Wondering when your corporation tax is due? Read our guide to find out when you have to make corporation tax payments.

What Businesses Have A Corporation Tax Due Date?

All limited companies based and operating in the UK need to pay corporation tax before a set date.

Limited companies based outside the country but holding UK offices or stores are also obliged to pay corporation tax on their UK earnings.

How much corporation tax do you have to pay?

The amount of tax you’ll have to pay depends on how much taxable profits your company earns during an accounting period.

For example, if you made £50,000 in profit as a limited company, you’d have to pay 19% in corporation tax (as stated in this rates and relief guide). If your company made in excess of this, the tax amount would rise to 25%.

What businesses are exempt from corporation tax?

There is no corporation tax threshold.

However, some businesses are completely exempt from corporation tax deadlines. Partnerships and sole traders do not have to pay corporation tax, and, therefore, don’t have to worry about a corporation tax due date.

Instead, partnerships and sole traders pay income tax and capital gains tax.

Filing Your Company Tax Return

Before you pay corporation tax, you must first file your tax return to HMRC.

This report details your earnings, losses, and loans. HMRC will assess this, and provide you with a corporation tax bill. This will reflect the exact amount of corporation tax you must pay based on your financial activity in the last year.

The deadline for filing your tax return is one year after the end of your company’s last accounting period.

You must ensure that your company tax return is 100% accurate. Accidental inaccuracies could lead to up to 30% interest being added to your tax account. Deliberate inaccuracies can incur a much bigger fine, and even lead to you having to pay 100% in interest.

Corporation Tax Bill Due Date

As aforementioned, you’ll get your tax bill after submitting your tax return.

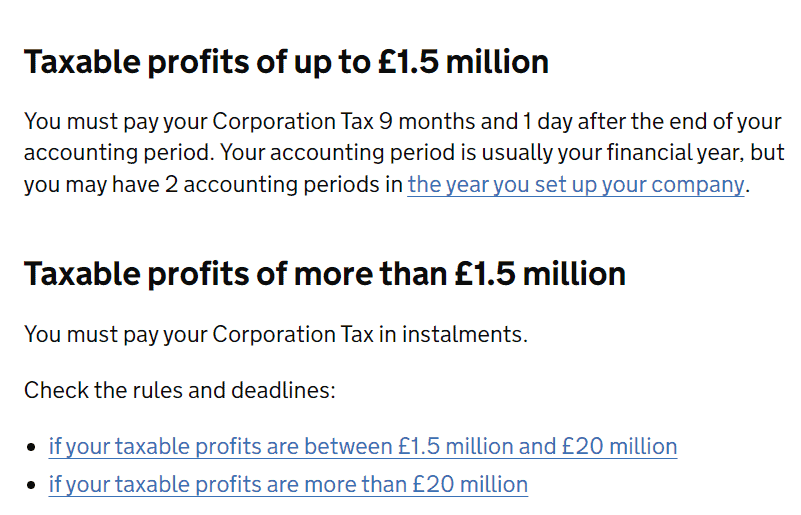

This bill must be settled within nine months and one day after your company’s last accounting period.

So, if your company’s accounting period ended on the 30th of April, you’d have to pay your corporation bill by the 1st of February.

Every company’s corporation tax bill is different – it depends entirely on when a company’s accounting period ends.

Late Corporation Tax Return Filing

If you fail to meet your corporation tax payment deadline, the amount you’ll owe when you do submit the tax return will be increased.

The penalties for late corporation tax payments are as follows:

- One day – £100

- After three months – an additional £100

- After six months – 10% interest is added to your bill (or 10% of however much corporation tax you have outstanding)

- After one year – an additional 10% is added

Late Corporation Tax Payment Penalties

If you fail to meet the corporation tax deadline, you’ll be charged interest on the outstanding amount. If HMRC doesn’t receive your corporate tax after significant interest is added, they may carry out one of the following procedures:

- Use a debt-collecting agency to retrieve the money.

- Go directly to your bank or building society and recover the money from there.

- Sell off your assets.

- Arrange court proceedings.

- Close your company down or send it into liquidation.

Even if you’ve made the payment within the deadline, it may take a few days for the payments to reach the HMRC. For example, a payment through a BACS transfer will take three days to arrive at the HMRC. When setting up a new direct debit, it can take as many as five days for the payment to be delivered.

Final Thoughts

To successfully pay HMRC corporation tax, you need to first submit your corporation tax returns. Then, you’ll receive a bill for how much you owe in tax. This can be paid electronically or in person.

To ensure you meet the corporation tax return deadline, hire a company accountant to take care of your return filing and payments.

Sources:

https://blog.shorts.uk.com/corporation-tax-everything-you-need-to-know

https://www.simplybusiness.co.uk/knowledge/articles/2022/12/when-is-corporation-tax-due/