Wondering about the best way to set-up you payroll system in the UK? Read out guide to find out about your various options:

Managing Payroll In-House or Outsourcing

One of the first steps in setting up payroll is deciding on the payroll method you’re going to use. You can manage payroll in-house or you can outsource to one of the many payroll providers available.

When business owners choose to handle their payroll services in-house, it’s usually due to the affordability and flexibility that this option provides. It also gives you more control over what’s happening with your payroll, and may sometimes be the more secure option.

Business owners who choose to outsource their payroll services usually choose to do so for time management purposes or a lack of resources. Payroll can be extremely time-consuming and outsourcing these services will help you to focus on growing other areas of your business.

Setting Up Payroll

Below are the steps that you will need to take in order to set up payroll for your business.

1. Register as an employer

Before you start paying your employees, you’ll need to register as an employer with HMRC. This is how you get your PAYE number, which needs to be included on employee payslips.

Just be aware that it can take up to five days to get your employer PAYE reference number and you’ll only be able to register within two months before you start to pay your employees.

2. Set up PAYE

When you register as an employer online, you should get a login for PAYE. However, if you registered as an employer some other way and didn’t receive your login information, you will have to enrol for PAYE online separately.

3. Utilise payroll software

A lot of companies choose to use payroll software to help them with their unique needs. If you choose to use software as opposed to outsourcing to a payroll provider, you’ll want to make sure that it can handle all your payroll needs.

Assess the number of employees that you have, the frequency at which you’ll process payroll, and the size of your business before you make any final decisions. Picking the right payroll software is a crucial part of a smooth payroll process.

4. Record all the necessary data

There are a variety of ways that you’ll need to record data for payroll. Firstly, you will need to record employee details and update HMRC with that employee information. This needs to be done for PAYE purposes. If you’ve hired independent contractors or freelancers, however, they do not need to be paid with PAYE.

Secondly, you will need to record what you pay your employees, any sick leave they’ve taken, tax code notices, and anything else that may be important for payroll.

HMRC may check in on your business to see if you’re paying your tax correctly and to ensure other payroll information is accurate too. Having everything recorded and up to date will make this a smooth process.

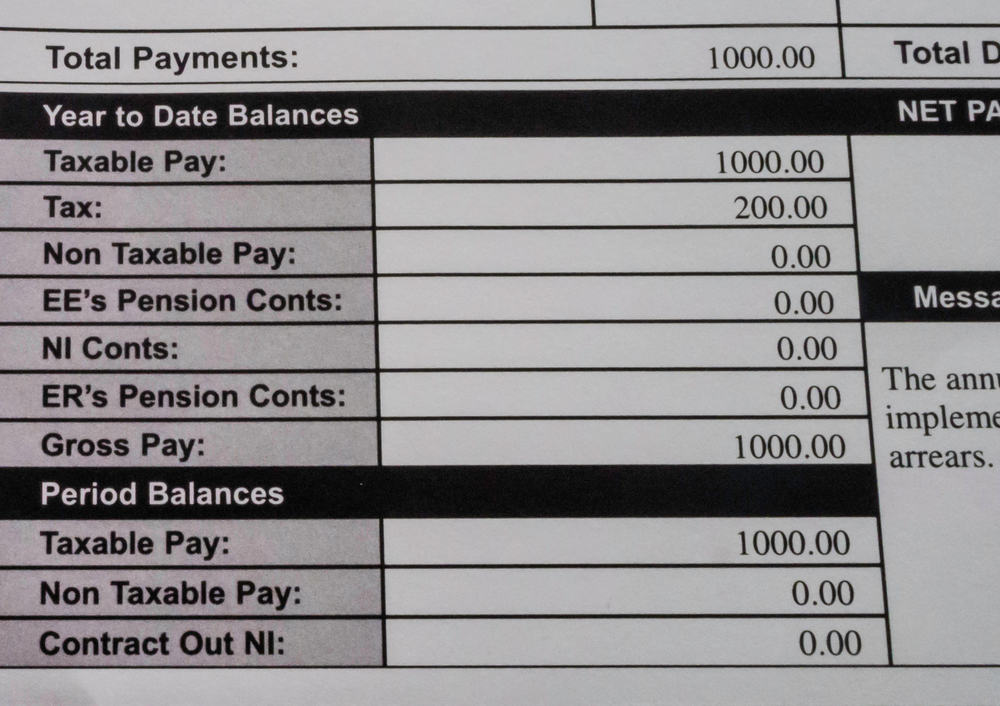

5. Calculate employees’ pay and deductions

As we mentioned previously, you will need to record your employee wages whilst including things such as statutory pay.

In addition, you’ll need to make the necessary deductions to pay each employee the correct amount. If you’re using software, it can do this for you through the use of each employee’s tax code and National Insurance category letter.

Some of the deductions you may need to make include unpaid leave, pension contributions, student loan repayments, income tax, and National Insurance contributions.

All of the payments and deductions mentioned above will need to be reported to HMRC in a Full Payment Submission (FPS).

6. Pay HMRC accordingly

This is the point when you will need to pay HMRC the tax and National Insurance contributions that were reported in the FPS for the previous tax month.

If you utilise payroll software, it will come in handy here, as it will be able to calculate those payments for you.

7. Prepare next year’s tax payments

The last thing that you’ll need to do is prepare for the upcoming tax year. This can be done by completing any reports for the previous tax year, updating employee payroll records, and making any necessary changes to the software that you use.

FAQs

How do I set up payroll on HMRC?

To set up payroll on HMRC, you will need to register as an employer with HMRC and use the login information to access PAYE online. Once you have done this, you can start following the necessary processes of choosing the right software for your business, keeping records of important information, and paying HMRC.

Do I need an accountant to do payroll?

You do not need an accountant to do payroll. It is possible to do everything yourself with the help of a payroll system. However, hiring an accountant to manage payroll for your company might be the better decision, as they will have the expertise to do everything properly.

Can I use Excel for payroll?

You can use Excel for payroll, but it is a manual approach and can therefore be a slow process. It’s also mainly used when businesses have only a few employees (less than 10) and when there are no complex tax or labour laws in the location where the business operates.

Final Thoughts

Once you’ve decided how you’re going to manage payroll, the steps to setting it up are pretty straightforward. However, these steps can be time-consuming if you don’t have the right software or don’t know exactly what you’re doing.

It’s important to record everything properly and keep track of all payments and deductions that need to be made. This will keep you on good terms with HMRC and will prevent you from incurring any fines.

And remember, if everything seems overwhelming or you don’t have the expertise to handle payroll yourself, you can always hire an accountant to assist you.