The right small business payroll software is critical to your business. Make a mistake and you could get a massive fine from HMRC.

There are 127 different payroll software companies in the UK. So how do you find the right one for your business?

Most websites only list software providers that pay them a commission. We’re a little different.

We scoured genuine user reviews from Trustpilot, iPhone App Store and the Google Play Store to find the 11 best payroll software companies for UK small businesses.

They are ranked below based on these scores, not how much they’re paying us.

And to be clear some of these companies do pay us a commission, but most don’t. (You can see who’s currently paying us a commission at the bottom of this page).

Best Small Business Payroll Software Providers With An App

| Software | Trustpilot Rating | iPhone App Rating | Android App Rating |

|---|---|---|---|

| Rippling | 4.8 | 3.0 | No Rating |

| BrightPay | 4.6 | 2.8 | 3.3 |

| FreeAgent | 4.6 | 4.8 | 4.7 |

| QuickBooks Payroll | 4.6 | 4.4 | 3.7 |

| ANNA Free PayRoll | 4.5 | 4.5 | 4.5 |

| PayCaptain | 4.5 | 4.8 | 4.5 |

Rippling: Highest Rated With An App

Rippling is the highest rated small business payroll software in the UK with an app.

Rippling Reviews:

- 4.8 out of 5 on Trustpilot (based on 1,018 reviews)

Here are some key things to know about it:

Rippling Cost

Rippling’s pricing is very straightforward but not 100% transparent.

They charge per user (employee) per month.

Prices start from £7 per user per month but can vary based on the total number of users and what features your business needs.

They do not have a free plan or a free trial unlike some other companies on the list.

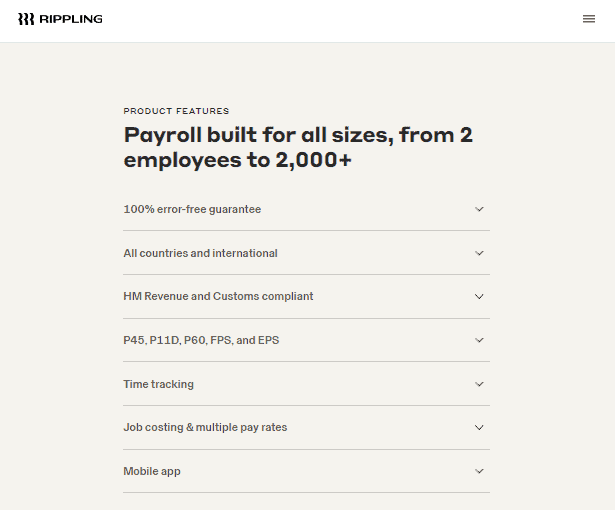

Rippling Features

Here are some of Rippling’s main features:

- 100% error-free guarantee

- All countries and international

- HM Revenue and Customs compliant

- P45, P11D, P60, FPS, and EPS

- Time tracking

- Job costing & multiple pay rates

- Mobile app

In addition it can integrate with the following other programs:

Below are some Pros and Cons taken from real customers on Trustpilot, Getapp and other review sites.

Rippling Pros

- “One of my favorite Rippling features is the reminder function — it makes sure I don’t miss any deadlines and nothing falls through the cracks. I have hit all my onboarding sign ups, open enrollments, etc., right on time. I also love the design and ease of use. It’s simple and easy to find information from one hub.”

- “Rippling is the perfect tool for managing employee information and tracking employee changes. With Rippling, you can keep all your employee files in one place and easily update employee information as it changes. Rippling also makes tracking employee changes easy, so you always know who is hired, promoted, or fired. Overall, Rippling is a great way to manage your employee information.”

- “Makes linking payroll and time charts very easy to manage.”

- “Loved the ease of it, the interface and the reporting. Easily managed by the employee.”

- “Much easier than our last payment database. Very intuitive.”

Rippling Cons

- “This company is wonderfully automated until you need a person. Then they don’t respond or help in any way.”

- “I would like to be able to link my QSHERA directly to the software.”

- “For overseas team members we would have had to use a EOC which was not the idea of having a global system. This was really only a US solution”

BrightPay

Brightpay has very high Trustpilot reviews, but the same can’t be said about it’s app.

BrightPay Reviews

- 4.6 out 5 on Trustpilot (based on 188 reviews)

- 2.8 out of 5 on iPhone App Store (based on 49 reviews)

- 3.3 out of 5 on Google Play (based on 173 reviews)

Here are the key things to know about BrightPay.

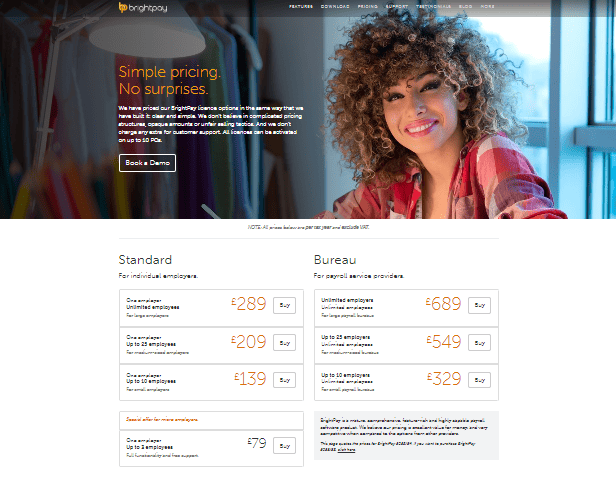

BrightPay Costs

BrightPay offers a 60 day free trial of their software. This gives you lots of time to try it and see if you like it.

Their cheapest plan comes in at £79 + VAT per month, they also have plans at £289 + VAT per month and a full bureau service from £689 + vat per month.

BrightPay Features

Special Offer Features

- One employer

- Up to 3 employees

- Full functionality and free support.

Standard Features

- One employer

- Unlimited employees

- For large employers

Bureau Features

- Unlimited employers

- Unlimited employees

- For large payroll bureaus

In addition they offer the following integrations:

- Exact

- Kashflow

- Sage

- Quickbooks

- Xero

Here are some Pro and Cons from Trustpilot, SoftwareAdvice.co.uk and other review sites.

BrightPay Pros

- “Very easy to use, much easier than Sage payroll. Had the free version before and even the support then was second to none. You write an email and in less than a day they get back to you whether you’re a paying customer or using the software for free. You see straight away when you have to submit to HMRC which is for me the most important part as I don’t want to pay a fine. CIS is very easy to do. I’m in my third year with BrightPay and never had a fault in the software whereas with sage it happens frequently.”

- “Inexpensive and talks directly to payroll software.”

- “The interface and usability of this product is very well done and makes it enjoyable to use on a day to day basis.”

