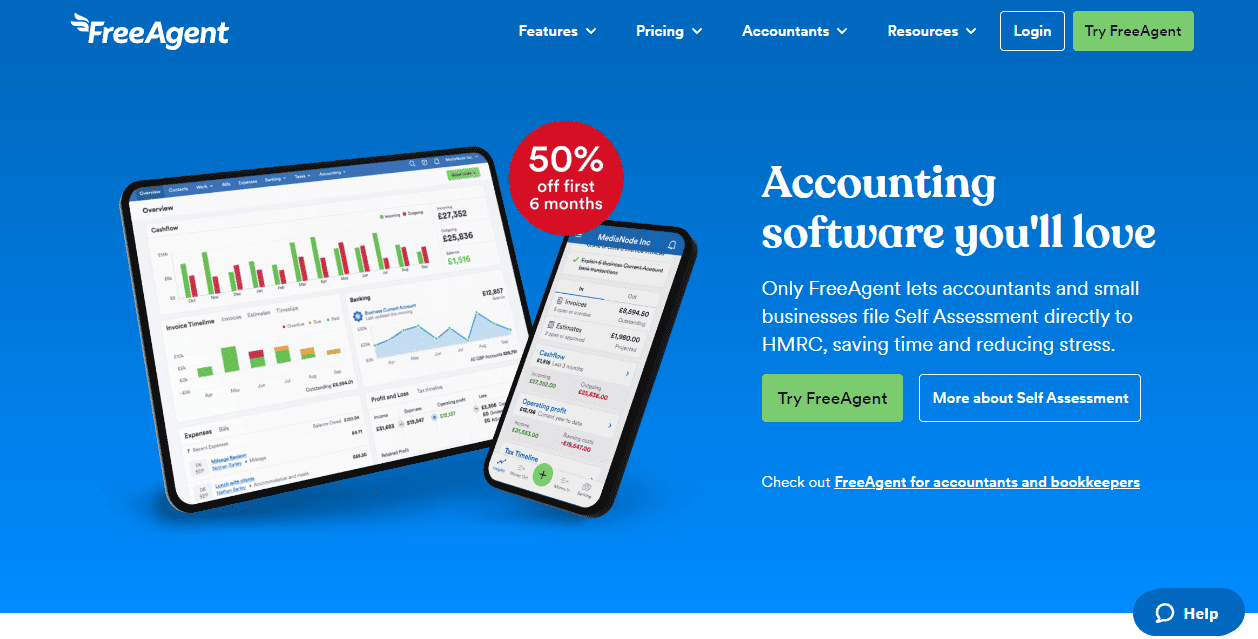

Find out what actual customers of FreeAgent accounting software think about it.

Or better yet leave your own review.

We also go over how much FreeAgent costs, what features it offers and what other reviewers think about it.

FreeAgent User Reviews

FreeAgent Review Summary

Recent FreeAgent Reviews

Free Agent Review

Excellent especially for those with no accounting knowledge. syncs to bank (Nat West) for me and pulls in all bank transactions then matches to invoices (customer and supplier) in the FreeAgent system. If no invoice to match to which suggest expense category – not always correct but can easily change its default postings. Does all VAT and annual returns for you by syncing with companies house and HMRC.

Submit A Review For FreeAgent

Key FreeAgent Information

Software Name: FreeAgent

Listed On HMRC Website As Being compatible with Making Tax Digital: Approved

Who can use this software: Agents and businesses

HMRC Listed Features Digital record keeping, Updates to HMRC for self-employment, Updates to HMRC for UK property, Tax estimates from HMRC based on provided updates, Free version available

Platforms: Web-based application, Android, iOS, Windows phone

Click to visit the FreeAgent website

FreeAgent Reviews From Other Websites

- Trustpilot: 4.6 out 5 based on 2,180 reviews.

- iPhone App Store: 4.8 out of 5 based on 9,600 reviews.

- Android App Store: 4.8 out of 5 based on 1,130 reviews.

