Find out what actual customers of ANNA Free PayRoll payroll software think about it.

Or better yet leave your own review.

We also go over how much ANNA Free PayRoll costs, what features it offers and what other reviewers think about it.

ANNA Free PayRoll User Reviews

ANNA Free PayRoll Review Summary

Recent ANNA Free PayRoll Reviews

There are no reviews yet. Be the first one to write one.

Submit A Review For ANNA Free PayRoll

Key ANNA Free PayRoll Information

Software Name: ANNA Free PayRoll

Company Name: #1 ANNA PayRoll

Listed On HMRC Website: Yes

Listed As Free By HMRC: Yes

Business Size: Medium

Sector Focus: None

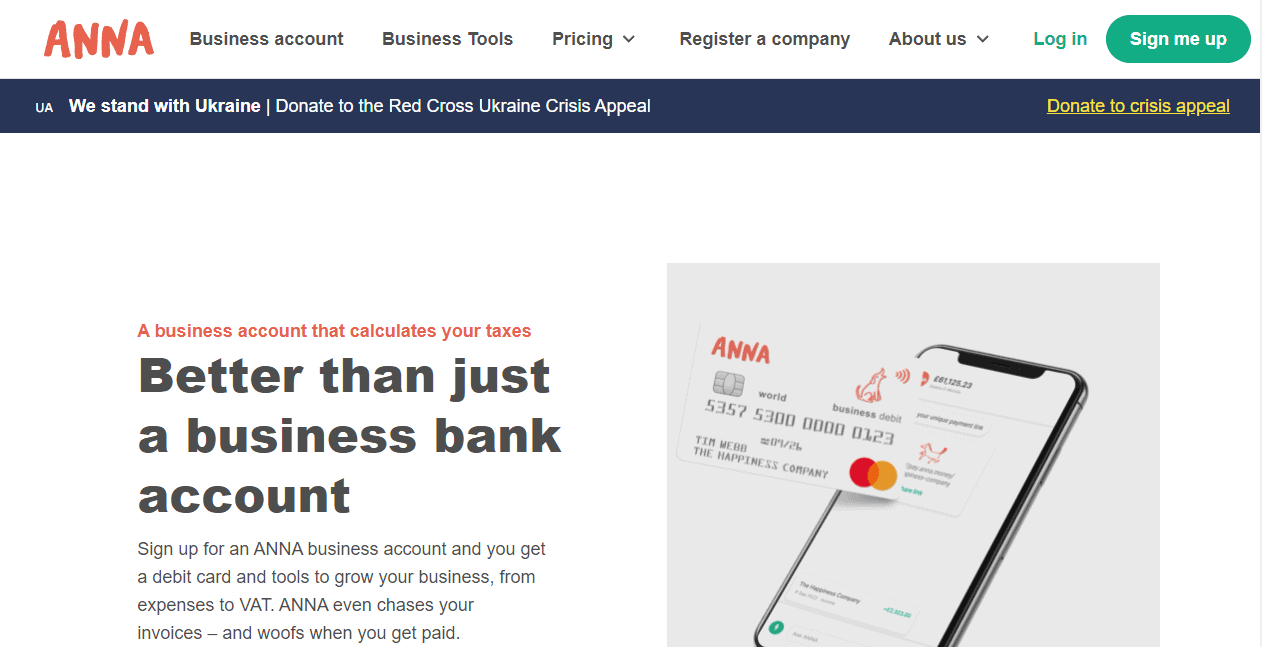

Click to visit the ANNA Free PayRoll website

ANNA Free PayRoll Reviews From Other Websites

- Trustpilot: 4.5 out 5 based on 2,516 reviews.

- iPhone App Store: 4.5 out of 5 based on 773 reviews.

- Android App Store: 4.5 out of 5 based on 23 reviews.

ANNA Free PayRoll Prices

How much does ANNA Free PayRoll cost? Here is what they publish on their website:

ANNA Free PayRoll Free Plan / Free Trial

- Offers A Free Plan? Yes

- Offers A Free Trial? No

- How Long Does The Free Trial Last? Not Applicable

Paid Plan Costs

Here are the names for for the various plans ANNA Free PayRoll offers and how much they cost per month:

- Pay as you go: £14.90

- Business: £14.90

- Big Business: £49.90

ANNA Free PayRoll Features

Pay as you go Features

- Local transfers in and out – 20p per bank transfer

- ATM withdrawals – £1 per ATM withdrawal

- International payments – £5 per SWIFT payment

- Currency conversion fee for transfers – 1%

- Personal payment link for accepting payments – Payment link with 1% commission

- Additional debit cards – 1 debit card included, £3 per extra card

- Pay cash in – Pay cash in with 1% commission

- Pots – £1 per pot monthly

- Cashback on purchases – 1% on select categories

- Prices are shown before VAT

Business Features

- Local transfers in and out – 50 free bank transfers per month 20p per transfer after that

- ATM withdrawals – 3 free ATM withdrawals per month £1 per withdrawal after that

- International payments – 1 free SWIFT payment £5 per payment after that

- Currency conversion fee for transfers – 1%

- Personal payment link for accepting payments – Free payment link usage up to £200 per month, 1% commission after that

- Additional debit cards – Up to 5 debit cards included £3 per card, per month after that

- Pay cash in – Pay in up to £300 cash per month for free, 1% commission after that

- Pots – 2 free pots, £1 per pot, per month after that

- Cashback on purchases – 1% on select categories

- The free allowances and discounts included in this plan are worth £40

Big Business Features

- Local transfers in and out – Unlimited free bank transfers

- ATM withdrawals – Unlimited free ATM withdrawals

- International payments – 4 free SWIFT payments per month £5 per payment after that

- Currency conversion fee for transfers – 0.5%

- Personal payment link for accepting payments – Unlimited, commission-free payment link usage

- Additional debit cards – Unlimited free debit cards

- Pay cash in – Pay cash into your account commission free

- Pots – Unlimited pots

- Cashback on purchases – 1% on select categories

- Some restrictions still apply â ask us in chat if you need a bespoke plan for your business

Other Software Integrations

Popular Features List:

- Run Unlimited Payrolls: No

- Automatic Tax Filing & Payments: Yes

- Live Customer Support: Yes

- Ability To Manage Employee Benefits: Yes

- Employee Access to Platform: Yes

- Direct Deposits: Yes

- Expense Reimbursements: Yes

- Time Off Tracking: £49.90

- Handle Deductions From Pay: Yes

- Debt Repayment From Pay: #1 ANNA PayRoll

- Background Checks: No

- Offers An API: Yes

- Create Payslips: Yes

- Create P45: No

- Create P60: No

- Bonus Incentive Pay: No

- Pension Filing: Yes

- Statutory Payments (E.g. Sick Pay, Maternity Pay, etc.): No

- Direct HMRC Submissions: Yes

- RTI Compliant: No

Pros & Cons

The following pros and cons come from Trustpilot and other third-party review sites from around the web.

Pros

- ANNA’s ‘Pay as you go’ business current account has no monthly fee.

- You can open an ANNA business account in as little as three minutes.

- ANNA offers 24/7 customer support through its mobile app.

- ANNA’s mobile app is available on Android and iOS.

Cons

- Since ANNA Money is an e-money account, and not a bank account, your money is not protected by the Financial Services Compensation Scheme (FSCS).

- ANNA Money does not accept cheques.

- At £14.90 a month, ANNAâs cheapest paid account is more expensive than many competitors.