- “I’ve tried a lot of payroll software and bright pay has the easiest software to navigate its a user friendly and covers almost all of the payroll concerns”

- “I like that’s it’s so easy to use. You don’t need to have payroll experience. Brightpay alerts you need to send through your RTI and pension contributions. It also is free for auto enrolment. My previous payroll software were charging extra for auto enrolment. I’ve been using Brightpay for over 3 years. I pleased to say they have never increased their prices. It’s an excellent product. The developers clearly have the end user in mind. If you get stuck their help guides are fantastic. 10/10”

BrightPay Cons

- “There is nothing I don’t like, the least I would say that you have to download a new version with every tax year and not just an update.”

- “Lacking on customisation and some of the more advanced features available in other software”

- “The customer support is below average at times when I or my employees have had urgent questions and concerns.”

- “what I wish Brightpay must have is the capacity to trace back or correct some input of records foe example some alteration may have done but it is hard to trace back the records.”

FreeAgent

FreeAgent offers an extremely popular suite of accounting software including payroll processing. Here are some of the key things to know:

FreeAgent Reviews

- 4.6 out of 5 on Trustpilot (based on 2,137 reviews)

- 4.8 out of 5 on iPhone App Store (based on 9,400 reviews)

- 4.7 out of 5 on Google Play (based on 1,100 reviews)

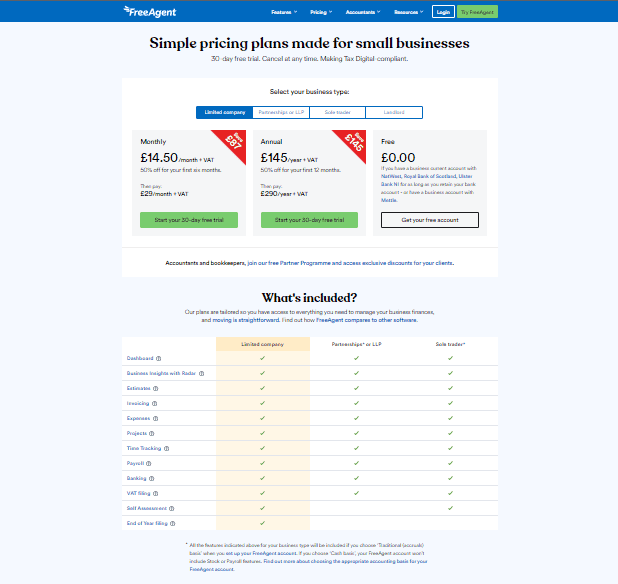

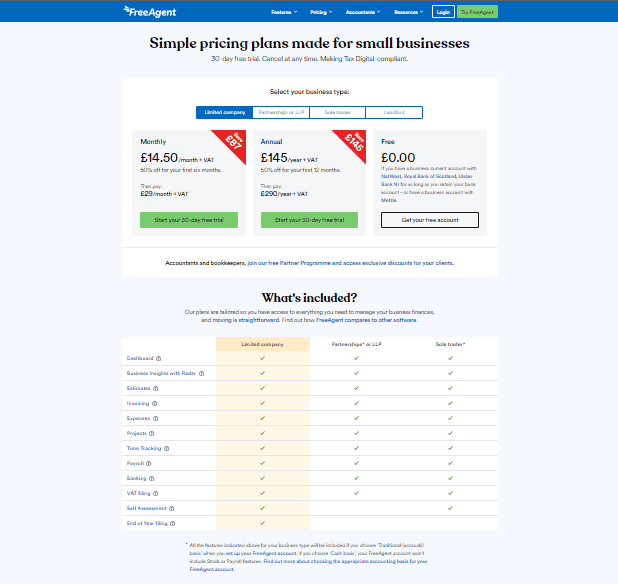

FreeAgent Costs

FreeAgent offers a 30 day free trial on their plans which range in price from £5 to £29 per month + VAT.

However, they also offer a free plan: “If you have a business current account with NatWest, Royal Bank of Scotland, Ulster Bank, for as long as you retain the account – or have a Mettle bank account and make at least one transaction a month.” (Note: Optional add-ons may be chargeable.)

FreeAgent Features

Here are some of FreeAgent’s main features:

- Dashboard – See the big picture for your business at a glance with cashflow, profit and loss, invoice timelines and more.

- Business Insights with Radar – Get intelligent insights, tailored trend-spotting and personalised tips all in one place.

- Estimates – Win more work with professional estimate templates ready to be converted to invoices.

- Invoicing – Get paid faster with easy invoicing tools. Send customised invoices, reminders and thank-you emails.

- Expenses – Track business costs quickly and easily. Snap receipts and record out-of-pocket expenses on the go.

- Projects – Keep tabs on your project income, expenses and profitability – all in one place.

- Time Tracking – Track the time you spend on projects, add this to invoices and generate timesheet reports.

- Payroll – Run monthly payroll and file auto-calculated PAYE and National Insurance directly to HMRC.

- Banking – Set up a bank feed and let all of your transactions flow into FreeAgent automatically.

- VAT filing – Generate MTD-compliant VAT returns automatically and file them directly to HMRC in minutes.

- Self Assessment – Get a real-time view of how much you owe for your tax return and file it directly to HMRC.

- End of Year filing – Generate the data for Final Accounts and Corporation Tax returns and file directly from FreeAgent.

Additionally they offer the following integrations:

- IRIS

- BTCSoftware

- HMRC

- GoSimpleTax

- TaxCalc

- Staffology

- BrightPay

Here are some FreeAgent Pros and Cons from Trustpilot, Software Advice, Capterra and other review sites:

FreeAgent Pros

- “At the moment it’s free through my business banking account – I tried it because of this but it would definitely be worth paying for.

I am relatively new to running a business and the software is very intuitive for a novice. My accountant is pretty happy with it too, so that’s a big thumbs up!

It makes invoicing and payment of exenses very easy, and is great for keeping track of money coming in/out and keeping an eye on invoices due for payment. Payroll is incorporated (you can file it with HMRC through FreeAgent or let your accountant do it separately).

I also like the fact that it reminds me when my corporation tax and annual accounts are due. In a few clicks I can see my profit & loss account and my trial balance as well as spend in the different (customisable) categories.

Really helps me keep on top of everything. The Android app is also great for reconciling payments and recording expenses on the move. The help files are fantastic, and the clear accounting descriptions and explanations make them a great resource for a small business even if you don’t use the software.”

- “The greatest thing about FreeAgent is the ease of bookkeeping, being able to have any bank transactions and PayPal transactions automatically put into bookkeeping form and easily explain what each transaction is, whether it’s a sale or stock purchases.

It is online 24/7 so you can access it without having to worry about losing it and you can also back it up if you really want to. The support times are very quick during normal working hours.”

