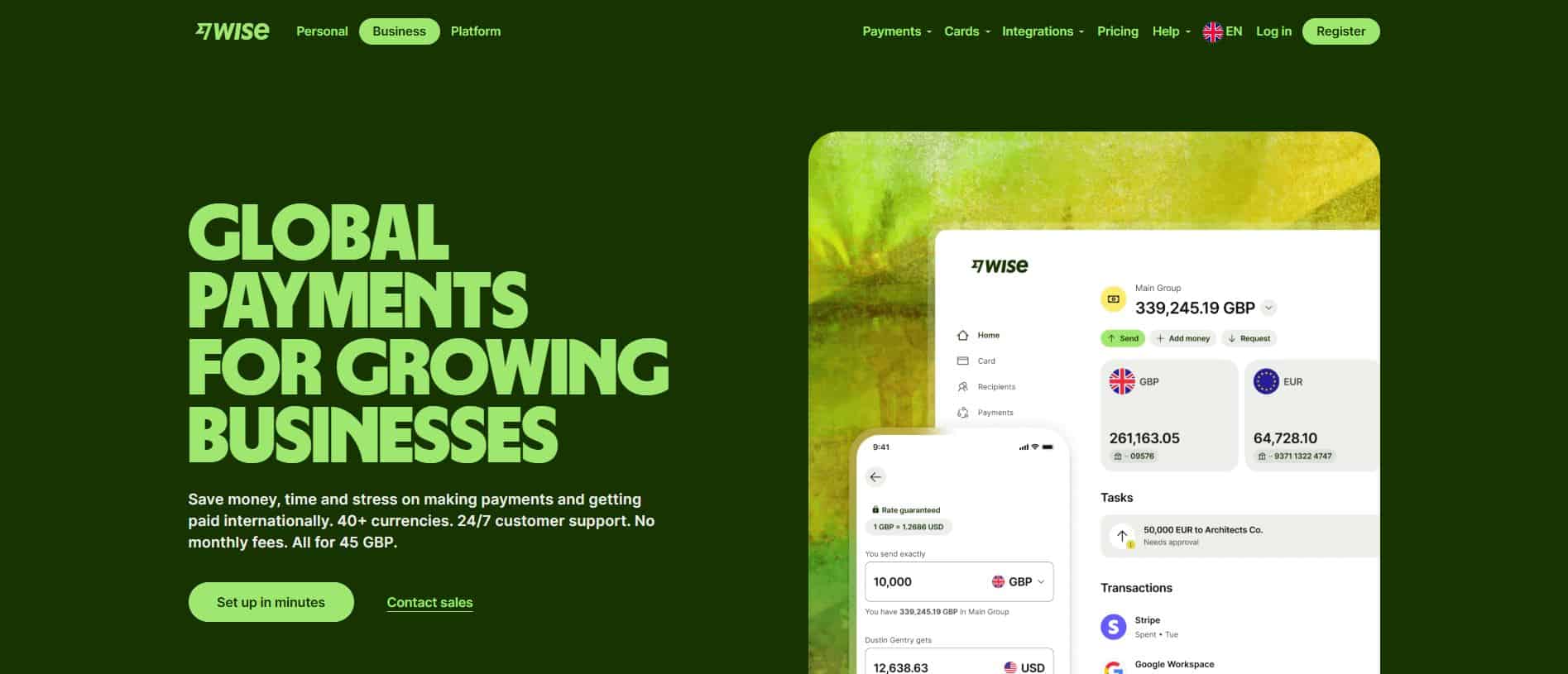

Wise (formerly TransferWise) offers a business account that makes sending and receiving foreign currencies easier for businesses. It has accounts for sole traders, freelancers, small businesses, and large enterprises.

Founded in 2011 by some of the team behind Skype, the company received a $25 million investment from Sir Richard Branson. Wise’s mission is to deliver a banking product that is instant, convenient, transparent, and lower cost, so that customers can move money quickly at a fair price, without hidden fees.

Wise is regulated by the Financial Conduct Authority (FCA) and had over 12.8 million customers worldwide in 2024.

Wise Business Banking Services

Current Accounts

Wise keeps banking simple by offering only one type of current account for business owners, including small businesses and freelancers.

Opening a business bank account with Wise costs £45. Once your account is set up, you’ll receive a debit card free of charge. Each additional debit card costs £3 including delivery.

Wise doesn’t charge an annual account fee; you only pay for the services you use.

Business account holders can withdraw up to £200 monthly from an ATM for free. If you plan to withdraw more than that, you can expect to pay 1.75% of the amount you withdraw plus £0.50 per transaction.

You can also receive local payments in 9 currencies (including GBP, USD, and EUR) and Swift payments in 21 currencies at no cost.

You can earn up to 0.5% cashback on spending through your Wise debit card.

Whilst receiving money in most currencies is free (excluding Swift payments from the US and Canada), Wise charges business account holders a range of fees for sending money or making payments in foreign currencies.

For instance, the cost of sending money or exchanging currencies starts at 0.33% of the transaction value, depending on the currency.

Topping up an e-wallet or funding an account in certain currencies (other than GPB, USD, EUR, AUD, etc.) can incur a 2% fee.

Wise also charges fees to grow your money. If you want to earn interest on your account holdings by joining Wise Interest, there’s an annual fee of 0.56%. Or, if you want to invest the money in your Wise account in the iShares World Equity Index Fund (the only ETF supported by Wise at present), there’s an annual charge of 0.61%.

Besides sending and receiving money, the Wise app has many useful tools for business owners, including managing team expenses and setting spending limits. Plus, you can integrate your Wise account with various accounting software platforms including Xero, Quickbooks, Zoho, Plum, and more.

Savings Account

Wise doesn’t offer a traditional business savings account. However, Wise and BlackRock have partnered to give customers the option to earn interest on any GBP, EUR, or USD in their accounts.

To do this, customers must enable the interest function in the app. Wise then invests that money into an “interest-earning fund that holds government-guaranteed assets.”

The money in your account accrues interest daily, and you can use it anytime. It’s important to note that any interest you earn may be subject to tax (e.g., capital gains) depending on your specific financial circumstances.

Overdrafts

Unavailable.

Business Finance and Loans

Unavailable.

Wise Reviews and Ratings

Reviews from Trustpilot, Smart Money People, and Reviews.io are generally positive. Many customers like the exchange rates and how quickly Wise processes money transfers. Customers who have been more critical of the bank seem to have issues with blocked or cancelled transfers.

Wise isn’t included in the Which? list of ‘Best & Worst Banks’.

In July 2024, Wise commissioned an independent price comparison study which found that, on average, Wise is “5x cheaper for spending abroad” than competitors such as Monzo, Revolut, PayPal, and the Post Office, among others.

In 2024, Wise expanded its services in Brazil and is now an authorised payment institution. In January 2025, the company expanded into Mexico. Customers in 160 countries can now send or receive money in over 40 currencies.

Smart Money People – 4.7/5 (based on 115 reviews)

Trustpilot – 4.3/5 (based on 247,559 reviews)

Reviews.io – 2.2/5 (based on 44 reviews)

Which? – Not included

Pros

- An affordable way to send and receive foreign currencies.

- Fast and intelligent. You can manage it all online.

- Generally positive reviews.

Cons

- Not necessarily a replacement for a normal business current account.

- Only useful for businesses working and spending abroad. Some customers wish their accounts had more features.

Website: Wise Business Banking