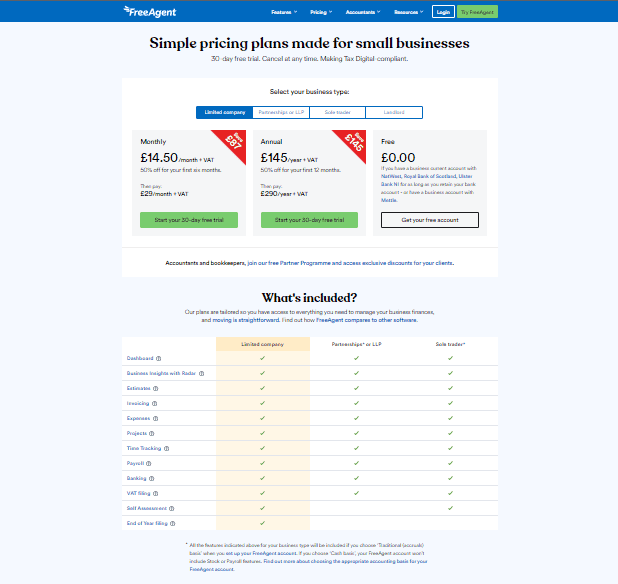

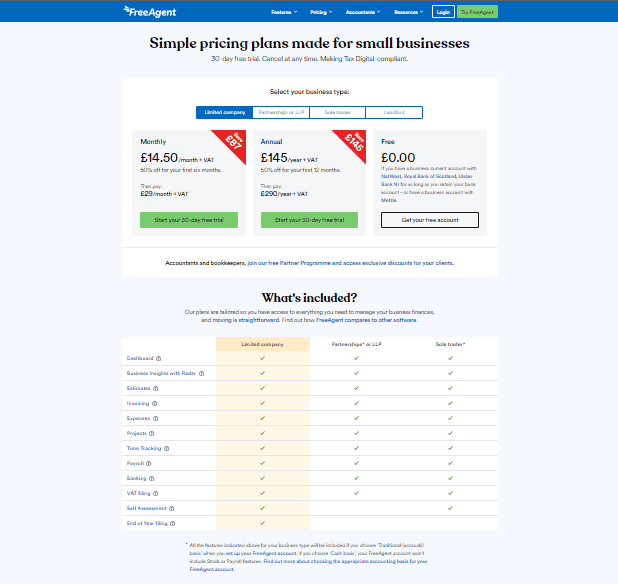

FreeAgent Prices

How much does FreeAgent cost? Here is what they publish on their website:

FreeAgent Free Plan / Free Trial

- Offers A Free Plan? Yes

- Offers A Free Trial? Yes

- How Long Does The Free Trial Last? 30 days

Paid Plan Costs

Here are the names for for the various plans FreeAgent offers and how much they cost per month:

- Sole trader: £9.50

- Partnerships or LLP: £12

- Limited company: £14.50

FreeAgent Features

Sole trader Features

- Dashboard – See the big picture for your business at a glance with cashflow, profit and loss, invoice timelines and more.

- Business Insights with Radar – Get intelligent insights, tailored trend-spotting and personalised tips all in one place.

- Estimates – Win more work with professional estimate templates ready to be converted to invoices.

- Invoicing – Get paid faster with easy invoicing tools. Send customised invoices, reminders and thank-you emails.

- Expenses – Track business costs quickly and easily. Snap receipts and record out-of-pocket expenses on the go.

- Projects – Keep tabs on your project income, expenses and profitability – all in one place.

- Time Tracking – Track the time you spend on projects, add this to invoices and generate timesheet reports.

- Payroll – Run monthly payroll and file auto-calculated PAYE and National Insurance directly to HMRC.

- Banking – Set up a bank feed and let all of your transactions flow into FreeAgent automatically.

- VAT filing – Generate MTD-compliant VAT returns automatically and file them directly to HMRC in minutes.

- Self Assessment – Get a real-time view of how much you owe for your tax return and file it directly to HMRC.

Partnerships or LLP Features

- Dashboard – See the big picture for your business at a glance with cashflow, profit and loss, invoice timelines and more.

- Business Insights with Radar – Get intelligent insights, tailored trend-spotting and personalised tips all in one place.

- Estimates – Win more work with professional estimate templates ready to be converted to invoices.

- Invoicing – Get paid faster with easy invoicing tools. Send customised invoices, reminders and thank-you emails.

- Expenses – Track business costs quickly and easily. Snap receipts and record out-of-pocket expenses on the go.

- Projects – Keep tabs on your project income, expenses and profitability – all in one place.

- Time Tracking – Track the time you spend on projects, add this to invoices and generate timesheet reports.

- Payroll – Run monthly payroll and file auto-calculated PAYE and National Insurance directly to HMRC.

- Banking – Set up a bank feed and let all of your transactions flow into FreeAgent automatically.

- VAT filing – Generate MTD-compliant VAT returns automatically and file them directly to HMRC in minutes.

Limited company Features

- Dashboard – See the big picture for your business at a glance with cashflow, profit and loss, invoice timelines and more.

- Business Insights with Radar – Get intelligent insights, tailored trend-spotting and personalised tips all in one place.

- Estimates – Win more work with professional estimate templates ready to be converted to invoices.

- Invoicing – Get paid faster with easy invoicing tools. Send customised invoices, reminders and thank-you emails.

- Expenses – Track business costs quickly and easily. Snap receipts and record out-of-pocket expenses on the go.

- Projects – Keep tabs on your project income, expenses and profitability – all in one place.

- Time Tracking – Track the time you spend on projects, add this to invoices and generate timesheet reports.

- Payroll – Run monthly payroll and file auto-calculated PAYE and National Insurance directly to HMRC.

- Banking – Set up a bank feed and let all of your transactions flow into FreeAgent automatically.

- VAT filing – Generate MTD-compliant VAT returns automatically and file them directly to HMRC in minutes.

- Self Assessment – Get a real-time view of how much you owe for your tax return and file it directly to HMRC.

- End of Year filing – Generate the data for Final Accounts and Corporation Tax returns and file directly from FreeAgent.

Other Software Integrations

- IRIS

- BTCSoftware

- HMRC

- GoSimpleTax

- TaxCalc

- Staffology

- BrightPay

Popular Features List:

- Payroll Software Integration: Yes

- Track VAT: Yes

- VAT Filing: Yes

- Real-Time Financial Reports: Yes

- Prepare Self Assessment: Yes

- Income Tax Estimates: Yes

- Manage Income & Expenses: Yes

- Create Invoices: Yes

- Forecast Cash Flow: Yes

- Accept and Make Payments In Different Currencies: Yes

- Employee Time Tracking: Yes

- Projects: Yes

- Bank Feed Integration: Yes

- End of Year Filings: Yes

- Capture Bills And Receipts: Yes

- Bulk Reconcile Transactions: Yes

- Track Inventory & Stock Levels: Yes

Pros & Cons

The following pros and cons come from Trustpilot and other third-party review sites from around the web.

Pros

- User Interface

- User Friendly

- Saves Time

- Customer Service

- Meets Business Needs

Cons

- Pay As You Earn (PAYE) software

- More bespoke accounting categories based on particular industries

- Quicker updating of tax return info