- “The billing and invoicing functionality is a key feature of the product and works very well. They send a Monday motivator email summarising your agenda for the week on Monday mornings. This includes items such as unbilled hours logged, payments to approve and bills to chase or pay. MFA is supported for increased security.”

- “It’s straight forward, easy to set up and use. Everything you need to manage your accounts is in plain sight rather then you needing to know there is a completely different process somewhere else that actually needs to be completed. The processes are quick and easy to work out.”

FreeAgent Cons

- “Exporting information is a bit tricky in some areas – you can get a pdf out quite easily but an xls or csv would be more useful (you can export the entire company dataset as a csv, but not filtered individual elements such as unpaid expenses or balances within individual accounts).

In some cases you can get round this by cutting and pasting, but it’s a bit fiddly. Exporting all company data does not export attachments – so you need to keep a separate copy of scanned receipts etc outside FreeAgent.

It is one of the more expensive cloud accounting software packages out there, but I have looked at a whole range and you can’t beat the functionality, so that’s what you are paying for I guess!”

- “Some features of FreeAgent are still very buggy, such as the automation of transactions. For example it will either not detect some transactions or it will do too many, which means you have to check on a regular basis to compare the bookkeeping balance to your actual balances shown on PayPal and your bank, which I think almost defeats the purpose of having bookkeeping software.

I really hope they manage to squash these bugs because something as important as tax should not be treated lightly. Early on in their existence they advertised that you would get free accounting advice but now they are very hesitant to do so (e.g: help with knowing how to explain transactions and so on).”

- “It is very clunky and awkward to use. It is very expensive for what it is and definitely not even worth using for free.

Several essential basic functions are missing and it is very restrictive/prescriptive forcing you to work their way or not at all. Customer services regularly have to fudge “”workarounds”” to fill the gaps in FreeAgent’s basic functionality and often these “”workarounds”” make more mess than doing nothing, leaving you with more to pay your accountant to fix it.

FreeAgent does several things in very unusual ways and then doesn’t allow you to fix them. Payroll does post journals into your ledgers but even the best accountants can’t make any sense of them. This software tries to be all things to small businesses giving tools that quite frankly are dangerous to unqualified accountants.

It allows you to do your own VAT, Corporation Tax and Self Assessment wrongly, without any tax planning advice which could cost you tens of thousands of pounds in VAT/tax that isn’t due, not to mention HMRC penalties etc.

I know of several clients who have overpaid an absolute fortune and had seriously damaging run-ins with HMRC as a direct result of trying to DIY using this software. Buyer BEWARE!!!

- There are few things that I don’t like to be honest, the only one that can be annoying is the bank feeds can sometimes be a little slow to show items. A manual refresh option for bank feed data would be useful.”

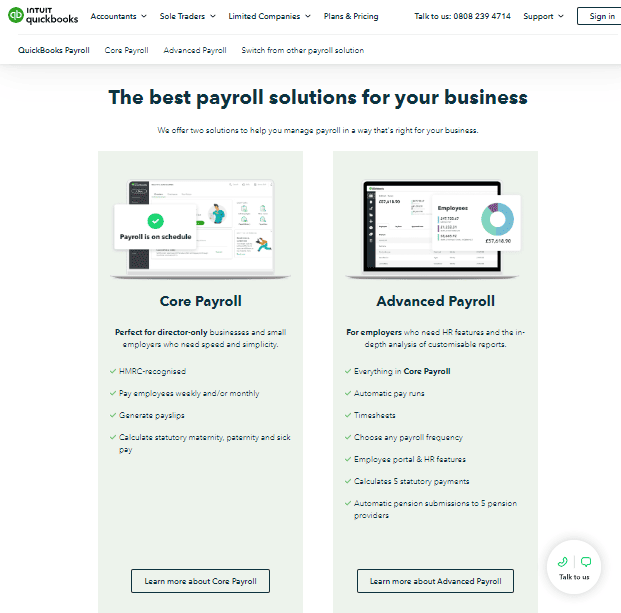

QuickBooks Payroll

QuickBooks Payroll Reviews

- 4.6 out of 5 on Trustpilot (based on 13,039 reviews)

- 4.4 out of 5 on iPhone App Store (based on 814 reviews)

- 3.7 out of 5 on Google Play (based on 30,400 reviews)

QuickBooks Payroll Costs

Quickbooks payroll software starts from just £1.40 per month + £0.40 per month for payroll functionality. However, this is their introductory rate, their full priced plans start at £14 per month + VAT and go up to £70 per month + VAT.

QuickBooks Payroll Features

Here are some QuickBooks Payroll main features:

- HMRC-recognised

- Pay employees weekly and/or monthly

- Generate payslips

- Calculate statutory maternity, paternity and sick pay

- For employers who need HR features and the in-depth analysis of customisable reports.

- Automatic pay runs

- Timesheets

- Choose any payroll frequency

- Employee portal & HR features

- Calculates 5 statutory payments

- Automatic pension submissions to 5 pension providers

Moreover it also integrates with the following software:

Here are some of the Pro and Cons of QuickBooks Payroll from Trustpilot, GetAPP and other third-party review platforms.

QuickBooks Payroll Pros

- If it ain’t broke don’t fix it. QuickBooks has always worked and keeps updating and adding new features our accountants love it.

- Simple, straight forward software does all you need

- The simple form and pension submission …easy to understand

- Very simple to use if you have very little payroll software experience. Very useful reports are available to show overviews of payruns.

- Very Simple to navigate around and also the remainder helping me to avoid Missing payment deadlines.

QuickBooks Payroll Cons

- Could stand to have better support customer response.

- Would be good to integrate pension so I don’t have to log into two systems

- It’s basic but upgrade is available at additional cost

- Not as fully fleshed out as competitors in my opinion such as sage. Expensive.

