Card One Money and Expend are two of the leading companies when it comes to expense cards for your UK business. But which one is better?

Below we look at how they compare. From reviews to costs to features we look at all the key things you want to know before making your decision.

Card One Money vs Expend Reviews

| Card One Money | Expend | |

| Trustpilot Review Rating | 4.6 | 4.6 |

| Number of Trustpilot Reviews | 749 | 209 |

| iPhone App Rating | 2.7 | 4.4 |

| Number of iPhone App Reviews | 60 | 14 |

| Android App Rating | 3.8 | 3.6 |

| Number of Android App Reviews | 194 | 15 |

Card One Money vs Expend Key Details

| Card One Money | Expend | |

| Website | Click Here to Visit Card One Money Website | Click Here to Visit Expend Website |

| Card Type | Mastercard | Mastercard |

| Offers Physical Cards? | Yes | Yes |

| Offers Virtual Cards? | No | Yes |

| Offers Prepaid Cards? | Yes | Yes |

| Cashback Plans? | Yes | No |

| Plans for Freelancers? | No | Yes |

| Plans for Small Business? | Yes | Yes |

| Plans For Medium Business? | Yes | Yes |

| Enterprise Plans? | No | Yes |

Card One Money vs Expend Cost

| Card One Money | Expend | |

| Free Plan? | No | No |

| Free Trial? | No | Yes |

| Cheapest Plan Price Per Month | £12.50 | £9.99 |

| Mid Plan Price Per Month | Not Applicable | Not Applicable |

| Top Plan Price Per Month | Custom pricing | £12.99 |

Card One Money vs Expend Features

Card One Money Features

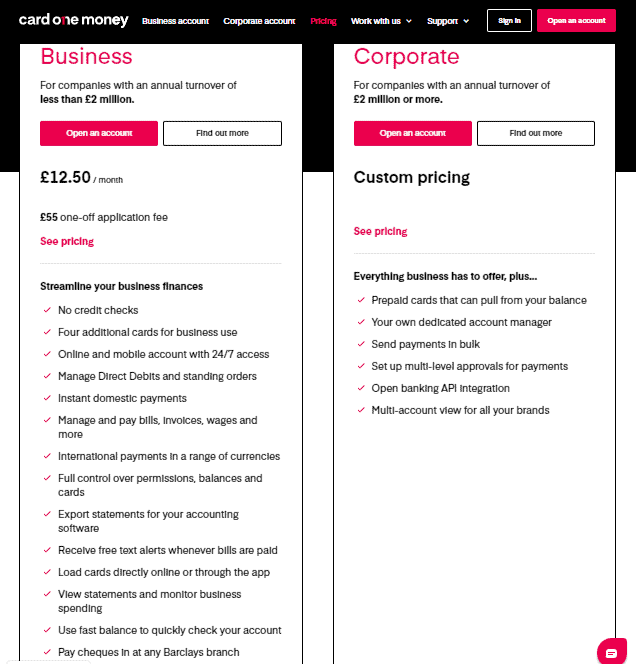

Business

- No credit checks

- Four additional cards for business use

- Online and mobile account with 24/7 access

- Manage Direct Debits and standing orders

- Instant domestic payments

- Manage and pay bills, invoices, wages and more

- International payments in a range of currencies

- Full control over permissions, balances and cards

- Export statements for your accounting software

- Receive free text alerts whenever bills are paid

- Load cards directly online or through the app

- View statements and monitor business spending

- Use fast balance to quickly check your account

- Pay cheques in at any Barclays branch

No Mid-Tier Plan

Not Applicable

Corporate

- No credit checks

- Four additional cards for business use

- Online and mobile account with 24/7 access

- Manage Direct Debits and standing orders

- Instant domestic payments

- Manage and pay bills, invoices, wages and more

- International payments in a range of currencies

- Full control over permissions, balances and cards

- Export statements for your accounting software

- Receive free text alerts whenever bills are paid

- Load cards directly online or through the app

- View statements and monitor business spending

- Use fast balance to quickly check your account

- Pay cheques in at any Barclays branch

- Prepaid cards that can pull from your balance

- Your own dedicated account manager

- Send payments in bulk

- Set up multi-level approvals for payments

- Open banking API integration

- Multi-account view for all your brands

Card One Money Accounting Software Integrations

Expend Features

Expend Essential

- First 30 days free

- Free Expend Mastercard (optional) with budget controls

- Intuitive mobile app with instant notifications

- Manage petty cash, out-of-pocket expense claims and third party cards

- Mileage tracking with automatic VAT calculation

- Expend Extract – instant data extraction from receipts

- Organise employees into Teams for easier expense approvals

- ‘Approve on the Move’ reviewing employee expenses in the mobile app

- Auto-chase missing expense receipts

- Invoice management with automated document collection

- Real-time insight and analytics of company wide spending

- Invite your accountant to view company wide spending for reporting purposes

- Securely sync expense data to your accounting software

- Dedicated Account Manager with custom onboarding and training

- Live chat, email and phone support

- No credit checks

- Unlimited users

No Mid-Tier Plan

Not Applicable

Expend Explorer

- First 30 days free

- Free Expend Mastercard (optional) with budget controls

- Intuitive mobile app with instant notifications

- Manage petty cash, out-of-pocket expense claims and third party cards

- Mileage tracking with automatic VAT calculation

- Expend Extract – instant data extraction from receipts

- Organise employees into Teams for easier expense approvals

- ‘Approve on the Move’ reviewing employee expenses in the mobile app

- Auto-chase missing expense receipts

- Invoice management with automated document collection

- Real-time insight and analytics of company wide spending

- Invite your accountant to view company wide spending for reporting purposes

- Securely sync expense data to your accounting software

- Live chat, email and phone support

- No credit checks

- Unlimited users

- 0% FX for Expend card users

- Dedicated Account Manager and Customer Success Manager

- Personalised on-boarding sessions and 121 training available

Expend Accounting Software Integrations

- Xero

- NetSuite

- Quickbooks

- Sage

- FreeAgent

Card One Money vs Expend Features Comparison

| Card One Money | Expend | |

| Apple Pay Compatible | No | No |

| Google Pay Compatible | No | No |

| Expense Claims | No | Yes |

| Expense Reimbursements | No | Yes |

| API | Yes | No |

| Access Controls/Permissions | Yes | Yes |

| Reconciliations | No | Yes |

| Approval Process Control | Yes | Yes |

| Budget Control | No | Yes |

| Expense Categorisation | No | Yes |

| Compliance Management | No | Yes |

| Customizable Fields | No | No |

| Fraud Detection | Yes | No |

| Multi-Currency Cards | Yes | Yes |

| Mileage Tracking | No | Yes |

| Mobile Receipt Upload | No | Yes |

| Real Time Notifications & Reporting | No | Yes |

| Receipt Management | No | Yes |

| Spend Control | Yes | Yes |

| Travel Management | No | Yes |

More Comparisons

Card One Money vs Zoho Expense

Card One Money vs Rydoo

Card One Money vs Amaiz

Card One Money vs B4B Payments

Card One Money vs CaxtonFX