Soldo and Intergiro are two of the leading companies when it comes to expense cards for your UK business. But which one is better?

Below we look at how they compare. From reviews to costs to features we look at all the key things you want to know before making your decision.

Soldo vs Intergiro Reviews

| Soldo | Intergiro | |

| Trustpilot Review Rating | 4.6 | 3.6 |

| Number of Trustpilot Reviews | 1602 | 168 |

| iPhone App Rating | 2.6 | 5 |

| Number of iPhone App Reviews | 69 | 4 |

| Android App Rating | 2.9 | No Rating |

| Number of Android App Reviews | 150 | No Reviews |

Soldo vs Intergiro Key Details

| Soldo | Intergiro | |

| Website | Click Here to Visit Soldo Website | Click Here to Visit Intergiro Website |

| Card Type | Mastercard | Mastercard |

| Offers Physical Cards? | Yes | Yes |

| Offers Virtual Cards? | Yes | Yes |

| Offers Prepaid Cards? | Yes | Yes |

| Cashback Plans? | No | No |

| Plans for Freelancers? | Yes | No |

| Plans for Small Business? | Yes | Yes |

| Plans For Medium Business? | Yes | Yes |

| Enterprise Plans? | Yes | Yes |

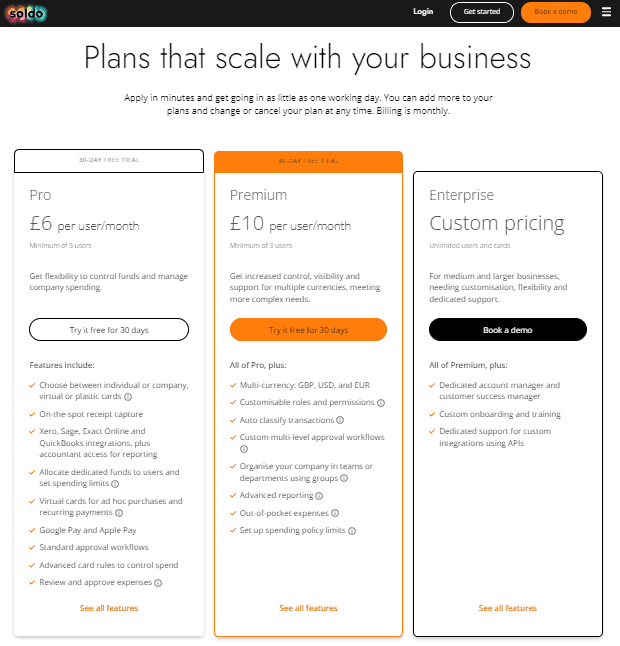

Soldo vs Intergiro Cost

| Soldo | Intergiro | |

| Free Plan? | No | No |

| Free Trial? | Yes | No |

| Cheapest Plan Price Per Month | £6.00 | £16.49 |

| Mid Plan Price Per Month | £10.00 | £42.53 |

| Top Plan Price Per Month | Custom pricing | Custom |

Soldo vs Intergiro Features

Soldo Features

Pro

- Choose between individual or company, virtual or plastic cards Tooltip

- On-the-spot receipt capture

- Xero, Sage, Exact Online and QuickBooks integrations, plus accountant access for reporting

- Allocate dedicated funds to users and set spending limits Tooltip

- Virtual cards for ad hoc purchases and recurring payments Tooltip

- Google Pay and Apple Pay

- Standard approval workflows

- Advanced card rules to control spend

- Review and approve expenses Tooltip

Premium

- Choose between individual or company, virtual or plastic cards Tooltip

- On-the-spot receipt capture

- Xero, Sage, Exact Online and QuickBooks integrations, plus accountant access for reporting

- Allocate dedicated funds to users and set spending limits Tooltip

- Virtual cards for ad hoc purchases and recurring payments Tooltip

- Google Pay and Apple Pay

- Standard approval workflows

- Advanced card rules to control spend

- Review and approve expenses Tooltip

- Multi-currency: GBP, USD, and EUR

- Customisable roles and permissions Tooltip

- Auto classify transactions Tooltip

- Custom multi-level approval workflows Tooltip

- Organise your company in teams or departments using groups Tooltip

- Advanced reporting Tooltip

- Out-of-pocket expenses Tooltip

- Set up spending policy limits Tooltip

Enterprise

- Choose between individual or company, virtual or plastic cards Tooltip

- On-the-spot receipt capture

- Xero, Sage, Exact Online and QuickBooks integrations, plus accountant access for reporting

