The following business credit cards all offer rewards. Rewards can vary including Avios points, Amex Membership Rewards, Amazon gift cards and the increasingly popular simple cashback business credit card.

The table below offers a simple comparison between the various rewards offered on UK business credit cards.

| Card Name | Reward Type | Reward Amount | Annual Fee |

|---|---|---|---|

| Capital On Tap Free Rewards* | Cashback | Uncapped 1% | £0 |

| Capital On Tap Business Rewards* | Cashback & points (including Avios) | Uncapped 1% + Points | £299 |

| American Express® Business Platinum Card | Amex Membership Rewards Points | 1 Point for Every £1 Spent | £650 |

| American Express® Business Gold Card* | Amex Membership Rewards Points | 1 Point for Every £1 Spent | £175 |

| Amazon Business Prime American Express® Card | Amazon Rewards | 2% on Amazon; 0.5% Elsewhere | £50 |

| Amazon Business American Express® Card* | Amazon Rewards | 1.5% on Amazon; 0.5% Elsewhere | £50 |

| Barclaycard Select Cashback credit card | Cashback | 1% | £0 |

| Barclaycard Premium Plus credit card | Cashback | 0.5% up to £400 per year | £150 |

| Santander Business Cashback Credit Card | Cashback | 1% | £30 |

| Natwest Business Plus credit card | Cashback | 0.5% - 3%; limit of £600 per year | £70 |

| RBS Business Plus credit card | Cashback | 0.5% - 3%; limit of £600 per year | £70 |

