So what is payroll? You may think payroll refers to the process of paying your employees’ wages or salaries at the end of their pay periods.

You’re not wrong, but that’s only a small part of the payroll process, which is actually quite detailed and involved. Let’s find out more:

Exactly what is payroll?

The term “payroll” itself is an easier way of referring to the management and operation of the whole payroll system.

The payroll process is actually one that begins before a business starts employing staff members. You can carry out payroll responsibilities yourself, or appoint somebody who will be processing payroll for the company.

Alternatively, you can find a payroll service provider to carry out the service.

The list below shows the top 5 payroll services providers in the UK:

If you decide to do payroll in-house, you will want to select your payroll system – whether you will use payroll software or do the task manually.

Thereafter, the responsible person must get the relevant information from each staff member. After that, they must capture this information to use during weekly or monthly payroll processing. Your bookkeeper, accountant, or payroll service provider should enter payment rates and periods for each employee.

They should set up all the special categories for items like overtime pay rates, bonuses, tax brackets, and other deductions. Once the initial setup is complete, the payroll administrator can begin calculating and inputting different wage and salary information.

This includes the gross and net pay, employee hours worked, and post and pre-tax deductions.

Payroll typically refers to paying employees on the company books and does not include contractors or freelancers as a rule.

Why do you need payroll?

The payroll process serves an important role in an organisation for several reasons. You have a duty to your employees and HMRC to provide accurate and timely records and payments. Here are some reasons payroll is necessary for a business:

Accurate employees remuneration

It’s a business’s duty to pay staff on time in a lawful and precise manner. Using payroll processes ensures that you’re able to accurately record employee hours. This determines their gross pay when calculating employee wages. Including overtime pay or sick pay becomes much easier with payroll software.

Gross pay deductions for the pay period get automatically calculated by a software system. These will determine your employee’s taxable income. After income taxes get deducted, you can be assured your staff member is taking home the correct amount.

Whether outsourcing to external payroll services or using company software, the processes for paying employees can be done in an efficient manner.

Complying with HMRC

It is imperative that every registered company in the UK maintains compliance with HMRC to operate. On employing a new staff member, the business must notify the tax authority. All tax deductions must be made according to the tax code that’s designated.

When you run payroll software ensure that your employees have the correct tax level set and that all taxes are accurately deducted. With efficient payroll processing, your business will be aware of any HMRC regulations or rule changes.

Keeping payment records

Keeping employee payment records is important for several reasons. Businesses need to be in a position to provide staff members with copies of their payslips or salary advice if required. When employees apply for loans or mortgages, these are documents that prove income and employment.

Payroll affords easy access to this documentation. It can also assist with calculating the annual salary of every employee at your company. This is valuable when you’re budgeting or forecasting for an upcoming financial period.

It’s easier to determine the annual income tax, pension deductions, and national insurance contributions of your staff members with payroll software. You can also view specific detail of employee wages or salaries, like gross pay deductions, for example. This can be handy when assessing salary increases or staff evaluations.

Keeping these records is also a valuable exercise if ever income tax queries arise.

What Elements Contribute To Payroll?

In order for payroll to correctly function, inputting the correct information into the system is essential. Without adhering to the stipulated requirements, you could end up missing certain elements. This could mean paying employees incorrectly and your business could get into trouble with HMRC.

Make sure you load the following information into your payroll accounting software:

Up-to-date employee details

It’s vital to input and maintain the current details of every employee on your payroll. Payroll software will not function as it should without the following:

- The employee’s registered full name

- Their residential address

- The employee’s gross pay and annual salary

- Their NI number for national insurance purposes

We suggest circulating a document to your employees on a yearly basis. Ask them to check the details you have on file, and update them where necessary.

It’s best practice to update these details at least once a year. Be sure to encourage proactivity by requesting payroll gets told of any changes to staff’s names and addresses in-between.

Wages and salaries

There are differences between wages and salaries. An employee payslip will have a different appearance depending on the payment type and frequency.

Wages

Staff members on wages are likely paid at the end of every week, according to the number of hours they’ve worked. Before starting to work for your business, an employee will agree to an hourly rate of pay. This rate and the number of hours worked during the week should reflect on the payslip for that period.

Due to the hourly rates, payroll software processes for wage-earning employees can make it hard to determine gross pay. It is imperative, with wage earners, that you keep tight records of the hours worked. This is very important from both tax and payroll perspectives. Without control, it could also cost the business unnecessary money.

