Which accounting software is better FreeAgent or OrtoAccounts?

We compare them based on real user reviews, prices and what features they both offer.

FreeAgent vs OrtoAccounts Basics

| FreeAgent | OrtoAccounts | |

| Software Website | FreeAgent Website | OrtoAccounts Website |

| HMRC MTD Status | Approved | Not Included |

| Who Can Use It? | Agents and businesses | Businesses |

| HMRC Listed Features | Digital record keeping, Updates to HMRC for self-employment, Updates to HMRC for UK property, Tax estimates from HMRC based on provided updates, Free version available | Income and expenditure, record keeping, simplified Payroll, VAT and Annual Accounting |

| Platforms | Web-based application, Android, iOS, Windows phone | Desktop, tablet, smart phone and cloud |

FreeAgent vs OrtoAccounts Reviews

Wondering if FreeAgent or OrtoAccounts has better user reviews. We compared them below.

| FreeAgent | OrtoAccounts | |

| Trustpilot Rating | 4.6 | No Rating |

| Number of Trustpilot Reviews | 2180 | No Reviews |

| iPhone App Rating | 4.8 | No Rating |

| Number of iPhone Reviews | 9600 | No Reviews |

| Android App Rating | 4.8 | No Rating |

| Number of Android Reviews | 1130 | No Reviews |

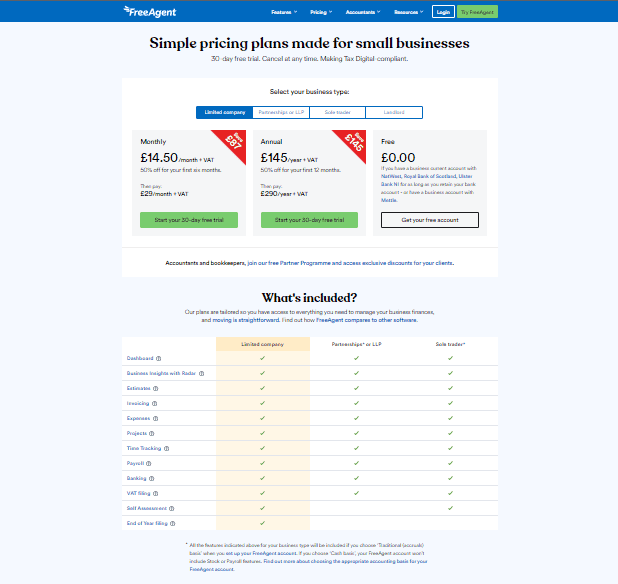

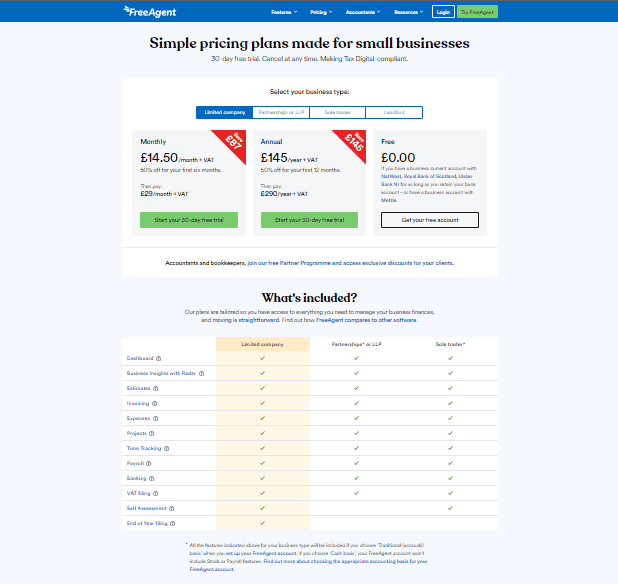

FreeAgent vs OrtoAccounts Prices

Which is cheaper FreeAgent or OrtoAccounts? Here are their prices compared.

Free Plans & Trials

| FreeAgent | OrtoAccounts | |

| Free Plan? | Yes | No |

| Free Trial? | Yes | Yes |

| Free Trial Length? | 30 days | No |

Paid Plan Prices

| FreeAgent | OrtoAccounts | |

| Cheapest Plan Cost Per Month | £9.50 | Not Listed |

| Mid-Tier Plan Cost Per Month | £12.00 | NA |

| Top Plan Cost Per Month | £14.50 | NA |

FreeAgent vs OrtoAccounts Features

FreeAgent Basic Features

- Dashboard – See the big picture for your business at a glance with cashflow, profit and loss, invoice timelines and more.

