Which payroll software is better QuickBooks Payroll or TRG Advantage Payroll?

We compare them based on real user reviews, prices and what features they both offer.

QuickBooks Payroll vs TRG Advantage Payroll Basics

QuickBooks Payroll | TRG Advantage Payroll | |

| Software Website | QuickBooks Payroll Website | TRG Advantage Payroll Website |

| Company Name | QuickBooks (Intuit) | TRG Advantage |

| Target Company Size (Small, Medium and/or Enterprise) | Small – Medium | Medium |

| Industry Focus | None | None |

QuickBooks Payroll vs TRG Advantage Payroll Reviews

Wondering if QuickBooks Payroll or TRG Advantage Payroll has better user reviews. We compared them below.

| QuickBooks Payroll | TRG Advantage Payroll | |

| Listed On HMRC Website | Yes | Yes |

| Trustpilot Rating | 4.6 | No Rating |

| Number of Trustpilot Reviews | 13039 | No Reviews |

| iPhone App Rating | 4.4 | No iPhone App |

| Number of iPhone Reviews | 814 | No Reviews |

| Android App Rating | 3.7 | No Android App |

| Number of Android Reviews | 30400 | No Reviews |

QuickBooks Payroll vs TRG Advantage Payroll Prices

Which is cheaper QuickBooks Payroll or TRG Advantage Payroll? Here are their prices compared.

Free Plans & Trials

| QuickBooks Payroll | TRG Advantage Payroll | |

| Listed As Having Free Plan By HMRC? | No | No |

| Free Plan? | No | No |

| Free Trial? | Yes | No |

| Free Trial Length? | 1 month | Not Applicable |

Paid Plan Prices

| QuickBooks Payroll | TRG Advantage Payroll | |

| Cheapest Plan Cost Per Month | £16.00 | Pricing Not On Website |

| Mid-Tier Plan Cost Per Month | NA | NA |

| Top Plan Cost Per Month | Not Listed | NA |

QuickBooks Payroll vs TRG Advantage Payroll Features

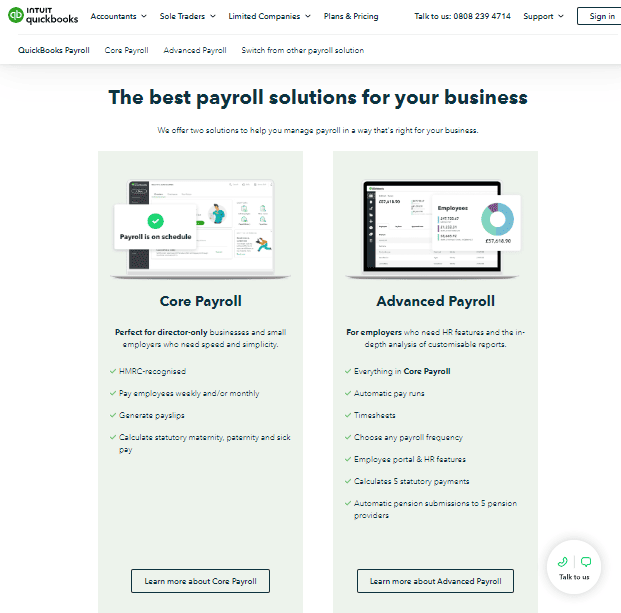

QuickBooks Payroll Basic Features

- Perfect for director-only businesses and small employers who need speed and simplicity.

- HMRC-recognised

- Pay employees weekly and/or monthly

- Generate payslips

- Calculate statutory maternity, paternity and sick pay

QuickBooks Payroll Software Integrations

TRG Advantage Payroll Basic Features

- HMRC Compliant

- RTI Compliant

- BACS Compliant

- Communication centre

- Employee Self Service

- API for your accounts and time recording software

- Real-time payroll calculations

- Enter new starters, overtime, bonuses via intuitive online access

- Electronic Invoicing and Accounts Receivable

- Run multiple payment schedules on unlimited employees

- Employee or group employees progressed forward or revert back in payroll year at any time

- Application wide validation to prevent entering invalid information

- No in-house IT expertise required

- No software to install

- Your data is password protected, secure & backed up daily

- Online help through dedicated UK based technical support team

- Audit trail of all transactions on system

TRG Advantage Payroll Software Integrations

Not Listed

Common Feature Comparison

| QuickBooks Payroll | TRG Advantage Payroll | |

| Unlimited Payrolls | No | Yes |

| Automated Tax Filing and Payments | Yes | No |

| Live Customer Support | Yes | No |

| Ability To Manage Employee Benefits | Yes | No |

| Employee Access To Platform | Yes | Yes |

| Direct Deposit | Yes | No |

| Expense Reimbursement | Yes | Yes |

| Time Off Tracking | Yes | Yes |

| Handle Deductions From Pay | Yes | No |

| Debt Repayment From Pay | Yes | No |

| Employee Background Checks | No | No |

| Has An API | Yes | Yes |

| Create Payslip | Yes | No |

| Create P45 | No | No |

| Create P60 | Yes | No |

| Pay For Salaried Employees | Yes | Yes |

| Pay For Hourly Employees | Yes | Yes |

| Bonus / Incentive Pay | No | Yes |

| Pension Filing | Yes | No |

| Statutory Payments (E.g. Sick Pay, Maternity Pay, etc.) | Yes | No |

| Direct HMRC Submissions | Yes | Yes |

| RTI Compliant | Yes | Yes |

More Comparisons

QuickBooks Payroll vs Unit4 Payroll

QuickBooks Payroll vs WCBS HR & Payroll

QuickBooks Payroll vs Wealden HR Pay

QuickBooks Payroll vs XCD HR and Payroll

QuickBooks Payroll vs ZeelPayroll