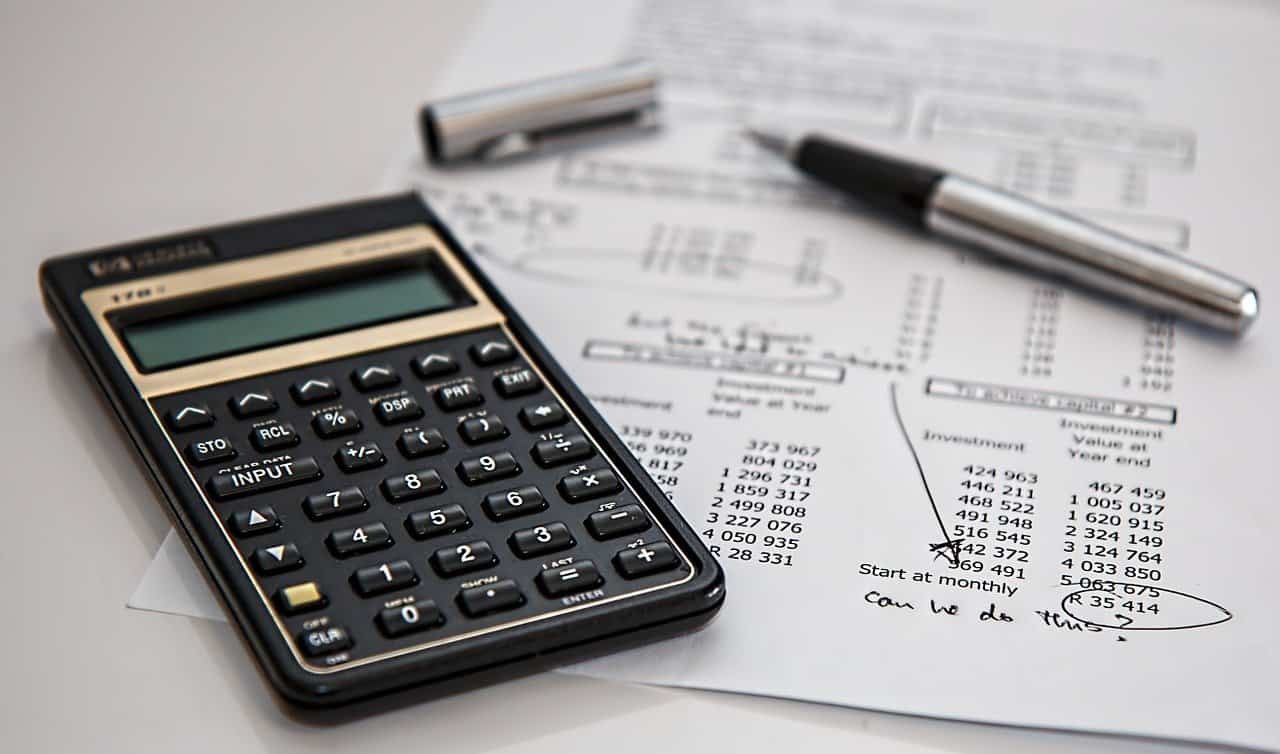

If you want to discreetly release funds from your sales ledger then invoice discounting is the type of invoice finance for you.

Unlike other types of invoice finance, invoice discounting is a confidential service that allows you to release the funding locked up in unpaid invoices from the day you raise them without it being obvious to your customers that you are using the service.

Below we have explored what the leading providers of invoice discounting can offer.