A good practice is to introduce a clocking system for staff on hourly rates. This makes it easier to track the hours worked by members over any specific pay period.

Salaries

Employees earning salaries get paid once a month on a stipulated date. Their annual amount is generally agreed upon in their employment contracts. Employers split this amount into monthly payments that don’t differ. Any differences can occur due to further bonuses, commissions, or overtime clauses in the staff’s contracts.

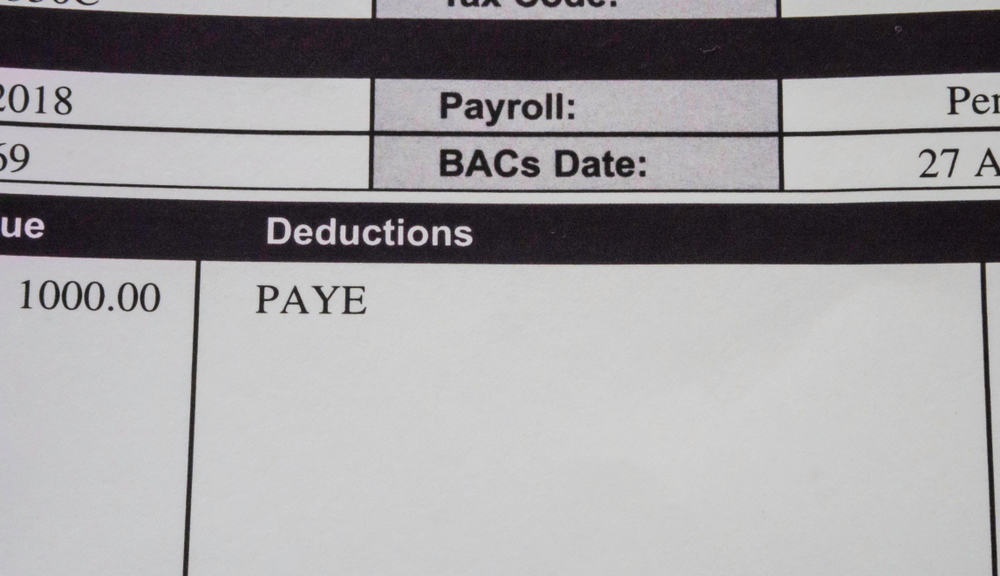

Payslips

Payslips for employees on salaries and wages should always include their gross pay and their net pay. Gross pay is the total earnings of a staff member before any deductions. Net pay is the employee’s pay received as cash or into a bank account after PAYE and all other deductions.

Income tax and national insurance

As a business owner or financial director, you are responsible for ensuring every employee’s income tax payments. You must also make sure all national insurance contributions get deducted before paying them.

The amount paid over to HMRC is based on the gross total you assign for salaries and wages. You should deduct this before the net pay of any employee is paid. It should be accurately calculated as part of your payroll processes. It is the business’s responsibility to pay HMRC before its stipulated deadlines.

Further income and deductions

Certain staff members may receive additional income or be subject to other deductions that appear on their payslips. These might be:

Incentive bonuses: Incentives in the form of bonuses are often included in employment agreement contracts. These often take the form of monthly payments for achieving targets. They could also be annual amounts for good performance.

Commissions: Salespeople and certain other employees could work on a basic salary plus commission basis. Others may earn commission only. As such, their monthly salaries could differ from month to month, and you should set up payroll to calculate these commissions.

Pensions: Employees often choose to contribute to pension schemes offered by the organization. Businesses should include these deductions as automatically-assigned payroll elements. Should an employee choose to stop their membership, payroll should drop the deduction immediately.

Student loans: A staff member with an outstanding student loan must start repaying it once they reach a certain pay grade. They can request their employer deduct a weekly or monthly amount from their pay. Running payroll correctly allows the administrator to make such a change to their deductions.

Conclusion

We’ve gone some way to answering the question, “What is payroll?” & “Why is Payroll Needed?” Should you decide to run it within your company, instead of outsourcing payroll, hire a payroll accountant for your peace of mind.

This will ensure the payroll function satisfies your staff, management, and HMRC regulations.

FAQs

What should I do if I make an error on an employee’s payroll?

You should rectify the mistake immediately. Depending on the error, you may have to submit a correction to HMRC. Whatever the case, you should provide the employee with an amended payslip.

What are the HMRC payroll information submission deadlines?

The deadline for submitting payroll information to HMRC is on or before an employee’s payday. You may incur penalties if you fail to do so.