- Allocate dedicated funds to users and set spending limits Tooltip

- Virtual cards for ad hoc purchases and recurring payments Tooltip

- Google Pay and Apple Pay

- Standard approval workflows

- Advanced card rules to control spend

- Review and approve expenses Tooltip

- Multi-currency: GBP, USD, and EUR

- Customisable roles and permissions Tooltip

- Auto classify transactions Tooltip

- Custom multi-level approval workflows Tooltip

- Organise your company in teams or departments using groups Tooltip

- Advanced reporting Tooltip

- Out-of-pocket expenses Tooltip

- Set up spending policy limits Tooltip

- Dedicated account manager and customer success manager

- Custom onboarding and training

- Dedicated support for custom integrations using APIs

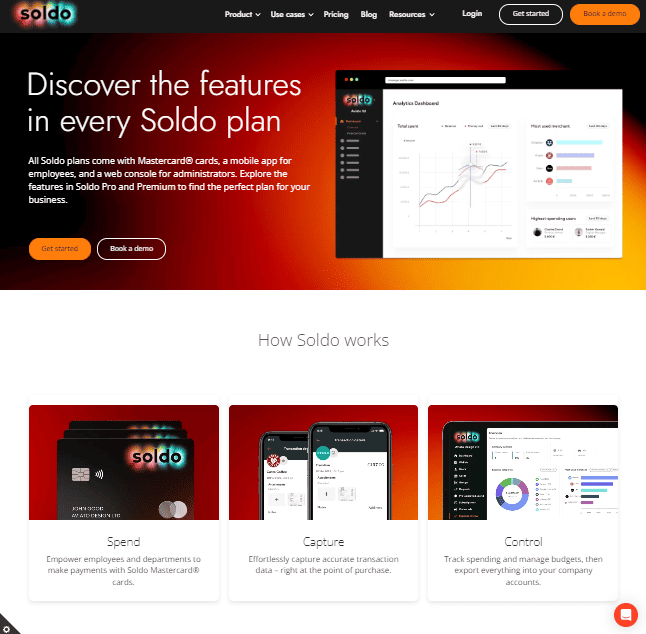

Soldo Accounting Software Integrations

- Xero

- QuickBooks

- Exact Online

- Sage

Intergiro Features

Starter

- Highly-acclaimed customer support via email and chat

- Business banking API

- EURO IBAN (SEPA)

- Multi-currency IBAN (SWIFT)

- Hold and convert balances in USD GBP, SEK, NOK, DKK, PLN, AUD, EUR

- Virtual and physical cards for business expenses

- Inbound Euro payments (via SEPA) – Free

- Outbound Euro payments (via SEPA) – 25x / month or 10,000€ / month

- International payments (inbound / outbound via SWIFT) – €20 per transaction

- Outbound local payments in USD, GBP, SEK, DKK, NOK, PLN, AUD – 2€

Growth

- Highly-acclaimed customer support via email and chat

- Business banking API

- EURO IBAN (SEPA)

- Multi-currency IBAN (SWIFT)

- Hold and convert balances in USD GBP, SEK, NOK, DKK, PLN, AUD, EUR

- Virtual and physical cards for business expenses

- Inbound Euro payments (via SEPA) – Free

- Outbound Euro payments (via SEPA) – No thresholds

- International payments (inbound / outbound via SWIFT) – €10 per transaction

- Outbound local payments in USD, GBP, SEK, DKK, NOK, PLN, AUD – €1

Enterprise

- Highly-acclaimed customer support via email and chat

- Business banking API

- EURO IBAN (SEPA)

- Multi-currency IBAN (SWIFT)

- Hold and convert balances in USD GBP, SEK, NOK, DKK, PLN, AUD, EUR

- Virtual and physical cards for business expenses

- Inbound Euro payments (via SEPA) – Customised

- Outbound Euro payments (via SEPA) – Customised

- International payments (inbound / outbound via SWIFT) – Customised

- Outbound local payments in USD, GBP, SEK, DKK, NOK, PLN, AUD – Customised

Intergiro Accounting Software Integrations

Not Listed

Soldo vs Intergiro Features Comparison

| Soldo | Intergiro | |

| Apple Pay Compatible | Yes | Yes |

| Google Pay Compatible | Yes | Yes |

| Expense Claims | Yes | No |

| Expense Reimbursements | Yes | No |

| API | Yes | Yes |

| Access Controls/Permissions | Yes | Yes |

| Reconciliations | No | Yes |

| Approval Process Control | Yes | No |

| Budget Control | Yes | No |

| Expense Categorisation | Yes | No |

| Compliance Management | Yes | Yes |

| Customizable Fields | Yes | No |

| Fraud Detection | Yes | Yes |

| Multi-Currency Cards | Yes | Yes |

| Mileage Tracking | Yes | No |

| Mobile Receipt Upload | Yes | No |

| Real Time Notifications & Reporting | Yes | Yes |

| Receipt Management | Yes | No |

| Spend Control | Yes | Yes |

| Travel Management | Yes | Yes |

More Comparisons

Soldo vs GoSolo

Soldo vs 3S Money

Soldo vs Dext

Soldo vs Tipalti

Soldo vs Moss