Companies are ranked in no particular order.

| Company | Max Release Value |

|---|---|

| ABC Finance | 95% |

| ABN AMRO Commercial Finance | 90% |

| Advantedge | 90% |

| Aldermore | 90% |

| Allied Irish Bank | 90% |

| Bank of Scotland | 90% |

| Barclays | 90% |

| Bibby Financial Services | 100% |

| Close Brothers | 90% |

| Danske Bank UK | 85% |

| Hitachi Capital | 90% |

| HSBC | 90% |

| Independent Growth Finance | 90% |

| Lloyds Bank | 90% |

| Metro Bank | 90% |

| Muse | Not stated |

| NatWest | 90% |

| Paragon Bank | 95% |

| Peak Cashflow | 85% |

| PFC Finance | 90% |

| Pulse Cashflow Finance | 90% |

| Royal Bank of Scotland | 90% |

| Satago | Not stated |

| Satellite Finance | 90% |

| Skipton Business Finance | 90% |

| Time Finance | 90% |

| Trade Finance Global | Not stated |

| Ulster Bank | 90% |

| Ultimate Finance | 95% |

| White Oak | 95% |

1. ABC Finance

- Provides a brokerage service

- Choice of invoice finance products including discounting

- Offers up to 95% of invoice values

- No brokerage fees

- Service fee applies

- A percentage fee called a discount fee is charged on borrowed funds

- They will help you search the whole market

- Retain responsibility for your debts

- Confidential service

- Apply over the phone

Website ABC Finance Invoice Discounting

Read the full ABC Finance review

2. ABN AMRO Commercial Finance

- Offers asset lending products including discounting

- Advance up to 90% of invoice values

- Funding can be received in days

- Confidential service

- Allows you to retain control of your sales ledger and credit control

- Flexible finance

- Online account management

- Option to add Bad Debt Protection

- Provides a personal account manager/relationship manager

- Apply over the phone

Website ABN AMRO Commercial Finance Invoice Discounting

Read the full ABN AMRO Commercial Finance review

3. Advantedge

- Provides a choice of invoice finance products including discounting

- Up to 90% of unpaid invoice values can be released

- Access funds quickly, same day if invoices are loaded before midday

- Keep your credit control

- Confidential service

- Manage your account online

- Grows with your business sales

- Retain your customer relationships

- Suitable for a variety of SMEs

- Apply over the phone

Website Advantedge Invoice Discounting

Read the full Advantedge review

4. Aldermore

![]()

- Provides a range of invoice finance including discounting

- Release up to 90% of invoice values

- Funds can be received in 24 hours

- Provides discounting to established credit control

- Confidential service

- Retain your invoice collections

- Manage your account online

- Funding availability is recalculated after every transaction

- Option to add Bad Debt Protection

- Apply over the phone

Website Aldermore Invoice Discounting

Read the full Aldermore review

5. Allied Irish Bank

- Offers invoice discounting only

- Up to 90% of unpaid invoice values can be released

- Confidential arrangement

- Maintain your relationships with your customer

- Customers pay invoices into a designated collection account

- A service fee is applied

- A discount charge is applied to each transaction

- Fees are agreed at the time of sanction

- Security may be required

- Apply over the phone

Website Allied Irish Bank Invoice Discounting

6. Bank of Scotland

- Offers a choice of invoice finance that includes discounting

- Advance up to 90% of invoice values

- Funds can be received in 24 hours

- Option of single or full invoice finance

- Confidential service

- Can select invoices for funding (single invoice finance)

