Find out what actual customers of FreeAgent payroll software think about it.

Or better yet leave your own review.

We also go over how much FreeAgent costs, what features it offers and what other reviewers think about it.

FreeAgent User Reviews

FreeAgent Review Summary

Recent FreeAgent Reviews

There are no reviews yet. Be the first one to write one.

Submit A Review For FreeAgent

Key FreeAgent Information

Software Name: FreeAgent

Company Name: FreeAgent Central Ltd

Listed On HMRC Website: Yes

Listed As Free By HMRC: No

Business Size: Small – Medium

Sector Focus: None

Click to visit the FreeAgent website

FreeAgent Reviews From Other Websites

- Trustpilot: 4.6 out 5 based on 2,137 reviews.

- iPhone App Store: 4.8 out of 5 based on 9,400 reviews.

- Android App Store: 4.7 out of 5 based on 1100 reviews.

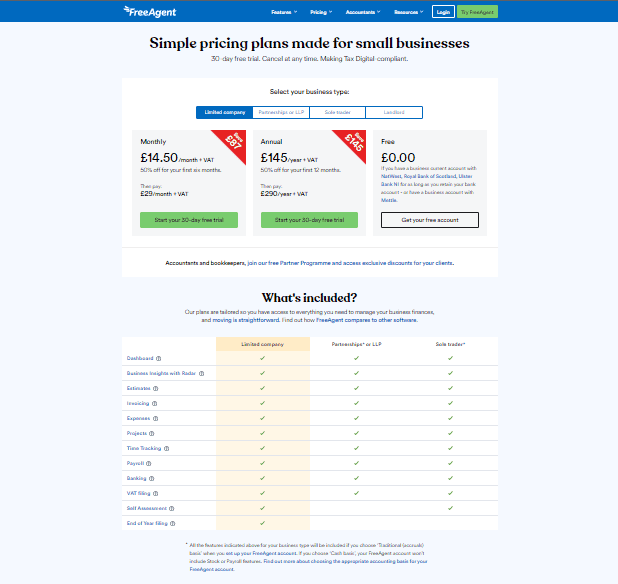

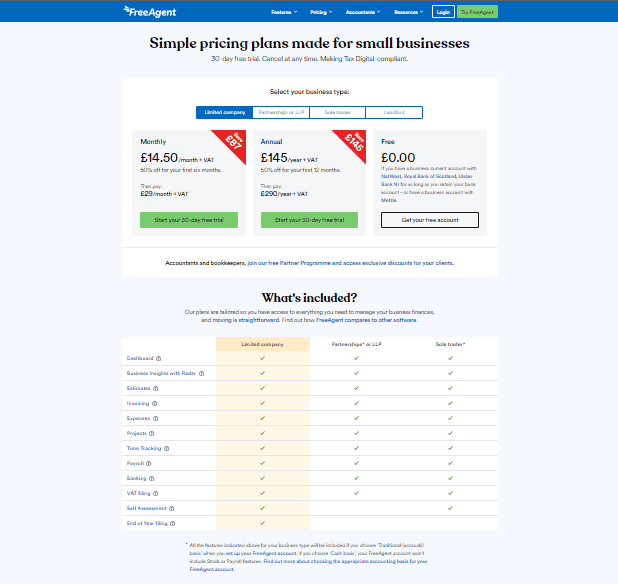

FreeAgent Prices

How much does FreeAgent cost? Here is what they publish on their website:

FreeAgent Free Plan / Free Trial

- Offers A Free Plan? No

- Offers A Free Trial? Yes

- How Long Does The Free Trial Last? 30 days

Paid Plan Costs

Here are the names for for the various plans FreeAgent offers and how much they cost per month:

- Sole trader: £12

- Partnerships or LLP: £12

- Limited company: £14.50

FreeAgent Features

Sole trader Features

- Dashboard – See the big picture for your business at a glance with cashflow, profit and loss, invoice timelines and more.

- Business Insights with Radar – Get intelligent insights, tailored trend-spotting and personalised tips all in one place.

- Estimates – Win more work with professional estimate templates ready to be converted to invoices.

- Invoicing – Get paid faster with easy invoicing tools. Send customised invoices, reminders and thank-you emails.