- Business Insights with Radar – Get intelligent insights, tailored trend-spotting and personalised tips all in one place.

- Estimates – Win more work with professional estimate templates ready to be converted to invoices.

- Invoicing – Get paid faster with easy invoicing tools. Send customised invoices, reminders and thank-you emails.

- Expenses – Track business costs quickly and easily. Snap receipts and record out-of-pocket expenses on the go.

- Projects – Keep tabs on your project income, expenses and profitability – all in one place.

- Time Tracking – Track the time you spend on projects, add this to invoices and generate timesheet reports.

- Payroll – Run monthly payroll and file auto-calculated PAYE and National Insurance directly to HMRC.

- Banking – Set up a bank feed and let all of your transactions flow into FreeAgent automatically.

- VAT filing – Generate MTD-compliant VAT returns automatically and file them directly to HMRC in minutes.

- Self Assessment – Get a real-time view of how much you owe for your tax return and file it directly to HMRC.

FreeAgent Software Integrations

- IRIS

- BTCSoftware

- HMRC

- GoSimpleTax

- TaxCalc

- Staffology

- BrightPay

OrtoAccounts Basic Features

- Cloud based from PC, tablet or phone

- Easy to follow online user manual

- Company data for up to 5 directors, 10 employees, 10 vehicles & 10 company cars

- All rates, bands, thresholds and allowances generated automatically based on Gov.UK

- Client database

- Quotation pro-forma including automatic quote generation and approval

- Purchase Orders

- Time sheets

- Receipt scanning with automatic expense generation

- Fully categorised expenses

- Recurring Expenses

- Automatic annual generation of Home Office Rental Agreement

- Mileage based on HMRC claim rates and user defined charge out rates

- Payroll including monthly submission to HMRC

- Payslip & P60 statements

- Including pension benefit, company car, car & fuel benefit, health benefit & statutory payments (sick, maternity, paternity, shared parental, adoption, bereavement & furlough).

- Pension auto-enrolment checker

- Statutory Reliefs & Advances and Employers NI Allowance

- Invoicing including GBP/EUR/USD options & customisable automatic dunning emails

- Invoice pro-forma including customisable expense comments

- VAT including quarterly submission to HMRC

- Annual Account generation including annual submission to HMRC

- Annual Confirmation Statement

- Summary of current and historic profit & loss accounts

- Annual Submission of Self Assessment returns

- Cash position statement

- Auto-filled Dividend Certificates with multiple shareholders, normal & special share classes

- Assets including one off and recurring purchases, write downs collated in pools, Cash- First Year- & AIA Allowances, asset sales and capital gains calculations and Cash Loans

- Inward and outward Stock Control System

- Importing of Bank Statements & automated reconciliation with manual validation

OrtoAccounts Software Integrations

Not Listed

Common Feature Comparison

| FreeAgent | OrtoAccounts | |

| Payroll Software Integration | Yes | Yes |

| Track VAT | Yes | No |

| VAT Filing | Yes | Yes |

| Real-Time Financial Reports | Yes | No |

| Prepare Self Assessment | Yes | Yes |

| Income Tax Estimates | Yes | No |

| Manage Income & Expenses | Yes | Yes |

| Create Invoices | Yes | Yes |

| Forecast Cash Flow | Yes | No |

| Accept and Make Payments In Different Currencies | Yes | Yes |

| Employee Time Tracking | Yes | Yes |

| Projects | Yes | No |

| Bank Feed Integration | Yes | No |

| End of Year Filings | Yes | No |

| Capture Bills And Receipts | Yes | Yes |

| Bulk Reconcile Transactions | Yes | Yes |

| Track Inventory & Stock Levels | Yes | No |

| FreeAgent | OrtoAccounts | |

| Pros |

|

|

| Cons |

|

|

More Comparisons

FreeAgent vs PaperLess

FreeAgent vs Odoo Accounting

Wave vs Ember

Wave vs Kashoo

Wave vs Crunch