- The Calculations of Tax and NI deductions

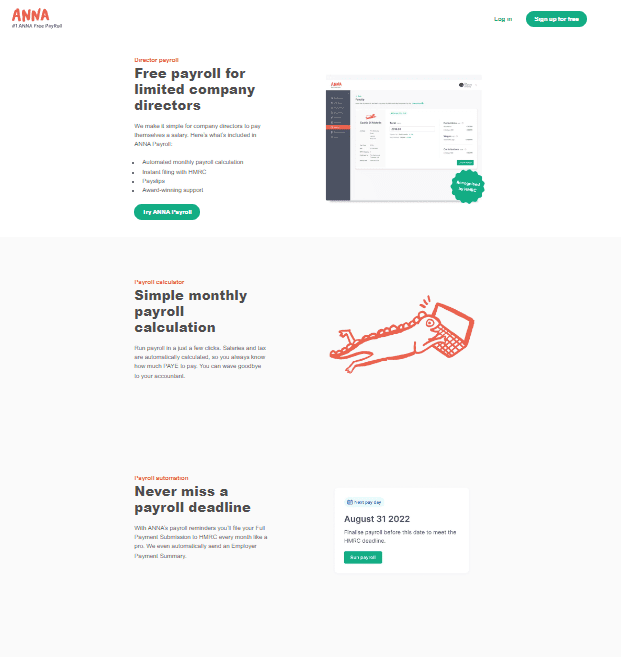

ANNA Free PayRoll

ANNA Free PayRoll Reviews

- 4.5 out of 5 on Trustpilot (based on 2,516 reviews)

- 4.5 out of 5 on iPhone App Store (based on 773 reviews)

- 4.5 out of 5 on Google Play (based on 23 reviews)

ANNA Free PayRoll Costs

ANNA Free PayRoll is completely free as it comes part of ANNA’s free business bank account. However, they also have paid plans at £14.90 and £49.90 per month, which offer more banking features.

ANNA Free PayRoll Features

ANNA doesn’t list a lot of it’s payroll software features on their website, but here are some of their business bank account features:

- Local transfers in and out – 20p per bank transfer

- ATM withdrawals – £1 per ATM withdrawal

- International payments – £5 per SWIFT payment

- Currency conversion fee for transfers – 1%

- Personal payment link for accepting payments – Payment link with 1% commission

- Additional debit cards – 1 debit card included, £3 per extra card

- Pay cash in – Pay cash in with 1% commission

- Pots – £1 per pot monthly

- Cashback on purchases – 1% on select categories

- Prices are shown before VAT

ANNA also has the following integrations:

- Xero

- Sage

- Etsy

- Woo

- ebay

- amazon

Here are some pros and cons taken from Trustpilot and other review sites.

ANNA Free PayRoll Pros

- ANNA’s ‘Pay as you go’ business current account has no monthly fee.

- You can open an ANNA business account in as little as three minutes.

- ANNA offers 24/7 customer support through its mobile app.

- ANNA’s mobile app is available on Android and iOS.

”

ANNA Free PayRoll Cons

- Since ANNA Money is an e-money account, and not a bank account, your money is not protected by the Financial Services Compensation Scheme (FSCS).

- ANNA Money does not accept cheques.

- At £14.90 a month, ANNA’s cheapest paid account is more expensive than many competitors.

PayCaptain

PayCaptain Reviews

- 4.5 out of 5 on Trustpilot (based on 15 reviews)

- 4.8 out of 5 on iPhone App Store (based on 12 reviews)

- 4.5 out of 5 on Google Play (based on 8 reviews)

PayCaptain Costs

PayCaptain no longer publicly list prices on their website.

PayCaptain Features

- Cloud Based Payroll Software

- Registered with the Financial Conduct Authority

- Flexible Payments

- Hi-tech bureau service

- Analytics & pay gap reporting

- Sends all payments to employees via Faster Payments (not BACS)

- Open APIs allow for robust integrations with third-party systems.

PayCaptain also has the following integrations:

- Hibob

- Birdie

- Deputy

- Yapster

- Phase 3

- Rotaready

- Silver Cloud

- PensionSync

- Includability

- Collegia

Here are some pro and cons from Trustpilot, Capterra and other review sites:

PayCaptain Pros

- “Seamless transition and great support tram”

- “Good app that’s accessible by employees; but really impressed at the end of the day by the customer service from the operations and payroll managers”

- “The software is extremely intuitive and user friendly from both an admin and end employee perspective.”

- “All app/web-based so I can run payroll at my fingertips from my mobile. It’s all visual and is easy for our employees to use too. The built-in features of on-demand pay and digital wallets help with the financial well-being of our people.”

- “The integration process was simple and straightforward.”

”

PayCaptain Cons

- “Probably could use a UX improvement in terms of how it looks but it’s not really an issue; all the matters is that it works well and it does! Doesn’t yet sync with Xero – though it does allow you to download journal entries; looking forward to it directly sync with Xero (when will it come?)”

- “Opportunity to automate some communication away from email to make the experience even better”

- “The only feature we feel is missing is the accessibility to past employees P45’s.”

Best Small Payroll Software Without An App

| Software | Trustpilot Rating | Number of Trustpilot Reviews |

|---|---|---|

| Debitam Payroll | 4.9 | 4,495 |

| Qtac Payroll | 4.8 | 121 |

| Deel | 4.8 | 2,919 |

| Pento | 4.6 | 134 |

| PayEscape | 4.5 | 41 |

Debitam Payroll: Highest Rated Company Overall

Debitam Payroll Reviews

Debitam Payroll has the highest overall rating on Trustpilot of any payroll software company approved by HMRC.

- 4.9 out of 5 on Trustpilot (based on 4,495 reviews)

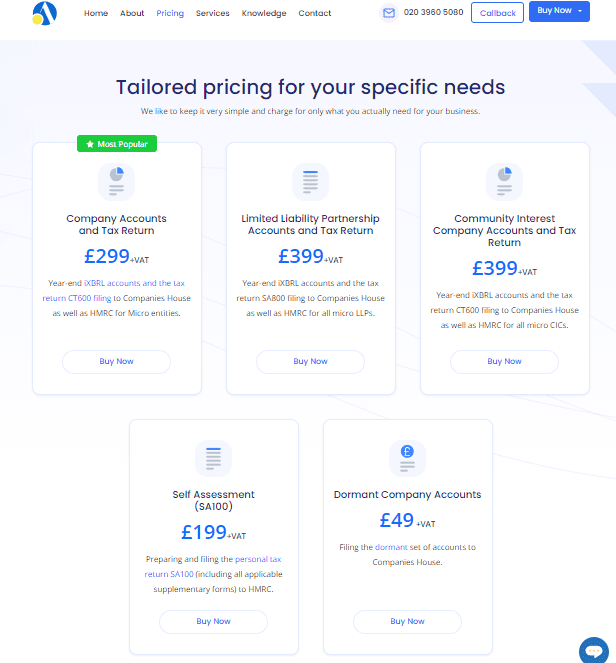

Debitam Payroll Costs

Debitam charges between £49+VAT and £399+VAT for their services. They do not offer a free plan or free trial.

Debitam Payroll Features

Dormant Company Accounts

- Filing the dormant set of accounts to Companies House.

Company Accounts and Tax Return

- Year-end iXBRL accounts and the tax return CT600 filing to Companies House as well as HMRC for Micro entities.

Community Interest Company Accounts and Tax Return

- Year-end iXBRL accounts and the tax return CT600 filing to Companies House as well as HMRC for all micro CICs.

Here are some pros and cons from Trustpilot and other third party review sites.