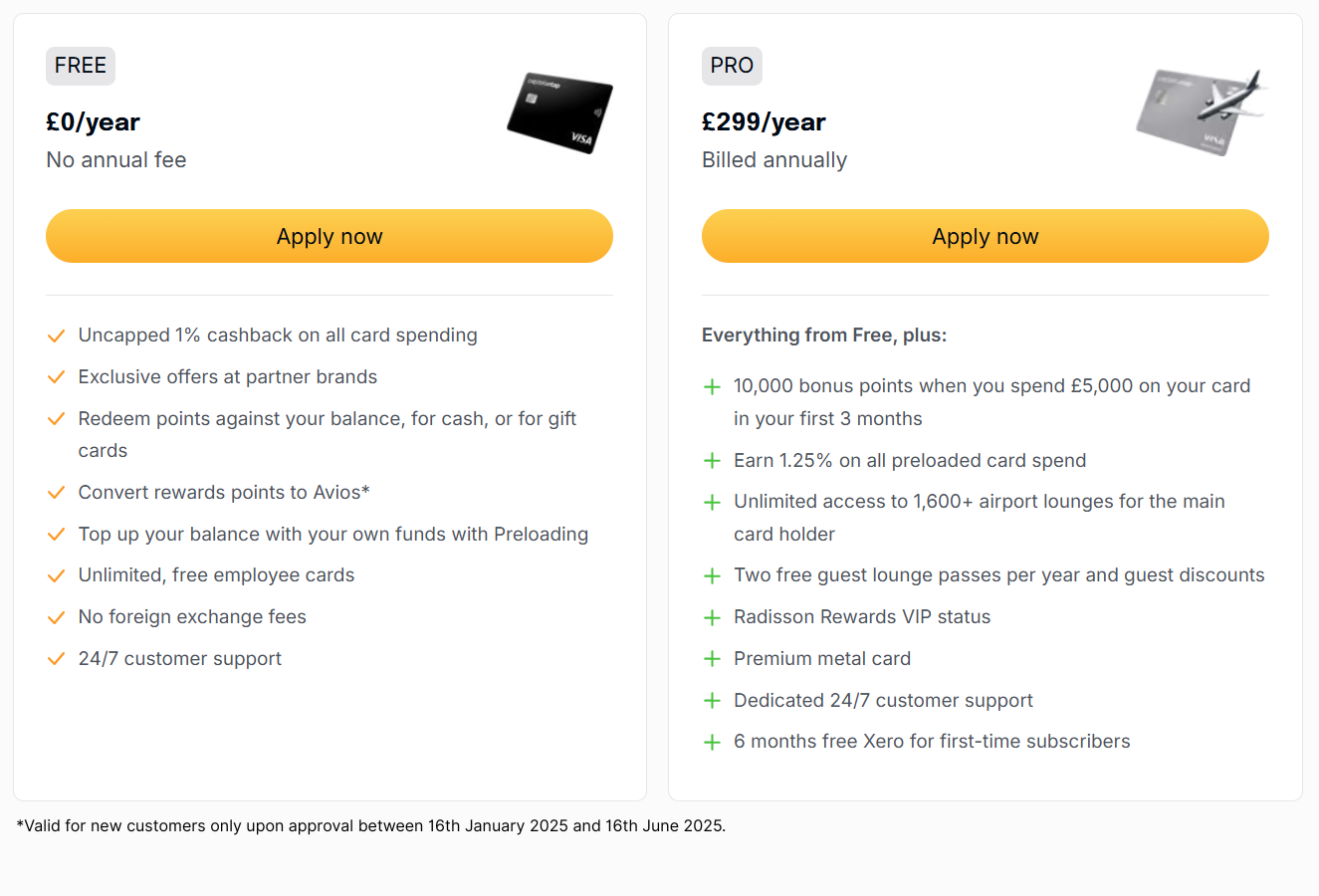

Capital On Tap

Capital On Tap offers two business rewards cards one of which has no annual fee.

Capital On Tap Free Rewards Card

- No annual fee

- Uncapped 1% cashback on card spending

- Redeem points against your balance, for cash, or for discounted gift cards

- Rates as low as 14.67% APR (variable)

- Credit limits up to £250,000

- Unlimited free company cards

Click Here To Find Our More About the Capital On Tap Free Rewards Card

Capital On Tap Pro

- £299 per year

- Uncapped 1% cashback on card spending

- Earn 1.25% on all preloaded card spend

- 10,000 bonus points when you spend £5,000 in your first 3 months

- Redeem points for Avios

- Unlimited access to 1,600+ airport lounges for the main card holder

- Two free guest lounge passes per year and guest discounts

- Redeem points against your balance, for cash, or for discounted gift cards

- Rates as low as 14.67% APR (variable)

- Credit limits up to £250,000

- Unlimited free company cards

Click Here To Find Our More About the Capital On Tap Business Rewards Card

American Express (Amex)

Amex is the original business reward card provider who happens to offer the largest range of reward cards. Here are their current offerings.

Click here to compare Amex Business Rewards Cards

American Express® Business Platinum Card

- Annual Fee: £650

- Earn 1 Membership Rewards point for almost every full £1 you spend on the Card

- Earn double points every time you spend £10,000 in one month

- Receive £200 Annual Travel Credit when you spend at American Express Travel Online

- Airport Lounge Access

- Digital subscription to The Times and The Sunday Times

- Dedicated Account Managers

- Comprehensive worldwide travel insurance for business or pleasure

- Purchase Protection

- Refund Protection

American Express® Business Gold Card

- Annual Fee: £175

- Earn 1 Membership Rewards point for almost every full £1 you spend on the Card

- Earn 10,000 extra Membership Rewards points when you spend £20,000 per quarter

- Up to 54 calendar days payment period on purchases

- Travel Accident and Travel Inconvenience Insurance

- Purchase Protection (up to £2,500)

- Refund Protection (up to £300)

Amazon Business Prime American Express® Card

- Annual Fee: £50 (free if you spend over £8,000 per year on the card)

- Representative 38.3% APR variable

- You can enjoy 2% Amazon Rewards on purchases with Amazon and 0.5% on all purchases elsewhere. Terms and cap apply

- You can extend payment terms by 90 days on each Amazon purchase, instead of earning rewards, helping improve cashflow

- Up to 20 complimentary Employee Cards

Amazon Business American Express® Card

- Annual Fee: £50

- Representative 38.3% APR variable

- You can enjoy 1.5% Amazon Rewards on purchases with Amazon and 0.5% on all purchases elsewhere. Terms and cap apply

- You can extend payment terms by 60 days on each Amazon purchase, instead of earning rewards, helping improve cashflow

- Up to 20 complimentary Employee Cards

Click here to compare Amex Business Rewards Cards

Barclaycard

Barclaycard currently offers two business cashback credit cards. They are:

Barclaycard Select Cashback credit card

- No annual fees for your card and account

- 1% uncapped cashback

- Up to 56 days’ interest-free credit when you pay in full and on time

- Apple Pay enabled

- Get access to FreshBooks’ most popular accounting plan (worth £264 per year)

- Representative 26.2% – 26.5% (variable)

Barclaycard Premium Plus credit card

- Annual fee £150 in total per account

- 0.5% cashback on all eligible spend, up to £400 per year

- Representative APR 55.1% – 55.6%

- Save 2% on foreign exchange fees

- Comes with a six-month interest-free on purchases period

- Up to 56 days interest-free on purchases when you pay in full and on time

- Transform your Premium Plus into a priority pass to airport lounges and get two visits for free (Additional visits cost £20 each)

- business travel, purchase protection and cardholder misuse insurance

Barclaycard business credit card website

Santander

Santander just offers their Business Cashback Credit Card.