- Expenses – Track business costs quickly and easily. Snap receipts and record out-of-pocket expenses on the go.

- Projects – Keep tabs on your project income, expenses and profitability – all in one place.

- Time Tracking – Track the time you spend on projects, add this to invoices and generate timesheet reports.

- Payroll – Run monthly payroll and file auto-calculated PAYE and National Insurance directly to HMRC.

- Banking – Set up a bank feed and let all of your transactions flow into FreeAgent automatically.

- VAT filing – Generate MTD-compliant VAT returns automatically and file them directly to HMRC in minutes.

- Self Assessment – Get a real-time view of how much you owe for your tax return and file it directly to HMRC.

Partnerships or LLP Features

- Dashboard – See the big picture for your business at a glance with cashflow, profit and loss, invoice timelines and more.

- Business Insights with Radar – Get intelligent insights, tailored trend-spotting and personalised tips all in one place.

- Estimates – Win more work with professional estimate templates ready to be converted to invoices.

- Invoicing – Get paid faster with easy invoicing tools. Send customised invoices, reminders and thank-you emails.

- Expenses – Track business costs quickly and easily. Snap receipts and record out-of-pocket expenses on the go.

- Projects – Keep tabs on your project income, expenses and profitability – all in one place.

- Time Tracking – Track the time you spend on projects, add this to invoices and generate timesheet reports.

- Payroll – Run monthly payroll and file auto-calculated PAYE and National Insurance directly to HMRC.

- Banking – Set up a bank feed and let all of your transactions flow into FreeAgent automatically.

- VAT filing – Generate MTD-compliant VAT returns automatically and file them directly to HMRC in minutes.

Limited company Features

- Dashboard – See the big picture for your business at a glance with cashflow, profit and loss, invoice timelines and more.

- Business Insights with Radar – Get intelligent insights, tailored trend-spotting and personalised tips all in one place.

- Estimates – Win more work with professional estimate templates ready to be converted to invoices.

- Invoicing – Get paid faster with easy invoicing tools. Send customised invoices, reminders and thank-you emails.

- Expenses – Track business costs quickly and easily. Snap receipts and record out-of-pocket expenses on the go.

- Projects – Keep tabs on your project income, expenses and profitability – all in one place.

- Time Tracking – Track the time you spend on projects, add this to invoices and generate timesheet reports.

- Payroll – Run monthly payroll and file auto-calculated PAYE and National Insurance directly to HMRC.

- Banking – Set up a bank feed and let all of your transactions flow into FreeAgent automatically.

- VAT filing – Generate MTD-compliant VAT returns automatically and file them directly to HMRC in minutes.

- Self Assessment – Get a real-time view of how much you owe for your tax return and file it directly to HMRC.

- End of Year filing – Generate the data for Final Accounts and Corporation Tax returns and file directly from FreeAgent.

Other Software Integrations

- IRIS

- BTCSoftware

- HMRC

- GoSimpleTax

- TaxCalc

- Staffology

- BrightPay

Popular Features List:

- Run Unlimited Payrolls: No

- Automatic Tax Filing & Payments: Yes

- Live Customer Support: No

- Ability To Manage Employee Benefits: No

- Employee Access to Platform: No

- Direct Deposits: No

- Expense Reimbursements: Yes

- Time Off Tracking: £14.50

- Handle Deductions From Pay: No

- Debt Repayment From Pay: FreeAgent Central Ltd

- Background Checks: No

- Offers An API: Yes

- Create Payslips: Yes

- Create P45: No

- Create P60: Yes

- Bonus Incentive Pay: No

- Pension Filing: No

- Statutory Payments (E.g. Sick Pay, Maternity Pay, etc.): Yes

- Direct HMRC Submissions: Yes

- RTI Compliant: Yes

Pros & Cons

The following pros and cons come from Trustpilot and other third-party review sites from around the web.

