Employers assign payroll numbers to employees to make it easier for the payroll department to identify them.

Payroll numbers are also known as payroll ID numbers and are made up of a unique series of letters and numbers.

Payroll numbers can be used to safeguard the sensitive data of employees. They are a great way to minimise the risk of errors and are different from an ERN (Employer Reference Number) or PAYE reference number.

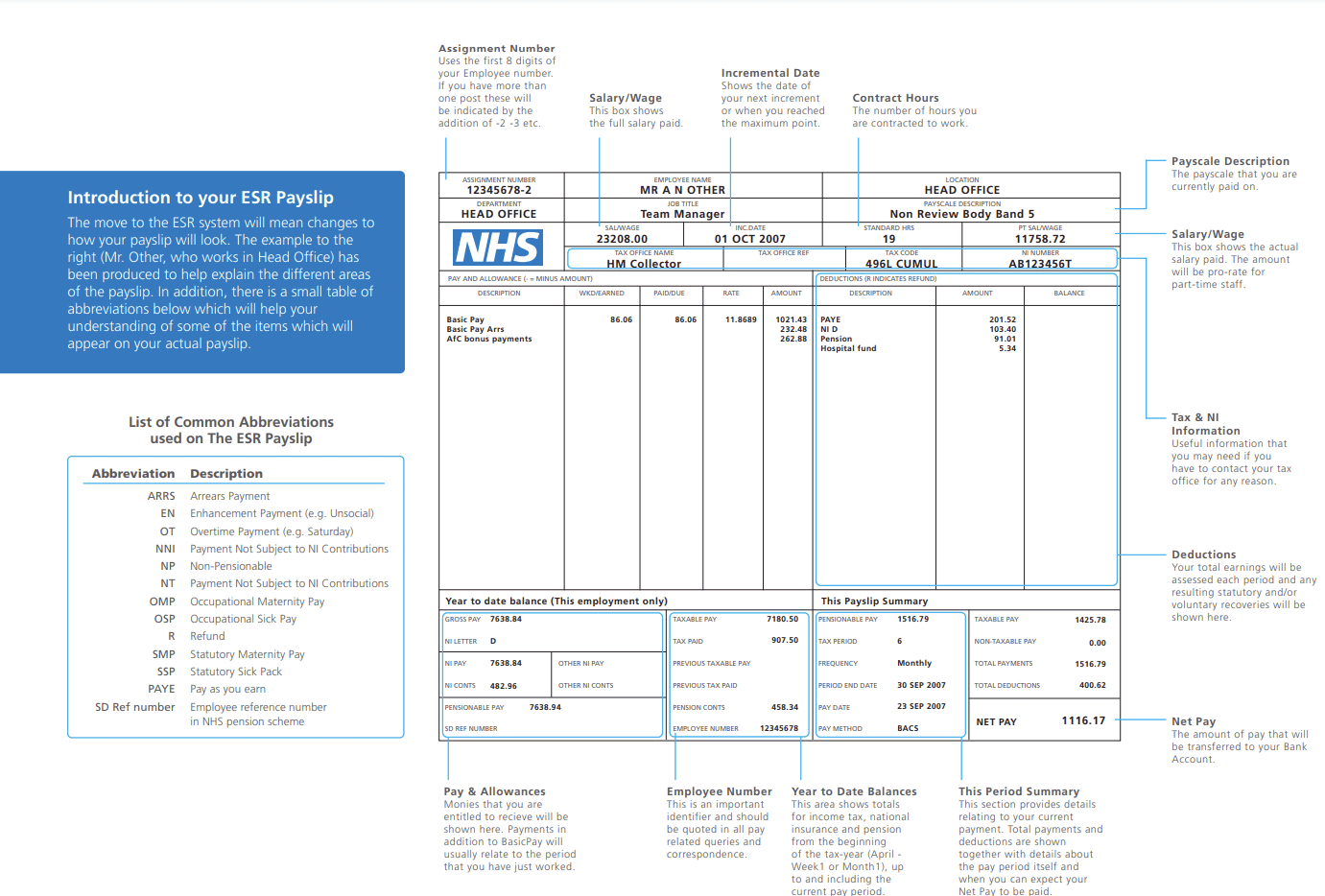

You can see an example below from NHS Payroll Services:

PAYE numbers are used by HMRC to determine different payroll schemes. They are used to collect Income Tax and National Insurance from earnings.

Businesses use the unique payroll number to track each employee across multiple databases. This minimises the need to upload excessive personal information every time.

This also minimises the risk of mix-ups if an employee shares the same or similar name to another. It allows stability should the name of an employee change while they are employed.

Why Are Payroll Numbers Important?

Payroll numbers are important for a number of reasons. They make it easier for payroll services to determine the pay and deductions when making employee payments.

The list below shows the top 5 payroll services providers in the UK:

Because payroll numbers are unique to each employee, it makes it easier to locate payslips or information when required.

Sensitive personal information is also protected by issuing employees’ payroll numbers. This helps to improve efficiency and reduces the amount of employee data stored. It also helps employers conform to GDPR (General Data Protection Regulation).

Assigning payroll numbers has been shown to minimise the risk of payroll errors. There is less chance of an HR or payroll manager inputting information for the wrong person. This helps to keep accurate records and ensures employees are paid correctly.

The payroll number is an essential element for companies that use payroll management software. Automated payroll software is a great way to streamline the payroll process and for keeping accurate records.

Where To Find A Payroll Number

Employees will find their unique payroll number in the top corner of their pay slips. It may also be found next to the employee’s name.

Payroll numbers will also be documented on official correspondence and time sheets.

Employees can also find their payroll numbers via online portals and dedicated payroll software.

Conclusion

The format of how each payroll number is created will be determined by the business. While they are not legally required, they improve processes. This makes it easier to streamline payroll duties with specialist software.

One of the main benefits of assigning payroll numbers is improved accuracy and minimises the risk of payment mistakes. It also simplifies the tracking of payment information and required deductions.

Hiring an accountant is another great way that businesses can ensure payments and deductions are accurate.

FAQs

Who creates payroll numbers?

A company’s HR department is typically tasked with creating payroll numbers. This task can also be outsourced to external companies.

Alternatively, they can be generated automatically using payroll software.

How long should a payroll number be?

There is no set rule for how long a payroll number should be or how it is made up.

The length is typically determined by how many employees work for a company and it can even be split up into departments by adding letters.

Some employers may use the employee’s National Insurance number. This ensures duplicate payroll numbers don’t occur.

Each payroll number is a unique identifier for each employee. Using at least six digits helps to ensure this.

Are payroll numbers a legal requirement?

Payroll numbers are not a legal requirement in the UK. However, they do make it easier to comply with data protection regulations and protect employee information.

The payroll number ensures corresponding salaries are paid to the relevant employee.

What happens to a payroll number when someone leaves?

When an employee leaves their unique payroll number will no longer be used. If they return to the company they would be issued with a new number.