Card One Money, formerly called CardOneBanking, is a business bank account that promises to be faster and easier to manage than a conventional bank current account. Based entirely online, customers can manage their accounts 24/7 on the app and on a desktop. Currently, 245,000 individuals and 33,000 businesses use Card One Money in the UK.

Card One Money Business Banking Services

Current Accounts

The Card One Money account has all the usual features – payments, transfers, UK call centres, Direct Debits, and a debit card. Businesses will receive up to four free prepaid Corporate MasterCards, which they can share with their team. You’ll also get text alerts when cash comes into your account.

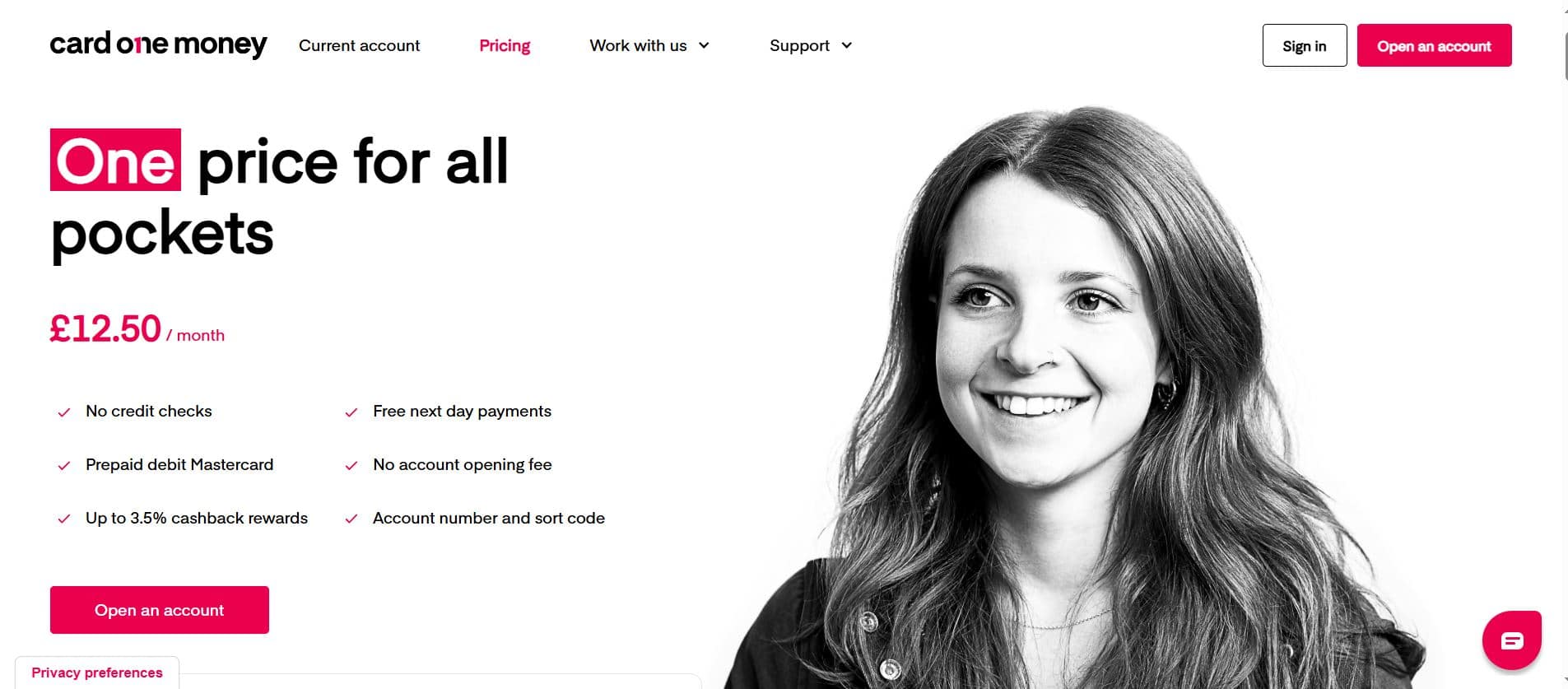

There’s a minimum monthly charge of £12.50, but no application or setup fees. There are also separate fees for ordering additional cards, withdrawing from an ATM, and making a variety of payments.

You can pay physical cash into your account at Barclays branches and the Post Office.

Savings Account

Unavailable.

Overdrafts

Unavailable.

Business Finance and Loans

Unavailable.

Card One Money Reviews and Ratings

There are 1,046 reviews on Trustpilot (from both personal and business customers), and 84% give Card One Money a 5-star rating. Of customers who were less than satisfied, some said that the company made it difficult to access their money and asked for personal information such as bank statements. Others found the customer service staff unprofessional.

There’s just three reviews on Smart Money People. Reviewers like the simplicity of the service, and say the company provides good customer service.

Card One Money isn’t included in the Which? list of ‘Best & Worst Banks’.

Card One Money won Best Business Card Programme at the 2014 Cards And Payments Awards Show.

Trustpilot – 4.4/5 (based on 1,046 reviews)

Smart Money People – 5/5 (based on 3 reviews)

Which? – Not included

Pros

- Manage your account online 24/7.

- Open an account without a credit check.

- Easy to use prepaid debit card.

Cons

- Not regulated by the Financial Services Compensation Scheme.

- Reviews are critical of customer service and general account management.

- Doesn’t have the same perks offered by other challenger banks.

Website: Card One Money Business Banking