American Express is a major global credit card provider offering a range of products for business owners. Founded in 1850, American Express is one of the oldest credit card providers in the world and is accepted fairly widely both online and in-store. Amex credit cards also come with various benefits and reward points, which could be a helpful feature for business customers.

American Express Business Finance

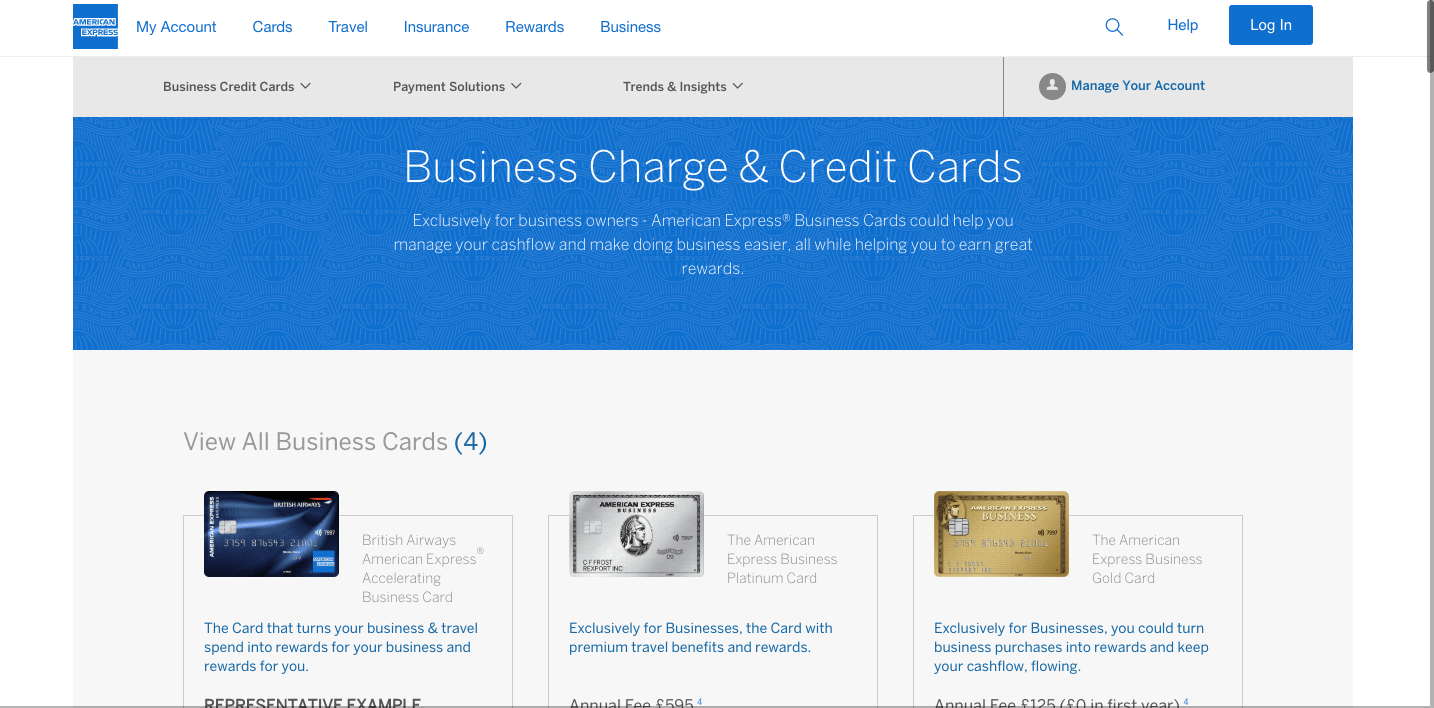

Business credit cards

American Express provides four credit and charge cards for businesses in the UK. Interest rates tend to be higher than business credit cards from mainstream banks, so it’s important to check affordability before you sign up.

American Express Basic Business Card

- APR not published.

- No annual fee.

- No pre-set spending limit.

- Up to 42 days payment period on purchases

-

No reward points.

British Airways American Express Accelerating Business Card

- 96.7% APR variable.

- Annual fee – £250.

- Up to 56 calendar days are interest-free when you pay your balance in full every month.

- 24/7 global credit card emergency replacement.

- Earn 1.5 Avios for every eligible £1 spent on purchases on your card, and earn double On Business Points with British Airways.

The American Express Business Platinum Card

- APR not published.

- Annual fee – £595.

- Up to 54 calendar days are interest-free when you pay your balance in full every month.

- Access to 1,200 airport lounges in 130 countries.

- Earn 1 Membership Rewards point for every full £1 you spend on the Card.

Gold Business Card by American Express

- APR not published.

- No annual fee in the first year (£175 per year afterwards).

- No pre-set spending limit.

- Up to 54 calendar days are interest-free when you pay your balance in full every month.

- Earn 1 Membership Rewards point for every full £1 you spend on the Card.

- 32.6% APR variable.

- No annual fee in the first year (£50 per year afterwards).

- Extended payment terms are available of 60 days on Amazon purchases instead of earning rewards.

- Earn 1.5% Amazon Rewards on designated Amazon purchases on the first £120,000 then 1%. Also, earn 0.5% Amazon Rewards on other purchases.

- 32.6% APR variable.

- Annual fee – £50.

- Extended payment terms are available of 90 days on Amazon purchases instead of earning rewards.

- Earn 2% Amazon Rewards on designated Amazon purchases on the first £120,000 then 1%. Also, earn 0.5% Amazon Rewards on other purchases.

American Express Reviews and Ratings

Online reviews are written by both personal and business customers.

Trustpilot reviews are mainly critical, with 71% of customers rating them ‘Bad’. Many complain about trying to remove incorrect charges, trouble with payments, and problems speaking to customer services. A few happier customers say customer service is first class. There are very few reviews on Reviews.co.uk but they’re mainly positive.

American Express cards get a good review from Which?, ranking 1st in a list of 29 credit card providers.

American Express has commonly been criticised for not being as widely accepted in the UK as other types of credit cards. The number of shops and restaurants accepting Amex keeps increasing, including supermarket chains, high street retailers, many restaurants, petrol stations, and online subscription services. If you’re unsure, check before you buy.

Trustpilot – 1.7/5 (based on 1,875 reviews)

Google Reviews – no reviews

Reviews.co.uk – 4/5 (based on 6 reviews)

Which? Customer Score – 80% (1st out of 26 credit card providers)

Pros

- Rewards points to earn, which is especially good for business owners spending and travelling regularly.

- Good range of cards to choose from.

- Excellent score from Which?

Cons

- Undeniably more expensive than many other credit cards. There could be a big annual fee to pay, as well as higher interest rates.

- Not as widely accepted as some other credit cards.

- Reviews are quite critical.

Website: American Express