Santander Business Cashback Credit Card

- Annual fee £30

- 1% cashback on all business spend with no cap

- Representative 23.7% APR (variable)

- No foreign transaction fees on purchases abroad when paying in the local currency

- Additional cards available at no extra cost to your £30 annual account fee

- Control the amount each additional cardholder can spend

- No interest charged if balance paid off in full and on time each month

- You must use the Business Cashback Credit Card for business use only

Santander Business Cashback Credit Card website

Natwest

Natwest’s only business reward card is their Business Plus credit card.

- £70 annual fee per cardholder

- Get 0.5% cashback on everything you buy

- 1% cashback on eligible travel and accommodation

- 2% cashback on eligible trade/business supplies

- 3% cashback at eligible fuel and electric vehicle charging stations

- Cashback limited to £600 per year

- Representative APR 29%

- No foreign transaction fees on purchases abroad

- Up to 56 days interest-free credit period on purchases if you pay your balance in full

- Enjoy merchant offers with Business Savings from Mastercard

- Minimum credit limit £500, maximum credit limit subject to status

- The NatWest Business Plus credit card has a 5* Moneyfacts rating

- No non-sterling transaction fees for purchases abroad

- Flexible monthly payments and minimum payments

Natwest Business Plus credit card website

Royal Bank Of Scotland (RBS)

RBS’s Business Plus credit card is identical to the Natwest one above.

- £70 annual fee per cardholder

- Get 0.5% cashback on everything you buy

- 1% cashback on eligible travel and accommodation

- 2% cashback on eligible trade/business supplies

- 3% cashback at eligible fuel and electric vehicle charging stations

- Cashback limited to £600 per year

- Representative APR 29%

- No foreign transaction fees on purchases abroad

- Up to 56 days interest-free credit period on purchases

- Enjoy merchant offers with Business Savings from Mastercard

- Minimum credit limit £500, maximum credit limit subject to status

- The RBS Business Plus Credit Card has a 5* Moneyfacts rating

- No non-sterling transaction fees for purchases abroad

- Flexible monthly payments and minimum payments

RBS Business Plus credit card website

Business Credit Cards With Rewards FAQs

What’s the best business credit card with rewards in the UK?

There’s no single best business reward credit card in the UK.

For example, Capital On Tap has the lowest APR, no annual fee for their basic card and 1% uncapped cashback. Making it a great choice for cheap, unlimited cashback.

However, if you travel a lot then one of AMEX’s membership points might be more valuable to you than cashback and worth the membership fee.

Therefore, you should look at current spend and figure how much if any benefit you’d get from any given card.

Are business rewards cards worth it?

That really depends on the card you choose and how you use it.

If your card has an annual fee you want to make sure that if offers you at least that much in either rewards and/or cashback to make it worthwhile.

For example, the NatWest & RBS Business Plus credit cards come with an annual £70 fee and offer a basic cashback amount of 0.5% (but up to 3% for some categories).

Therefore, at the basic rate you’d have to spend at least £14,000 on the card just to earn your annual membership fee back.

Which business credit card has the highest cashback?

NatWest & RBS Business Plus credit cards both offer 3% cashback at eligible fuel and electric vehicle charging stations, 2% cashback on eligible trade/business supplies and 1% cashback on eligible travel and accommodation.

However, your total cashback is limited to £600 per year and purchases outside the categories listed above only get 0.5% cashback.

For unlimited cashback the best you’ll find is 1% from Capital On Tap, Barclaycard and Santander.

Finally, while not strictly speaking Cashback, the Amazon Business Prime American Express® Card offers 2% Amazon rewards on all purchases from Amazon.

* Please note we have an affiliate relationship with Capital On Tap, Payhawk, Soldo, Juni and American Express who pay us a commission if you sign-up for a card via our link.

Also see: How To Get A Business Credit Card With Bad Credit In The UK