Which payroll software is better QuickBooks Payroll or Sumtotal Payroll?

We compare them based on real user reviews, prices and what features they both offer.

QuickBooks Payroll vs Sumtotal Payroll Basics

QuickBooks Payroll | Sumtotal Payroll | |

| Software Website | QuickBooks Payroll Website | Sumtotal Payroll Website |

| Company Name | QuickBooks (Intuit) | Sumtotal Systems UK Ltd |

| Target Company Size (Small, Medium and/or Enterprise) | Small – Medium | Enterprise |

| Industry Focus | None | None |

QuickBooks Payroll vs Sumtotal Payroll Reviews

Wondering if QuickBooks Payroll or Sumtotal Payroll has better user reviews. We compared them below.

| QuickBooks Payroll | Sumtotal Payroll | |

| Listed On HMRC Website | Yes | Yes |

| Trustpilot Rating | 4.6 | No Rating |

| Number of Trustpilot Reviews | 13039 | No Reviews |

| iPhone App Rating | 4.4 | 1.9 |

| Number of iPhone Reviews | 814 | 19 |

| Android App Rating | 3.7 | 2.1 |

| Number of Android Reviews | 30400 | 3980 |

QuickBooks Payroll vs Sumtotal Payroll Prices

Which is cheaper QuickBooks Payroll or Sumtotal Payroll? Here are their prices compared.

Free Plans & Trials

| QuickBooks Payroll | Sumtotal Payroll | |

| Listed As Having Free Plan By HMRC? | No | No |

| Free Plan? | No | No |

| Free Trial? | Yes | No |

| Free Trial Length? | 1 month | Not Applicable |

Paid Plan Prices

| QuickBooks Payroll | Sumtotal Payroll | |

| Cheapest Plan Cost Per Month | £16.00 | Pricing Not On Website |

| Mid-Tier Plan Cost Per Month | NA | NA |

| Top Plan Cost Per Month | Not Listed | NA |

QuickBooks Payroll vs Sumtotal Payroll Features

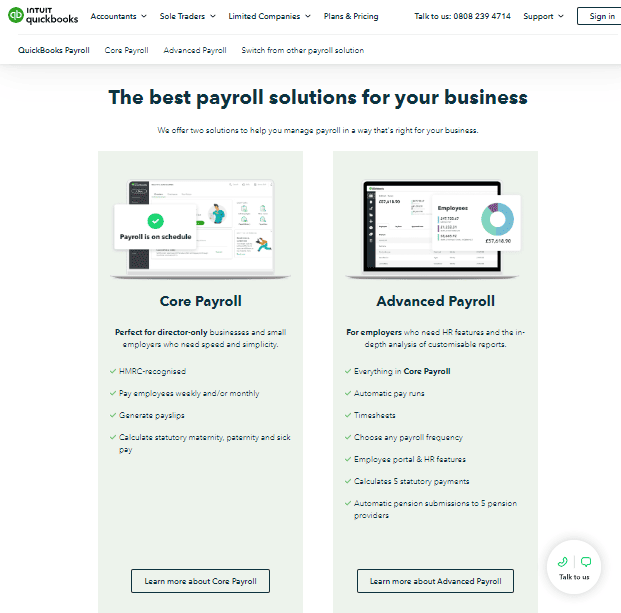

QuickBooks Payroll Basic Features

- Perfect for director-only businesses and small employers who need speed and simplicity.

- HMRC-recognised

- Pay employees weekly and/or monthly

- Generate payslips

- Calculate statutory maternity, paternity and sick pay

QuickBooks Payroll Software Integrations

Sumtotal Payroll Basic Features

- Control and track data, processes, pre-audits, employee eligibility, benefit offerings

- Quickly and easily change payroll rules and update employee benefit deductions

- Provide secure access to pay advice, annual statements, and benefit statements for employees

- Manage complex benefit plans for all employees

- Reduce administrative overhead and training time

- Achieve accurate and timely benefits enrollment

- Manage complex payroll with multiple pay types for a workforce of any size with unlimited employee and tax IDs

- Simplify union rules, dynamic pay structures

- Quickly and easily change payroll rules within the system

- Ensure full regulatory compliance for all states, provinces, and regions in North America, the UK, Ireland and Australia

Sumtotal Payroll Software Integrations

- Mercury XRS

- Lightcast

- Sapper

- EdCast

Common Feature Comparison

| QuickBooks Payroll | Sumtotal Payroll | |

| Unlimited Payrolls | No | No |

| Automated Tax Filing and Payments | Yes | No |

| Live Customer Support | Yes | No |

| Ability To Manage Employee Benefits | Yes | Yes |

| Employee Access To Platform | Yes | Yes |

| Direct Deposit | Yes | No |

| Expense Reimbursement | Yes | No |

| Time Off Tracking | Yes | Yes |

| Handle Deductions From Pay | Yes | Yes |

| Debt Repayment From Pay | Yes | No |

| Employee Background Checks | No | No |

| Has An API | Yes | No |

| Create Payslip | Yes | No |

| Create P45 | No | No |

| Create P60 | Yes | No |

| Pay For Salaried Employees | Yes | Yes |

| Pay For Hourly Employees | Yes | Yes |

| Bonus / Incentive Pay | No | No |

| Pension Filing | Yes | Yes |

| Statutory Payments (E.g. Sick Pay, Maternity Pay, etc.) | Yes | No |

| Direct HMRC Submissions | Yes | No |

| RTI Compliant | Yes | No |

More Comparisons

QuickBooks Payroll vs TalentPay

QuickBooks Payroll vs TaxShield P11D Manager

QuickBooks Payroll vs Technology One Human Resource and Payroll

QuickBooks Payroll vs TRG Advantage Payroll

QuickBooks Payroll vs Unit4 Payroll