Pros

- At the moment it’s free through my business banking account – I tried it because of this but it would definitely be worth paying for. I am relatively new to running a business and the software is very intuitive for a novice. My accountant is pretty happy with it too, so that’s a big thumbs up! It makes invoicing and payment of exenses very easy, and is great for keeping track of money coming in/out and keeping an eye on invoices due for payment. Payroll is incorporated (you can file it with HMRC through FreeAgent or let your accountant do it separately). I also like the fact that it reminds me when my corporation tax and annual accounts are due. In a few clicks I can see my profit & loss account and my trial balance as well as spend in the different (customisable) categories. Really helps me keep on top of everything. The Android app is also great for reconciling payments and recording expenses on the move. The help files are fantastic, and the clear accounting descriptions and explanations make them a great resource for a small business even if you don’t use the software.

- The greatest thing about FreeAgent is the ease of bookkeeping, being able to have any bank transactions and PayPal transactions automatically put into bookkeeping form and easily explain what each transaction is, whether it’s a sale or stock purchases. It is online 24/7 so you can access it without having to worry about losing it and you can also back it up if you really want to. The support times are very quick during normal working hours.

- It’s a Scottish company, albeit taken over by an anti-Scottish UK bank. Customer services are relatively quick to respond but don’t often understand or resolve your issue. They do send you a Monday motivator which is useful. It’s now free if you bank with RBS/Nat West, but I’d rather not bank with either and even at £0 it’s not worth it. I’d rather pay for a decent software and save the cost of hours of inefficiency and extra accountancy fees later.

- The billing and invoicing functionality is a key feature of the product and works very well. They send a Monday motivator email summarising your agenda for the week on Monday mornings. This includes items such as unbilled hours logged, payments to approve and bills to chase or pay. MFA is supported for increased security.

- It’s straight forward, easy to set up and use. Everything you need to manage your accounts is in plain sight rather then you needing to know there is a completely different process somewhere else that actually needs to be completed. The processes are quick and easy to work out.

Cons

- Exporting information is a bit tricky in some areas – you can get a pdf out quite easily but an xls or csv would be more useful (you can export the entire company dataset as a csv, but not filtered individual elements such as unpaid expenses or balances within individual accounts). In some cases you can get round this by cutting and pasting, but it’s a bit fiddly. Exporting all company data does not export attachments – so you need to keep a separate copy of scanned receipts etc outside FreeAgent. It is one of the more expensive cloud accounting software packages out there, but I have looked at a whole range and you can’t beat the functionality, so that’s what you are paying for I guess!

- Some features of FreeAgent are still very buggy, such as the automation of transactions. For example it will either not detect some transactions or it will do too many, which means you have to check on a regular basis to compare the bookkeeping balance to your actual balances shown on PayPal and your bank, which I think almost defeats the purpose of having bookkeeping software. I really hope they manage to squash these bugs because something as important as tax should not be treated lightly. Early on in their existence they advertised that you would get free accounting advice but now they are very hesitant to do so (e.g: help with knowing how to explain transactions and so on).

- It is very clunky and awkward to use. It is very expensive for what it is and definitely not even worth using for free. Several essential basic functions are missing and it is very restrictive/prescriptive forcing you to work their way or not at all. Customer services regularly have to fudge “workarounds” to fill the gaps in FreeAgent’s basic functionality and often these “workarounds” make more mess than doing nothing, leaving you with more to pay your accountant to fix it. FreeAgent does several things in very unusual ways and then doesn’t allow you to fix them. Payroll does post journals into your ledgers but even the best accountants can’t make any sense of them. This software tries to be all things to small businesses giving tools that quite frankly are dangerous to unqualified accountants. It allows you to do your own VAT, Corporation Tax and Self Assessment wrongly, without any tax planning advice which could cost you tens of thousands of pounds in VAT/tax that isn’t due, not to mention HMRC penalties etc. I know of several clients who have overpaid an absolute fortune and had seriously damaging run-ins with HMRC as a direct result of trying to DIY using this software. Buyer BEWARE!!!

- There are few things that I don’t like to be honest, the only one that can be annoying is the bank feeds can sometimes be a little slow to show items. A manual refresh option for bank feed data would be useful.

- Nothing much to be honest. It would be better if it was easier to link to other programs that you use but this can be overcome with a bit of thought.

Freeagent Comparsions

FreeAgent vs Xero Payroll

FreeAgent vs Pento

FreeAgent vs Rippling

FreeAgent vs Employment Hero Payroll

FreeAgent vs Moorepay Payroll