- Online account management

- Service that can grow with your sales

- Offers debtor protection

- Apply through Lloyds Bank which they deliver in partnership with

Website Bank of Scotland Invoice Discounting

Read the full Bank of Scotland review

7. Barclays

- Offers invoice finance in partnership with MarketFinance

- Their range include invoice discounting

- Choice of selective or whole ledger invoice discounting

- Release up to 90% of invoice values

- Confidential service

- Maintain your customer relationships and payments

- Choose the invoices to use

- Online management

- Funding can grow with your turnover

- Apply online

Website Barclays Invoice Discounting

Read the full Barclays review

8. Bibby Financial Services

- Provides a choice of invoice finance including discounting

- Can access up to 100% of unpaid invoice values

- Funds released in 24 hours

- Confidential service

- Retain your customer relationships

- Manage online

- Suitable for credit terms between 30 and 90 days

- Must have strong credit management

- Add Bad Debt Protection

- Request a call back to enquire/apply

Website Bibby Financial Services Invoice Discounting

Read the full Bibby Financial Services review

9. Close Brothers

- Provides a range of invoice finance products including discounting

- Release up to 90% of unpaid invoice values

- Receive funds instantly in real-time with your ledger

- Maintain control over the collection of payments

- Confidential service

- Grows with your business

- Integrates with your accounting system

- Caters for your whole sales ledger

- Minimum turnover of £500,000

- Apply over the phone or enquire online

Website Close Brothers Invoice Discounting

Read the full Close Brothers review

10. Danske Bank

- Offers a range of invoice financing including discounting

- Up to 85% of invoice values

- Confidential service

- Retain all customer contact

- Online system to process invoices for funding

- Rates and terms reflect their assessment of your business

- Can improve cash flow

- Requires you to have or open a Danske Bank account

- Must provide Personal Indemnities

- Apply over the phone

Website Danske Bank Invoice Discounting

11. Hitachi Capital

- Provides a choice of invoice finance including discounting

- Release up to 90% of unpaid invoice values

- Access payments up to 120 days early

- Funds received within 24 hours

- Can grow with your business turnover

- Confidential service

- Offers a 6 month trial period

- Suitable for medium-sized businesses

- Turnover over £250,000

- Apply over the phone

Website Hitachi Capital Invoice Discounting

Read the full Hitachi Capital review

12. HSBC

- Provides a choice of invoice finance including discounting

- Release up to 90% of invoice values

- Receive funds the next day

- Keep control of your sales ledger

- Confidential service

- Improve your cash flow

- Grows in line with your sales

- Arrangement fees apply

- Add credit protection to guard against late payments or bad debts

- Apply over the phone

Website HSBC Invoice Discounting

Read the full HSBC review

13. Independent Growth Finance

- Only offers invoice discounting

- Release up to 90% of invoice values

- Forms part of their Asset-Based Lending facility

- Provides a revolving funding line

- Can grow with your business

- Supports business growth

- Can make fast decisions

- Offers a personalised service

- Can supplement funding using additional assets

- Apply over the phone or enquire online

Website Independent Growth Finance Invoice Discounting

Read the full Independent Growth Finance review

