Which payroll software is better PayEscape or MyPAYE Online Payroll?

We compare them based on real user reviews, prices and what features they both offer.

PayEscape vs MyPAYE Online Payroll Basics

PayEscape | MyPAYE Online Payroll | |

| Software Website | PayEscape Website | MyPAYE Online Payroll Website |

| Company Name | Payescape Limited | My PAYE Ltd |

| Target Company Size (Small, Medium and/or Enterprise) | Enterprise | Medium |

| Industry Focus | None | None |

PayEscape vs MyPAYE Online Payroll Reviews

Wondering if PayEscape or MyPAYE Online Payroll has better user reviews. We compared them below.

| PayEscape | MyPAYE Online Payroll | |

| Listed On HMRC Website | Yes | Yes |

| Trustpilot Rating | 4.5 | 2.9 |

| Number of Trustpilot Reviews | 41 | 3 |

| iPhone App Rating | No iPhone App | No iPhone App |

| Number of iPhone Reviews | No Reviews | No Reviews |

| Android App Rating | No Android App | No Android App |

| Number of Android Reviews | No Reviews | No Reviews |

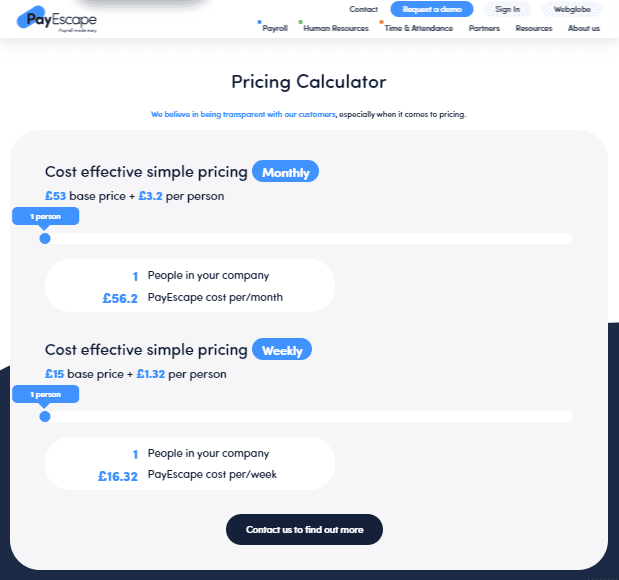

PayEscape vs MyPAYE Online Payroll Prices

Which is cheaper PayEscape or MyPAYE Online Payroll? Here are their prices compared.

Free Plans & Trials

| PayEscape | MyPAYE Online Payroll | |

| Listed As Having Free Plan By HMRC? | No | No |

| Free Plan? | No | No |

| Free Trial? | No | Yes |

| Free Trial Length? | Not Applicable | 30 days |

Paid Plan Prices

| PayEscape | MyPAYE Online Payroll | |

| Cheapest Plan Cost Per Month | £53.00 | Pricing Not On Website |

| Mid-Tier Plan Cost Per Month | NA | NA |

| Top Plan Cost Per Month | NA | NA |

PayEscape vs MyPAYE Online Payroll Features

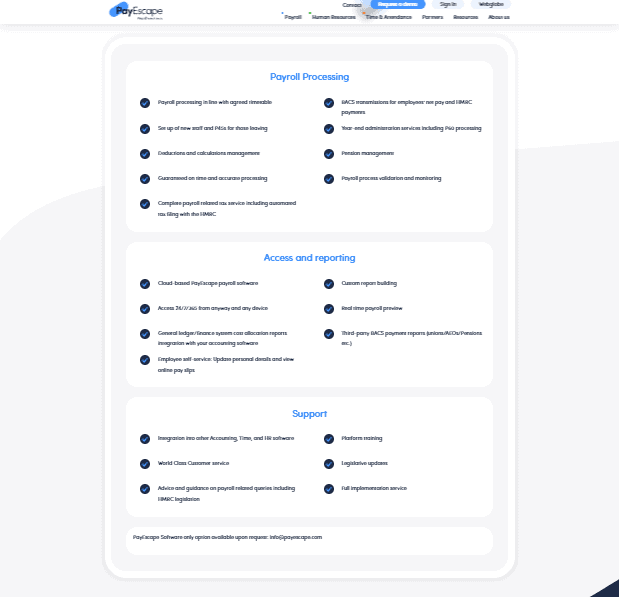

PayEscape Basic Features

- Payroll processing in line with agreed timetable

- BACS transmissions for employees’ net pay and HMRC payments

- Set up of new staff and P45s for those leaving

- Year-end administration services including P60 processing

- Deductions and calculations management

- Pension management

- Guaranteed on time and accurate processing

- Payroll process validation and monitoring

- Complete payroll related tax service including automated tax filing with the HMRC