Debitam Payroll Pros

- Company Accounts and Tax Return Filing

- VAT and Bookkeeping Services

Debitam Payroll Cons

- Expensive

Qtac Payroll

Qtac Payroll Reviews

Qtac Payroll is another highly rated but not well known payroll solution.

- 4.8 out of 5 on Trustpilot (based on 121 reviews)

Qtac Payroll Costs

Qtac offers a free P45 Checker and Qtax Pro for £150 +VAT. For their more advanced Qtac Payroll and Qtac Payroll Plus you have to request a trial.

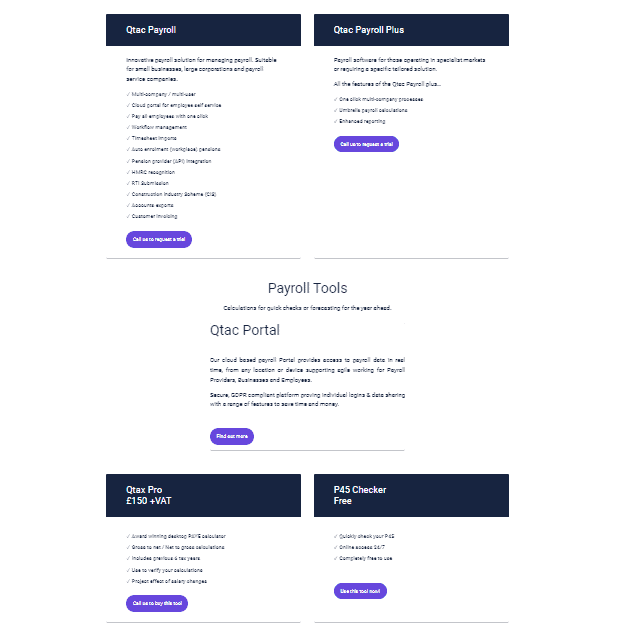

Qtac Payroll Features

P45 Checker

- Quickly check your P45

- Online access 24/7

- Completely free to use

Qtax Pro

- Award winning desktop PAYE calculator

- Gross to net / Net to gross calculations

- Includes previous 6 tax years

- Use to verify your calculations

- Project effect of salary changes

Qtac Payroll Plus

- Multi-company / multi-user

- Cloud portal for employee self service

- Pay all employees with one click

- Workflow management

- Timesheet imports

- Auto enrolment (workplace) pensions

- Pension provider (API) integration

- HMRC recognition

- RTI Submission

- Construction Industry Scheme (CIS)

- Accounts exports

- Customer invoicing

- One click multi-company processes

- Umbrella payroll calculations

- Enhanced reporting

They also offer the following integrations:

- BrightPay

- The People’s Pension

- Nest

Here are some pros and cons taken from Trustpilot and other review sites.

Qtac Payroll Pros

- Free plan

- Free trial

- Load of features

Qtac Payroll Cons

- No app

- No transparent pricing

Deel

Deel Reviews

Deel is one of the fastest growing payroll and HR companies in the world. With a focus on international payments it’s great choice if you have an international workforce.

- 4.8 out of 5 on Trustpilot (based on 2,919 reviews)

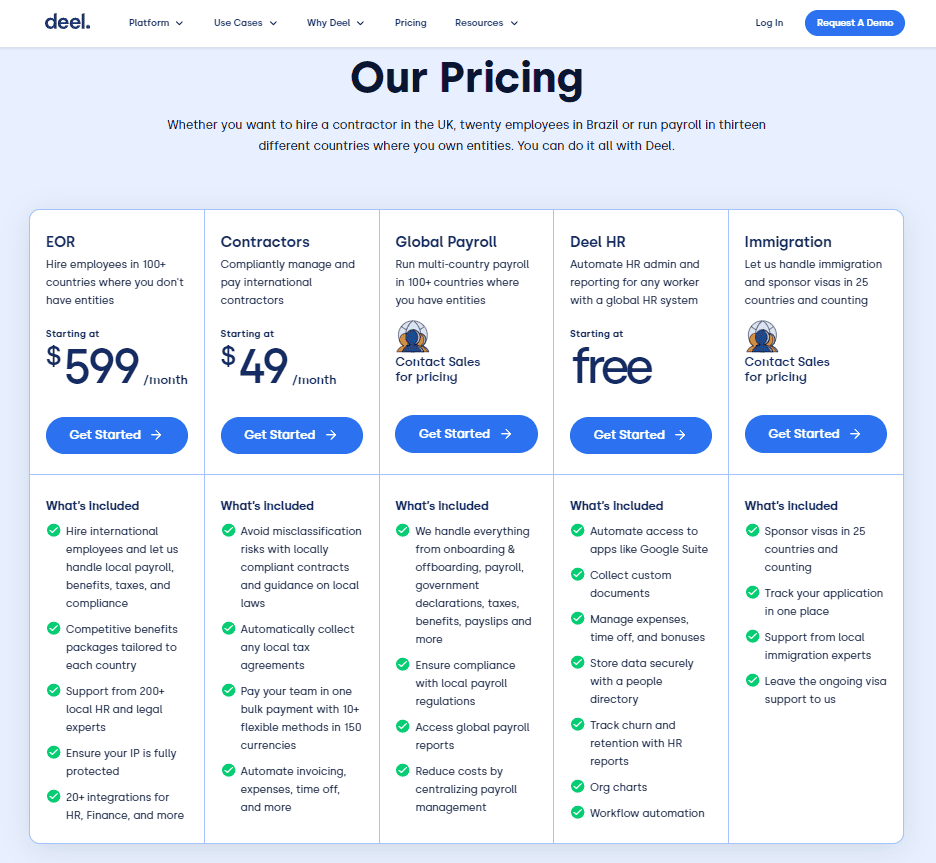

Deel Costs

Deel costs between $49 and $599 per month with no free trial or free plan option.

Deel Features

Contractors

- Avoid misclassification risks with locally compliant contracts and guidance on local laws

- Automatically collect any local tax agreements

- Pay your team in one bulk payment with 10+ flexible methods in 150 currencies

- Automate invoicing, expenses, time off, and more

EOR

- Hire international employees and let us handle local payroll, benefits, taxes, and compliance

- Competitive benefits packages tailored to each country

- Support from 200+ local HR and legal experts

- Ensure your IP is fully protected

- 20+ integrations for HR, Finance, and more

Deel also offers the following integrations:

- Quickbooks

- Xero

- Netsuite

- BambooHR

- Ashby

- Greenhouse

Here some pros and cons taken from Trustpilot, Software Advice other review websites.

Deel Pros

- “Deel’s global reach and support for numerous countries and currencies make it a valuable tool for businesses with international teams.”