14. Lloyds Bank

- Offers a choice of invoice financing including discounting

- Release up to 90% of invoice values

- Receive funding normally within 24 hours

- Confidential service

- Continue to manage your sales ledger and credit control processes

- Increase your borrowing as your sales rise

- Available for UK and overseas debt

- Dedicated Client Manager

- Suitable for businesses with a turnover above £250,000

- Apply over the phone

Website Lloyds Bank Invoice Discounting

Read the full Lloyds Bank review

15. Metro Bank

- Provides a choice of invoice finance including discounting

- Release up to 90% of invoice values

- Can receive funding within 24 hours

- Offers flexible contracts

- 28 day notice period

- Online system that is easy to use

- Provides a named Relationship Manager

- Caters for small businesses

- Offers funding up to £100,000

- Apply online

Website Metro Bank Invoice Discounting

Read the full Metro Bank review

16. Muse

- Offers a variety of invoice finance products including discounting

- Doesn’t state the amount you can release

- Confidential service

- Retain control of your sales ledger

- Will support your business in the background

- Lets you keep your customer relationships

- Help to improve your cash position

- Contract may apply

- Fees and charges are not stated

- Enquire online

Website Muse Invoice Discounting

17. NatWest

- Offers an invoice discounting product only

- Up to 90% of unpaid invoice values can be released

- Funds can be received in 24 hours

- Confidential service

- Keep control of your sales ledger

- Service available in GBP, EUR and USD

- Easy to use

- Manage your account online

- Dedicated Relationship Manager

- Enquire online

Website NatWest Invoice Discounting

Read the full NatWest review

18. Paragon Bank

- Provides a choice of invoice finance including discounting

- Access up to 95% of unpaid invoice values

- Can receive funds within 24 hours

- Confidential service

- Improve your cash flow

- Flexible terms

- Can grow with your business turnover

- Simple fee structure and no hidden fees

- Offers additional customer protection service

- Apply over the phone

Website Paragon Bank Invoice Discounting

Read the full Paragon Bank review

19. Peak Cashflow

- Offers a choice of invoice financing including discounting

- Release up to 85% of invoice values

- Funds will be released as soon as your invoice is raised

- Confidential so customers won’t know

- Tailor-made package

- Flexible to your business needs

- Can grow with your business

- Offers a 45 minute consultation

- Offers additional products including Bad Debt Protection

- Apply over the phone or enquire online

Website Peak Cashflow Invoice Discounting

Read the full Peak Cashflow review

20. PFC Finance

- Offers a brokerage service

- Provides a choice on invoice finance including discounting

- Release up to 90% of invoice values

- Confidential service

- Allows you to keep control of your customers

- Improve your cash flow

- Helps you to find the best provider

- Caters for a wider range of industries

- Apply over the phone

Website PFC Finance Invoice Discounting

Read the full PFC Finance review

21. Pulse Cashflow Finance

- Offers a range of invoice financing including discounting

- Up to 90% of invoice values can be released

- Confidential service

- Flexible source of funding

- Improve cash flow

- Transparent fees

- Grows in line with your sales

- Automatic upload of sales ledger

- Suitable for businesses trading for over 2 years with turnover above £2 million

