Card One Money and Silverbird are two of the leading companies when it comes to expense cards for your UK business. But which one is better?

Below we look at how they compare. From reviews to costs to features we look at all the key things you want to know before making your decision.

Card One Money vs Silverbird Reviews

| Card One Money | Silverbird | |

| Trustpilot Review Rating | 4.6 | 4.5 |

| Number of Trustpilot Reviews | 749 | 58 |

| iPhone App Rating | 2.7 | No Rating |

| Number of iPhone App Reviews | 60 | No Reviews |

| Android App Rating | 3.8 | No Rating |

| Number of Android App Reviews | 194 | No Reviews |

Card One Money vs Silverbird Key Details

| Card One Money | Silverbird | |

| Website | Click Here to Visit Card One Money Website | Click Here to Visit Silverbird Website |

| Card Type | Mastercard | No Card Provided |

| Offers Physical Cards? | Yes | No |

| Offers Virtual Cards? | No | No |

| Offers Prepaid Cards? | Yes | No |

| Cashback Plans? | Yes | No |

| Plans for Freelancers? | No | No |

| Plans for Small Business? | Yes | Yes |

| Plans For Medium Business? | Yes | Yes |

| Enterprise Plans? | No | No |

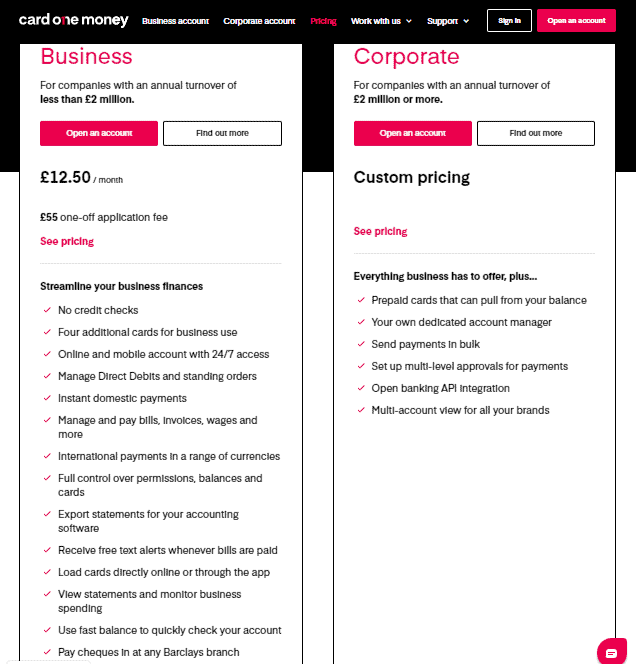

Card One Money vs Silverbird Cost

| Card One Money | Silverbird | |

| Free Plan? | No | Yes |

| Free Trial? | No | Yes |

| Cheapest Plan Price Per Month | £12.50 | Pricing Not On Website |

| Mid Plan Price Per Month | Not Applicable | Not Applicable |

| Top Plan Price Per Month | Custom pricing | Not Applicable |

Card One Money vs Silverbird Features

Card One Money Features

Business

- No credit checks

- Four additional cards for business use

- Online and mobile account with 24/7 access

- Manage Direct Debits and standing orders

- Instant domestic payments

- Manage and pay bills, invoices, wages and more

- International payments in a range of currencies

- Full control over permissions, balances and cards

- Export statements for your accounting software

- Receive free text alerts whenever bills are paid

- Load cards directly online or through the app

- View statements and monitor business spending

- Use fast balance to quickly check your account

- Pay cheques in at any Barclays branch

No Mid-Tier Plan

Not Applicable

Corporate

- No credit checks

- Four additional cards for business use

- Online and mobile account with 24/7 access

- Manage Direct Debits and standing orders

- Instant domestic payments

- Manage and pay bills, invoices, wages and more

- International payments in a range of currencies

- Full control over permissions, balances and cards

- Export statements for your accounting software

- Receive free text alerts whenever bills are paid

- Load cards directly online or through the app

- View statements and monitor business spending

- Use fast balance to quickly check your account

- Pay cheques in at any Barclays branch

- Prepaid cards that can pull from your balance

- Your own dedicated account manager

- Send payments in bulk

- Set up multi-level approvals for payments

- Open banking API integration

- Multi-account view for all your brands

Card One Money Accounting Software Integrations

Silverbird Features

Standard

No Features Listed On Website

No Mid-Tier Plan

Not Applicable

Not Top Plan

Not Applicable

Silverbird Accounting Software Integrations

Not Listed

Card One Money vs Silverbird Features Comparison

| Card One Money | Silverbird | |

| Apple Pay Compatible | No | No |

| Google Pay Compatible | No | No |

| Expense Claims | No | No |

| Expense Reimbursements | No | No |

| API | Yes | Yes |

| Access Controls/Permissions | Yes | Yes |

| Reconciliations | No | No |

| Approval Process Control | Yes | No |

| Budget Control | No | No |

| Expense Categorisation | No | No |

| Compliance Management | No | Yes |

| Customizable Fields | No | No |

| Fraud Detection | Yes | Yes |

| Multi-Currency Cards | Yes | Yes |

| Mileage Tracking | No | No |

| Mobile Receipt Upload | No | No |

| Real Time Notifications & Reporting | No | Yes |

| Receipt Management | No | No |

| Spend Control | Yes | No |

| Travel Management | No | No |

More Comparisons

Card One Money vs Intergiro

Card One Money vs GoSolo

Card One Money vs 3S Money

Card One Money vs Dext

Card One Money vs Tipalti