- “Deal was incredibly easy to get started, create new contractors and also manage hours/rates along with on/offboarding. At our stage we didn’t use many of the features but they’re so relevant to scaling businesses. The support was awesome!”

- “Easy to use and payment are very quick and on time”

- “Easy to setup and use , it has all you need and more”

- “The elegance and efficiency of Deel’s platform are undeniable. As someone who has grappled with cross-border payments and contracts for years, Deel has proven to be a game-changer.

It not only simplifies and accelerates the entire payment process, but its intuitive user interface and comprehensive features ensure that all your global payment needs are addressed in one place.

Moreover, the way Deel has resolved all contract grievances against other companies swiftly has enhanced its credibility. Their proactive approach to conflict resolution reflects a company that truly values its reputation and clients.”

Deel Cons

“

- “Integrations? It took some time to become fully comfortable with the system and its intricacies.”

- “There were some initial confusions around pricing and billing that could be made simpler. It would be nice to see some form of LMS within the platform.”

- “It’s tough to find significant faults in a platform as robust and user-friendly as Deel. However, there is always room for improvement. I’d appreciate more granular analytics and reporting features.

While the existing tools offer a clear overview, having more in-depth insights into payment trends and detailed contract histories could enhance the platform. I also think the user experience for people with multiple currencies could use a tonne of work as this has caused confusion in the past.

I also have had a negative experience with rolling contracts being paid out improperly. I think you should be able to just set a contract and simply request an amount to pay out without keeping it organised on a per deel invoice generated basis.

E.g. in my last contract I was dealing with a customer who only approved units of work that I submitted, but sometimes I would submit them late, which caused a lot of confusion on the system when I tried to do back-payments on my end. There just needs to be better options for this, in theory we should do these things perfectly but in reality, no.”

”

Pento

Pento Reviews

Pento is another popular and highly rated option of processing payroll.

- 4.6 out of 5 on Trustpilot (based on 134 reviews)

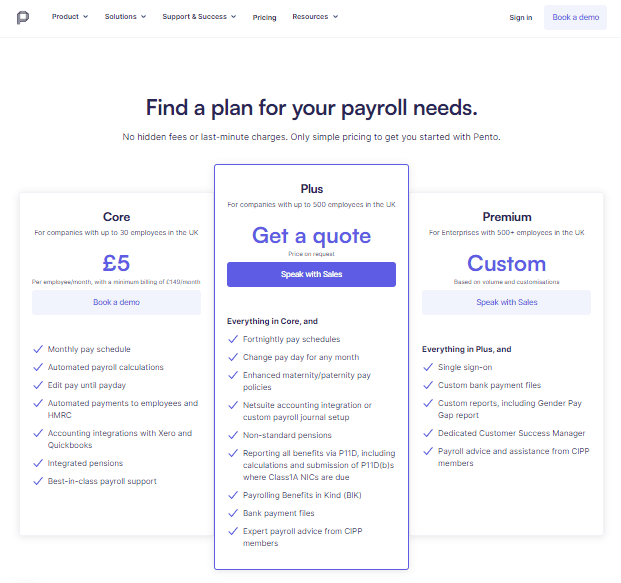

Pento Costs

Pento plans start at £5 per employee/month, with a minimum billing of £149/month. For larger companies their offer bespoke pricing, but require you to speak to their sales team.

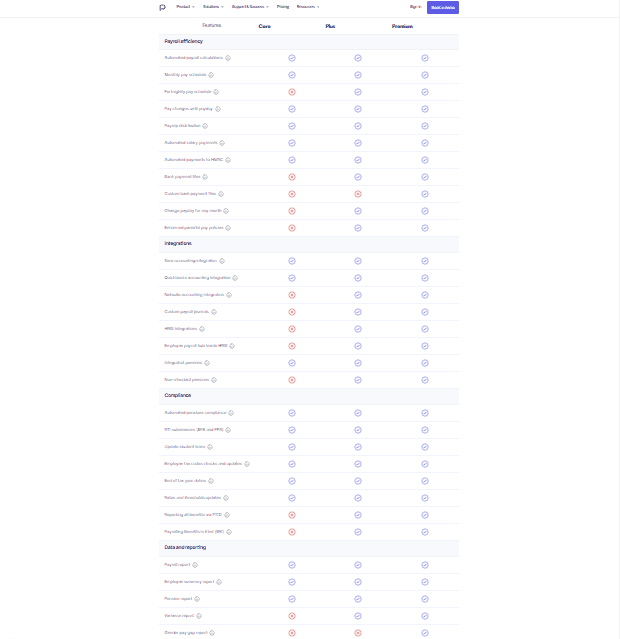

Pento Features

Here’s a full list of features they offer.

- Automated payroll calculations

- Monthly pay schedule

- Fortnightly pay schedule

- Pay changes until payday

- Payslip distribution

- Automated salary payments

- Automated payments to HMRC

- Bank payment files

- Custom bank payment files

- Change payday for any month

- Enhanced parental pay policies

- Xero accounting integration

- Quickbooks accounting integration

- Netsuite accounting integration

- Custom payroll journals

- HRIS integrations

- Employee payroll hub inside HRIS

- Integrated pensions

- Non-standard pensions

- Automated pensions compliance

- RTI submissions (EPS and FPS)

- Update student loans

- Employee tax codes checks and updates

- End of tax year duties

- Rates and thresholds updates

- Reporting all benefits via P11D

- Payrolling Benefits in Kind (BIK)

- Payroll report

- Employee summary report

- Pension report

- Variance report

- Gender pay gap report

- Custom reports

- Employee activity history

- HRIS sync logs

- Single sign-on

- Onboarding and data migration

- Day-to-day payroll support

- Guided Customer Success

- Dedicated Customer Success Manager

- Expert payroll advice from CIPP members

Additionally they offer the following software integrations.

- HiBob

- BambooHR

- CharlieHR

- Humaans

- Personio

- PeopleHR

- Xero

- Netsuite

- Quickbooks

- Custom journals

Here are some pro and cons from Trustpilot, Capterra and other review sites.

Pento Pros

- “We always thought of payroll as something boring and annoying. Now it’s just a few clicks every month and that’s it.”

- “It’s easy to use, even for non-technical users. Excellent customer support service. It has a wide range of features, including automated payroll processing, integration with different software, and employer self-service.”

- “Pento integrates with bamboo hr which makes things a lot easier. It is also fairly self explanatory what is where. It is good that employees get email payslips”

- “Once everything was up and running, I probably spend less than two minutes per month running payroll. UI is pretty intuitive and easy to navigate. When you have experience with other products, running payroll with one click feels like magic.”

