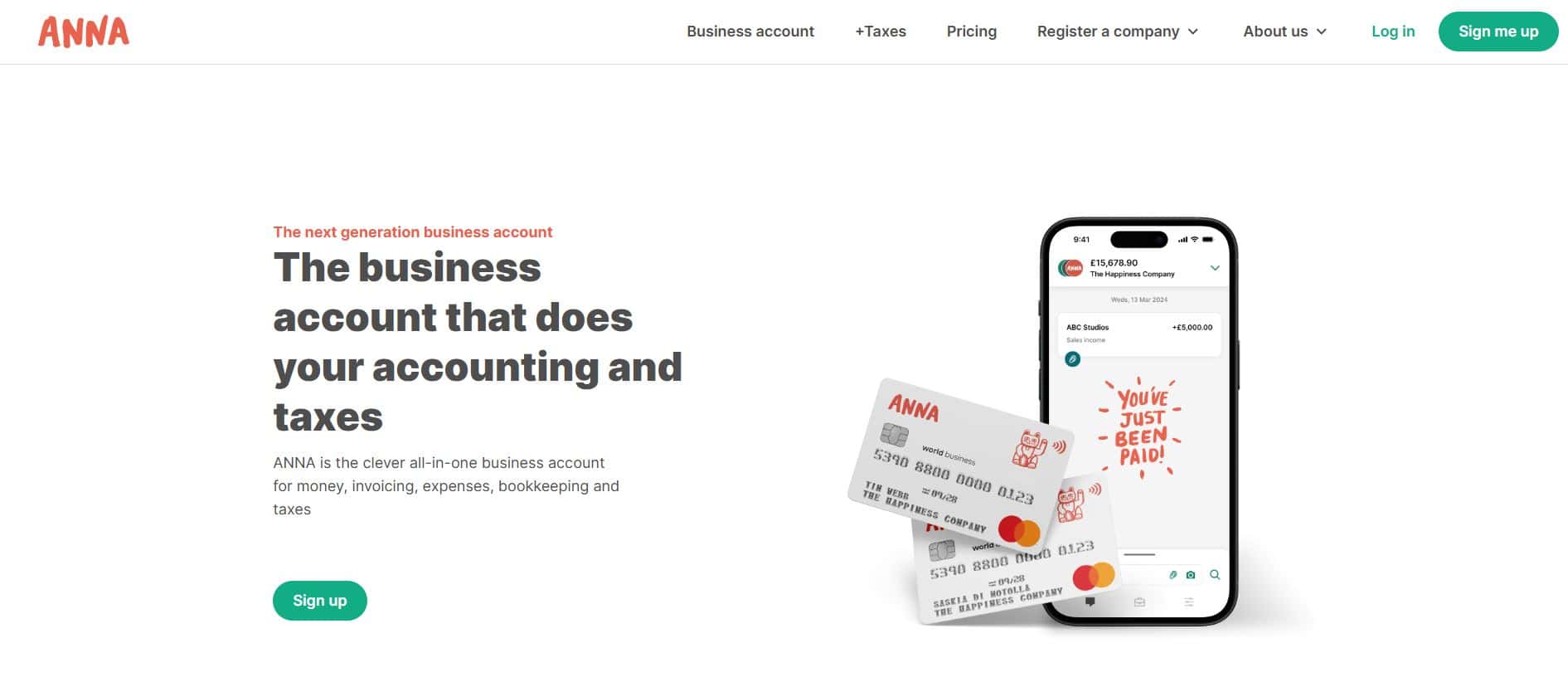

ANNA (which stands for Absolutely No-Nonsense Admin) is a mobile business current account for freelancers and small businesses. With your ID, you can open an account in 10 minutes and track all your transactions and payments on the app.

It also includes financial admin tools like invoice management and automatic tax reminders.

ANNA Business Banking Services

Current Accounts

An ANNA account combines most of the banking features you’d expect, with some optional accounting tools available for an extra cost. Businesses can open an account in minutes, which includes two debit cards.

The main advantage of an ANNA bank account is that it offers up to 40% cash back on more than 150 products and services. The exact offers are available through the app, and the selection of products and services changes often.

The fees for opening an ANNA bank account range from £0 to £49.90 monthly, plus VAT. The bank provides 1 free pot per account, but you can request additional ones for £1 per pot.

ANNA’s Pay As You Go account is free, and you only pay for the services you use each month. For instance, sending and receiving local payments costs 29p per payment. If you want a personal link to accept payments, ANNA charges a 1% commission.

ANNA also charges a 1.5% commission for ATM withdrawals.

For larger payments or sending money abroad, ANNA charges a flat fee of £5 per CHAPS payment and £5 for international payments, plus an additional 1% currency conversion charge.

Every ANNA bank account includes a limited range of accounting tools. You can create invoices or digitise receipts for free, and integrate with other accounting tools like Xero. ANNA also allows business owners to file VAT returns for a minimal fee of £3.50 plus VAT.

In addition to its free Pay As You Go account, ANNA offers two paid options: a Business account which costs £14.90 plus VAT per month, and a Big Business account for £49.90 monthly plus VAT.

The Business account entitles users to 50 local transfers per month, plus a 20p charge for each transaction over that amount. You can make 3 ATM withdrawals for free each month, or pay a 1% commission for additional withdrawals.

Regarding payments, the Business account includes 2 free CHAPS payments and 2 free international SWIFT payments per month. If you need to make additional CHAPS or SWIFT payments, you’ll pay a flat fee of £5 per payment.

Receiving payments to your Business account through a unique payment link is free up to £200 per month, or you can pay a 0.5% commission fee for any additional payments. ANNA allows Business accounts to pay in up to £300 per month for free. If you need to pay in more than that, you’ll have to pay a 1% commission.

With this type of account, ANNA allows up to 4 pots for free making it easier to manage your money. Additional pots can be purchased for £1 each.

The Big Business account gives unlimited access to most features described above. For £49.90 per month plus VAT, you can send and receive as many local and CHAPS payments as you need.

ANNA also gives Big Business account holders unlimited ATM withdrawals, no limit on paying in, and unlimited pots. However, there’s still a charge for some services such as SWIFT and international payments (4 free per month; £5 thereafter plus 0.5% currency conversion fee).

If you need more extensive accounting tools, all ANNA account holders with a limited company can choose to add on a suite of bookkeeping, tax, and payroll services for £24 per month plus VAT.

Savings Accounts

Unavailable.

Overdrafts

Unavailable.

Business Finance and Loans

Unavailable.

ANNA Reviews and Ratings

There are reviews available on Trustpilot and Smart Money People which are both very positive. 84% of Trustpilot reviewers rate ANNA ‘Excellent’ overall, with many people complimenting the fast, helpful customer service. They also think the app is easy to use and very convenient for modern businesses.

There are no public reviews on Reviews.co.uk and ANNA isn’t included in the Which? list of ‘Best & Worst Banks’.

ANNA successfully raised £3 million in equity crowdfunding in October 2019. This investment will reportedly help to fund more detailed tax calculations, an expense processing service, and AI capabilities.

Smart Money People – 4.7/5 (based on 394 reviews)

Trustpilot – 4.2/5 (based on 3,647 reviews)

Reviews.io – not included

Which? – not included

Pros

- Low monthly fees and low transaction fees.

- Pricing structure based on your business needs and usage.

- Very good reviews on Trustpilot and Smart Money People.

Cons

- Still a relatively new app – potentially less stable than a conventional bank.

- Fewer features than other online bank accounts.

- Can be expensive for businesses with a higher monthly turnover.

Website: ANNA Business Banking