- Apply over the phone

Website Pulse Cashflow Finance Invoice Discounting

Read the full Pulse Cashflow Finance review

22. Royal Bank of Scotland

- Offers invoice discounting only

- Up to 90% of unpaid invoice values can be released

- Funding can be released within 24 hours

- Confidential solution

- Maintain control of your sales ledger

- Available in GBP, EUR and USD

- Manage your account online

- Provides a Dedicated Relationship Manager

- Suitable for business with a turnover above £300,000

- Enquire online

Website Royal Bank of Scotland Invoice Discounting

Read the full Royal Bank of Scotland review

23. Satago

- Provides a choice of invoice finance including discounting

- Discounting solution is a full invoice finance solution

- Automatically fund all eligible invoices

- Confidential service

- Quick and easy to use

- Connects securely to accounting software

- Automatic reconciliation

- Transparent pricing with no hidden fees

- Includes cash management tools

- Apply online

Website Satago Invoice Discounting

Read the full Satago review

24. Satellite Finance

- Provides a brokerage service

- Offers a choice of invoice finance including discounting

- Access up to 90% of unpaid invoice values

- Release cash quickly

- Confidential service

- Handle your own sales ledger

- Maintain customer relationships

- Borrowing can grow as sales increase

- Check your eligibility using their online form

- Apply over the phone

Website Satellite Finance Invoice Discounting

Read the full Satellite Finance review

25. Skipton Business Finance

- Offers a choice of invoice finance including discounting

- Release up to 90% of invoice values

- Receive funds within 24 hours

- Tailored solution for each business

- Confidential solution

- Maintain control of your credit control

- Flexible solution

- Accessing funds from £25,000 to £5 million

- Improve cash flow

- Enquire online

Website Skipton Business Finance Invoice Discounting

Read the full Skipton Business Finance review

26. Time Finance

- Provides a choice of invoice finance including discounting

- Release up to 90% of unpaid invoice values

- Receive funding within 24 hours

- Confidential financing

- Maintain your credit control

- Manage your account online

- Fast decisions

- Caters for start-ups, small to large businesses

- Can choose to add Selective Bad Debt Protection

- Apply over the phone

Website Time Finance Invoice Discounting

Read the full Time Finance review

27. Trade Finance Global

- Provides a brokerage service

- Offers a choice of invoice finance including discounting

- The amount of funding you can access is not stated

- Can choose to release funds from domestic and international invoices

- Confidential service

- Retain control over your sales ledger

- Can opt to release funds from some or all of your invoices

- Requires monthly reconciliation

- Must demonstrate you have correct procedures and support in place

- Enquire online or call for more details

Website Trade Finance Global Invoice Discounting

Read the full Trade Finance Global review

28. Ulster Bank

- Provides an invoice finance solution that is a discounting solution

- Their web-based system is FacFlow

- Release up to 90% of unpaid invoice values

- Funds can be released the same day

- Confidential service

- Maintain your sales ledger and credit control

- Provides a secure service

- Dedicated relationship management team

- Caters for businesses with a turnover above £500,000

- Apply by arranging a meeting over the phone

Website Ulster Bank Invoice Discounting

29. Ultimate Finance

- Provides a choice of invoice finance including discounting

- Release up to 95% of invoice values

- Funding can be received within 24 hours

- Offers a confidential service

- Retain responsibility of your customers

- Can grow with your business

- Dedicated relationship manager

- Also offers Debtor Protection products

- Apply over the phone

Website Ultimate Finance Invoice Discounting

Read the full Ultimate Finance review

30. White Oak

- Offers a choice of invoice finance including discounting

- Up to 95% of unpaid invoice values released

- Confidential solution

- Maintain control of credit collections

- Allows borrowing from £200,000 to £5 million

- Suitable for businesses with a turnover between £200,000 and £10 million

- Must have been trading for over 3 years

- Apply online or request a callback

Website White Oak Invoice Discounting

Read the full White Oak review

How does invoice discounting work?

Invoice discounting is a type of invoice finance that allows you to advance the funds tied up in your unpaid invoices as soon as your invoices are raised. Unlike other financing products, invoice finance like this is not a debt as it is an advance on money owed to you. You can normally advance up to 90% of the unpaid invoice value which can be received in as little as 24 hours.

Invoice discounting is a confidential service that allows you to retain the responsibility of your credit control and sales ledger. It is a more discreet service than invoice factoring and it is less likely that your customers will be aware of the service as the money owed will be paid into an account that is in your name but under the control of the credit provider.

Some providers also offer a selective invoice discounting service which works the same but it allows you to choose which invoices or customers are used to raise funds.

Invoice Discounting FAQ

How much can I borrow?

The level of borrowing through invoice discounting can vary and most providers do not state a maximum lending amount, however, a few have stated theirs as £5 million.

Most providers offer to advance up to 90% of your unpaid invoice amounts but this can vary from 85% to 100% depending on the provider.

The amount you can borrow will also depend on the provider’s terms and their assessment of your eligibility and credit rating.

How much will invoice discounting cost?

The cost of invoice discounting is not clear as most providers do not publicise their charges on their website, and you need to request a quote to find out.

There tend to be 2 sets of charges for invoice discounting which are the service charge and transaction fee.

The service charge is a standard fee that is applied often monthly as a fee for accessing the service and applies for the length of the contract.

The transaction fee is a percentage charge that is applied to every invoice that advance payment is received on and it is taken from the customer payment before the remaining funds are transferred to you.

There may also be some other fees applied such as arrangement or set up costs.

How long can I borrow money for?

The length of time you can borrow the funds through invoice discounting depends on the terms you have with your customers for paying their invoices.

As the finance provider is paid by the customer paying their invoice, the borrowing term matches the customer’s terms which could be 30, 60, 90 or 120 days.

Once the customer pays their invoice to the invoice discounting provider, the loan amount and fees are taken from this payment and the remaining amount is transferred to you.

How to apply for invoice discounting?

Many invoice discounting providers request that you contact them to get a quote which they suggest you do over the phone so that they can discuss your needs.

Some providers have an online enquiry form or application and provide a list of their eligibility criteria so that you can check if you are suitable for their products.

The application and set-up process can take up to a couple of weeks to allow them to undertake the relevant checks and to get you set up on their online systems.