- “Pento has a great user interface and it makes payroll very easy to process each month. a lot of the payroll tasks which usually used to be manual are automated and also reassures that you are doing the same method of calculation each month e.g calculating gross pay for joiners and leavers mid-month, nil pay for employees etc…”

Pento Cons

- “the interface can be a bit clunky at times. It’s also not as customizable as I would like.”

- “Sometimes the pensions integration is dodgy or there are bugs that we spot in auditing and have to ask pento to fix”

- “The setup took some time, as we needed to set up all employees and link the bank account. Be sure not to change in the last days of the month.”

- “Not being able to see future payrolls and essentially being able to plan ahead. A few other bits that you need to contact the CS team for e.g. adding new approval users.

The price is also quite expensive to the other traditional payroll softwares out there but can see it’s use case for those that do not have any payroll background. Also, I usually request sales & CS bonuses from the leads every month and would be nice to have them update the figure directly themselves rather than it go through me to avoid errors and save time.”

PayEscape

PayEscape is another popular and highly rated option to consider.

PayEscape Reviews

- 4.5 out of 5 on Trustpilot (based on 41 reviews)

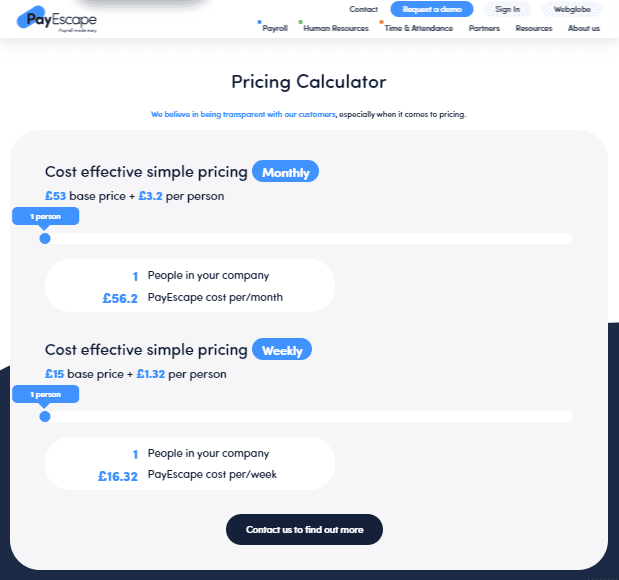

PayEscape Costs

PayEscape has a fair and unique way of pricing. You simply pay £53 per month base price + £3.2 per employee per month. This means your payroll costs scale linearly as the size of your company grows.

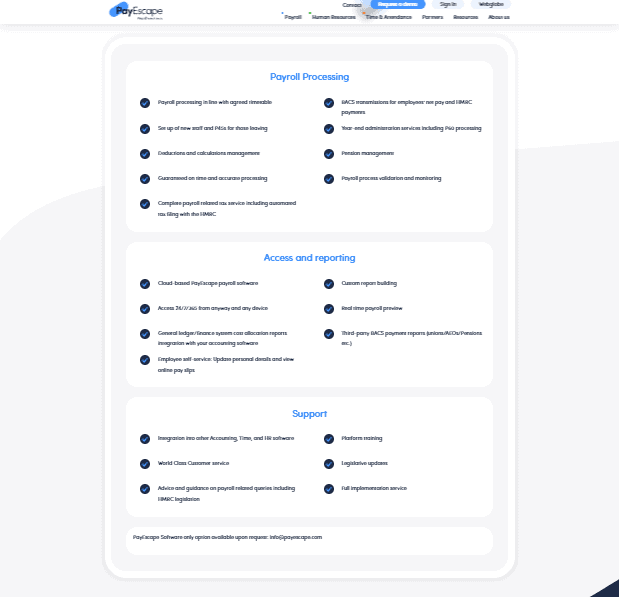

PayEscape Features

PayEscape offers many features including.

- Payroll processing in line with agreed timetable

- BACS transmissions for employees’ net pay and HMRC payments

- Set up of new staff and P45s for those leaving

- Year-end administration services including P60 processing

- Deductions and calculations management

- Pension management

- Guaranteed on time and accurate processing

- Payroll process validation and monitoring

- Complete payroll related tax service including automated tax filing with the HMRC

- Cloud-based PayEscape payroll software

- Custom report building

- Access 24/7/365 from anyway and any device

- Real time payroll preview

- General ledger/finance system cost allocation reports integration with your accounting software

- Third-party BACS payment reports (unions/AEOs/Pensions etc.)

- Employee self-service: Update personal details and view online pay slips

- Integration into other Accounting, Time, and HR software

- Platform training

- World Class Customer service

- Legislative updates

- Advice and guidance on payroll related queries including HMRC legislation

- Full implementation service

They also offer the following integrations

- Xero

- Kashflow

- FreshBooks

- UKG

- Cezanne

- BambooHR

PayEscape Pros

- BACS transmissions for employees’ net pay and HMRC payments

- Cloud-based PayEscape payroll software

- Integration into other Accounting, Time, and HR software

PayEscape Cons

- No app

- Not many reviews overall

Payroll Software FAQ

What is Payroll Software & Why Do I Need It?

UK payroll software is a type of program specifically designed to manage, automate, and streamline payroll processes for businesses operating within the United Kingdom.

This software plays a crucial role in ensuring compliance with UK-specific tax laws, employment legislation, and reporting requirements. Here are key aspects of UK payroll software:

- Compliance with UK Tax Laws:

- The software is tailored to handle UK tax calculations, including income tax and National Insurance contributions. It updates automatically to reflect changes in tax rates and thresholds.

- Real-Time Information (RTI) Reporting:

- It supports RTI reporting to HM Revenue & Customs (HMRC), allowing employers to report wages, taxes, and other deductions to HMRC each time they run payroll.

- Automatic Calculations:

- The software automatically calculates gross pay, deductions (like tax, National Insurance, pension contributions, and student loan repayments), and net pay. It can handle various pay frequencies (weekly, bi-weekly, monthly).

- Payslip Generation:

- Generates employee payslips, which can be printed or distributed electronically. These payslips detail gross pay, deductions, and net pay.

- Year-End Reporting:

- Assists with year-end tasks like preparing and filing P60 forms for employees, which summarize their annual earnings and deductions.

- Integration with Other Systems:

- Many payroll software solutions can integrate with other business systems, such as accounting software or human resources management systems, for seamless data transfer and management.

- Employee Self-Service Portals:

- Some software includes employee portals where employees can view their payslips, request time off, and update personal information, enhancing transparency and efficiency.

- Pension Auto-Enrolment:

- Handles the auto-enrolment for workplace pensions, including assessing which employees are eligible and managing pension contributions.

- Customization and Scalability:

- Offers customizable features to suit different business sizes and sectors, and can scale as a business grows.

- Data Security and Backup:

- Ensures the security and confidentiality of payroll data through encryption and secure storage, and often includes backup features to prevent data loss.

