Which payroll software is better Basic PAYE Tools or Wealden HR Pay?

We compare them based on real user reviews, prices and what features they both offer.

Basic PAYE Tools vs Wealden HR Pay Basics

Basic PAYE Tools | Wealden HR Pay | |

| Software Website | Basic PAYE Tools Website | Wealden HR Pay Website |

| Company Name | HMRC | Wealden HR & Payroll Solutions |

| Target Company Size (Small, Medium and/or Enterprise) | Small | Enterprise |

| Industry Focus | None | Education |

Basic PAYE Tools vs Wealden HR Pay Reviews

Wondering if Basic PAYE Tools or Wealden HR Pay has better user reviews. We compared them below.

| Basic PAYE Tools | Wealden HR Pay | |

| Listed On HMRC Website | Yes | Yes |

| Trustpilot Rating | 1.3 | No Rating |

| Number of Trustpilot Reviews | 312 | No Reviews |

| iPhone App Rating | 4.8 | No iPhone App |

| Number of iPhone Reviews | 130600 | No Reviews |

| Android App Rating | 4.7 | No Android App |

| Number of Android Reviews | 49900 | No Reviews |

Basic PAYE Tools vs Wealden HR Pay Prices

Which is cheaper Basic PAYE Tools or Wealden HR Pay? Here are their prices compared.

Free Plans & Trials

| Basic PAYE Tools | Wealden HR Pay | |

| Listed As Having Free Plan By HMRC? | Yes | No |

| Free Plan? | No | No |

| Free Trial? | No | No |

| Free Trial Length? | Not Applicable | Not Applicable |

Paid Plan Prices

| Basic PAYE Tools | Wealden HR Pay | |

| Cheapest Plan Cost Per Month | Free | Pricing Not On Website |

| Mid-Tier Plan Cost Per Month | NA | NA |

| Top Plan Cost Per Month | NA | NA |

Basic PAYE Tools vs Wealden HR Pay Features

Basic PAYE Tools Basic Features

- Payroll tasks

- Working out the tax

- National Insurance for your employees

- Sending information to HMRC

- Check a new employee’s National Insurance number (NVR)

- Send an Employer Payment Summary (EPS)

- Send an Earlier Year Update (EYU) – for the 2019 to 2020 tax year and earlier

Basic PAYE Tools Software Integrations

Not Listed

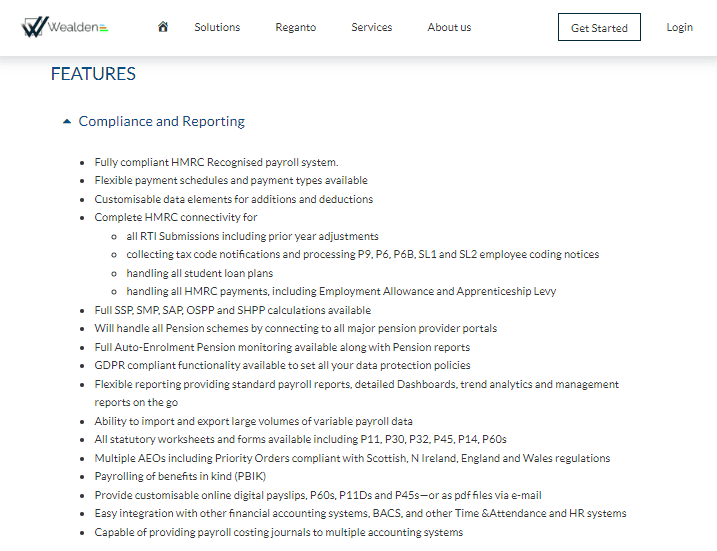

Wealden HR Pay Basic Features

- Fully compliant HMRC Recognised payroll system.

- Flexible payment schedules and payment types available

- Customisable data elements for additions and deductions

- Complete HMRC connectivity for

- Full SSP, SMP, SAP, OSPP and SHPP calculations available

- Will handle all Pension schemes by connecting to all major pension provider portals

- Full Auto-Enrolment Pension monitoring available along with Pension reports

- GDPR compliant functionality available to set all your data protection policies

- Flexible reporting providing standard payroll reports, detailed Dashboards, trend analytics and management reports on the go

- Ability to import and export large volumes of variable payroll data

- All statutory worksheets and forms available including P11, P30, P32, P45, P14, P60s

- Multiple AEOs including Priority Orders compliant with Scottish, N Ireland, England and Wales regulations

- Payrolling of benefits in kind (PBIK)

- Provide customisable online digital payslips, P60s, P11Ds and P45s—or as pdf files via e-mail

- Easy integration with other financial accounting systems, BACS, and other Time &Attendance and HR systems

- Capable of providing payroll costing journals to multiple accounting systems

- Full support for qualifying pension schemes offered by the National Employment Savings Trust (NEST), NOW: Pensions, The People’s Pension and many more.

- Supports NEST Web Services, allowing easy one-click submissions directly to NEST, without the need for CSV files.

- Enter your staging date and HRPay will notify you when to enrol your employees (and provide an assessment/cost preview).

- Provide employee assessments with action list.

- Enrol employees into a qualifying pension scheme.

- Defer your automatic enrolment duties by using a postponement period.

Wealden HR Pay Software Integrations

- NEST

- NOW

- The People’s Pension

Common Feature Comparison

| Basic PAYE Tools | Wealden HR Pay | |

| Unlimited Payrolls | No | No |

| Automated Tax Filing and Payments | No | No |

| Live Customer Support | No | No |

| Ability To Manage Employee Benefits | No | Yes |

| Employee Access To Platform | No | Yes |

| Direct Deposit | No | No |

| Expense Reimbursement | No | No |

| Time Off Tracking | No | Yes |

| Handle Deductions From Pay | No | Yes |

| Debt Repayment From Pay | No | Yes |

| Employee Background Checks | No | No |

| Has An API | No | No |

| Create Payslip | No | Yes |

| Create P45 | No | Yes |

| Create P60 | No | Yes |

| Pay For Salaried Employees | Yes | Yes |

| Pay For Hourly Employees | Yes | Yes |

| Bonus / Incentive Pay | No | No |

| Pension Filing | No | Yes |

| Statutory Payments (E.g. Sick Pay, Maternity Pay, etc.) | No | Yes |

| Direct HMRC Submissions | No | Yes |

| RTI Compliant | No | Yes |

More Comparisons

Basic PAYE Tools vs XCD HR and Payroll

Basic PAYE Tools vs ZeelPayroll

Basic PAYE Tools vs Zellis HCM Cloud

Basic PAYE Tools vs ZotaBooks

IRIS Payroll vs Advanced Payroll