Popular examples of UK payroll software include Sage Payroll, Xero Payroll, QuickBooks Payroll, and HMRC’s Basic PAYE Tools for small employers. The choice of software often depends on the size of the business, the complexity of its payroll needs, and its budget.

How Much Is UK Payroll Software?

The cost of payroll software in the UK varies widely depending on several factors, including the size of your business, the complexity of your payroll needs, and the specific features you require.

Here’s a general overview of the pricing structure for payroll software in the UK:

- Free Options:

- Some basic payroll software options are available for free, such as HMRC’s Basic PAYE Tools. These are generally suitable for small businesses with fewer employees.

- Entry-Level Software:

- For small businesses, entry-level payroll software can start from as little as £5 to £10 per month. These often have limitations on the number of employees or lack advanced features.

- Mid-Range Software:

- Mid-range solutions, which offer more features and can handle a larger number of employees, typically range from £20 to £50 per month.

- Comprehensive Solutions:

- For larger businesses or those needing advanced features like integrated HR systems, the cost can go upwards of £100 per month.

- Per Employee Pricing:

- Many payroll software providers charge based on the number of employees. Costs can range from £1 to £10 per employee per month.

- Annual Subscriptions:

- Some providers offer annual subscription plans, which might provide cost savings compared to monthly payments.

- Additional Costs:

- Be aware of additional costs for setup, training, support, or extra features like auto-enrolment for pensions or integrations with other systems.

- Bundled Packages:

- Providers may offer payroll software as part of a bundled package with other services like accounting or HR software, which can be more cost-effective for some businesses.

When choosing payroll software, it’s important to consider not just the cost but also the features you need.

A smaller business with straightforward payroll needs might do well with a more basic, cost-effective solution, while a larger business or one with more complex payroll requirements might find it worth investing in a more comprehensive system.

Always check for the latest pricing and offers directly from the software providers or through their official websites.

How Does Payroll Software Work?

UK payroll software automates and manages the payroll process for businesses, ensuring compliance with the United Kingdom’s specific payroll regulations and tax laws. Here’s how it works and the key functions it performs:

How It Works

- Data Entry:

- Employers input employee data into the software, including personal details, tax codes, and payment information.

- Setting Up Payroll:

- The software is set up based on the company’s specific payroll requirements, such as pay frequency (weekly, bi-weekly, monthly), types of employment contracts, and any additional benefits or deductions.

- Integration:

- Many payroll systems integrate with other business software, such as time tracking systems, HR systems, and accounting software, allowing for seamless data transfer.

- Automatic Calculations:

- The software calculates gross pay based on the hours worked or salary. It then automatically computes deductions like income tax, National Insurance contributions, pension contributions, and student loan repayments.

- Real-Time Information (RTI) Reporting:

- Each time the payroll is run, the software sends a Full Payment Submission (FPS) to HM Revenue & Customs (HMRC), reporting the employees’ pay and deductions.

- Payslip Generation:

- After calculations, the software generates payslips for each employee, detailing their earnings and deductions.

- Payments:

- Some payroll software can integrate with banking systems to facilitate direct payments to employees’ bank accounts.

- Year-End Reporting:

- At the end of the financial year, the software helps in submitting the final Full Payment Submission and generating P60 forms for employees.

- Record Keeping:

- The software keeps records of all payroll activities, ensuring compliance with legal record-keeping requirements.

Key Functions

- Tax Compliance:

- Ensures compliance with UK tax laws, updating automatically for changes in tax rates and thresholds.

- Deduction Management:

- Handles complex calculations for deductions and contributions, ensuring accuracy.

- Employee Management:

- Manages employee data, including changes in personal details, tax codes, and employment status.

- Reporting and Analytics:

- Provides reports on payroll expenses, tax liabilities, and other financial metrics.

- Legal Compliance:

- Keeps up with changes in employment law, such as minimum wage requirements, statutory payments for sick leave, maternity/paternity pay, etc.

- Pension Auto-Enrolment:

- Manages auto-enrolment for eligible employees into pension schemes and calculates contributions.

- Security and Data Protection:

- Ensures the security and confidentiality of sensitive payroll data, in line with data protection laws.

- Employee Self-Service:

- Allows employees to access their payslips and personal data, reducing administrative tasks for employers.

UK payroll software streamlines the payroll process, reduces the potential for errors, ensures legal compliance, and saves time for businesses. It’s an essential tool for efficiently managing payroll in compliance with UK regulations.

How Can I Do My Own Payroll In The UK?

Managing your own payroll in the UK involves several important steps to ensure you comply with legal requirements and accurately calculate and report employee payments and deductions. Here’s a general guide on how to do your own payroll:

- Register as an Employer with HMRC:

- If you haven’t already, you need to register with HM Revenue & Customs (HMRC) before the first payday. Registration can take up to two weeks.

- Choose Payroll Software:

- Use HMRC-recognized payroll software to report to HMRC. This software can help you record your employees’ details, provide a payroll number, calculate pay and deductions, and report to HMRC.

- Collect and Keep Records:

- Keep records of all employee payments and deductions, including salaries, benefits, and expenses.

- Employee Details:

- Collect and enter your employees’ details into your payroll system. This includes their name, address, National Insurance number, and tax code.

- Calculate Pay and Deductions:

- Determine each employee’s gross pay. Then calculate deductions, including income tax, National Insurance contributions, and any others like pension contributions or student loan repayments.

- Issue Payslips:

- Provide payslips to your employees, detailing their gross pay, deductions, and net pay. This can be done electronically or on paper.

- Report to HMRC:

- Report payroll information to HMRC through Full Payment Submission (FPS) each time you pay your employees. This is usually done using your payroll software.

- Pay HMRC:

- Pay HMRC the tax and National Insurance you owe. This is usually due by the 22nd of the next tax month if paying electronically, or by the 19th if paying by cheque.

- Year-End Reporting and Tasks:

- At the end of the tax year, you need to send a final report to HMRC. You also have to give your employees a P60, which summarizes their total pay and deductions for the year.

- Keeping Up to Date with Legislation:

- Stay informed about changes in payroll legislation to ensure ongoing compliance.

- Consider Professional Advice:

- If you’re unsure about any aspect of payroll, consider seeking advice from a professional accountant or payroll specialist.

Remember, payroll involves sensitive personal data, so it’s crucial to ensure that you handle this information securely and in compliance with data protection laws. Regularly reviewing and updating your payroll processes can help you stay compliant and efficient.

Please note the following companies pay us a commission. It has not influenced their rankings, but does mean we get paid if you visit their website and/or sign-up: Rippling, Deel, Pento, QuickBooks Payroll and ANNA Free PayRoll.