- Cloud-based PayEscape payroll software

- Custom report building

- Access 24/7/365 from anyway and any device

- Real time payroll preview

- General ledger/finance system cost allocation reports integration with your accounting software

- Third-party BACS payment reports (unions/AEOs/Pensions etc.)

- Employee self-service: Update personal details and view online pay slips

- Integration into other Accounting, Time, and HR software

- Platform training

- World Class Customer service

- Legislative updates

- Advice and guidance on payroll related queries including HMRC legislation

- Full implementation service

PayEscape Software Integrations

- Xero

- Kashflow

- FreshBooks

- UKG

- Cezanne

- BambooHR

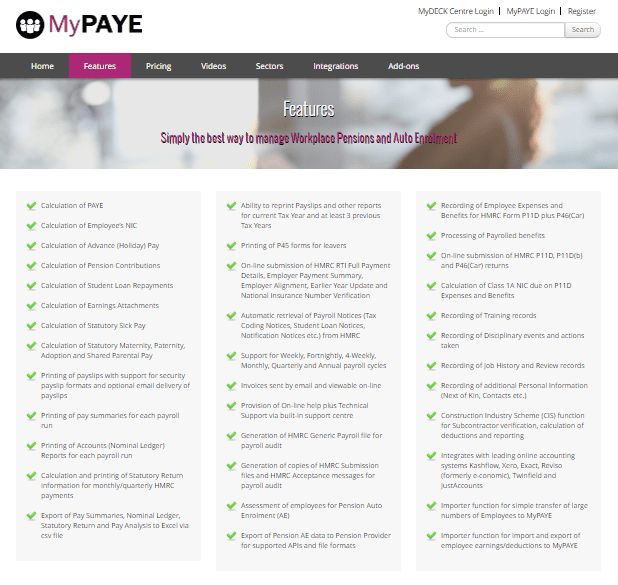

MyPAYE Online Payroll Basic Features

- Calculation of PAYE

- Calculation of Employee’s NIC

- Calculation of Advance (Holiday) Pay

- Calculation of Pension Contributions

- Calculation of Student Loan Repayments

- Calculation of Earnings Attachments

- Calculation of Statutory Sick Pay

- Calculation of Statutory Maternity, Paternity, Adoption and Shared Parental Pay

- Printing of payslips with support for security payslip formats and optional email delivery of payslips

- Printing of pay summaries for each payroll run

- Printing of Accounts (Nominal Ledger) Reports for each payroll run

- Calculation and printing of Statutory Return information for monthly/quarterly HMRC payments

- Export of Pay Summaries, Nominal Ledger, Statutory Return and Pay Analysis to Excel via csv file

- Ability to reprint Payslips and other reports for current Tax Year and at least 3 previous Tax Years

- Printing of P45 forms for leavers

- On-line submission of HMRC RTI Full Payment Details, Employer Payment Summary, Employer Alignment, Earlier Year Update and National Insurance Number Verification

- Automatic retrieval of Payroll Notices (Tax Coding Notices, Student Loan Notices, Notification Notices etc.) from HMRC

- Support for Weekly, Fortnightly, 4-Weekly, Monthly, Quarterly and Annual payroll cycles

- Invoices sent by email and viewable on-line

- Provision of On-line help plus Technical Support via built-in support centre

- Generation of HMRC Generic Payroll file for payroll audit

- Generation of copies of HMRC Submission files and HMRC Acceptance messages for payroll audit

MyPAYE Online Payroll Software Integrations

- Exact

- Just Accounts

- Kashflow

- Quickbooks

- Reviso

- Twinfield

- Xero

Common Feature Comparison

| PayEscape | MyPAYE Online Payroll | |

| Unlimited Payrolls | No | No |

| Automated Tax Filing and Payments | Yes | No |

| Live Customer Support | No | No |

| Ability To Manage Employee Benefits | Yes | Yes |

| Employee Access To Platform | Yes | No |

| Direct Deposit | No | No |

| Expense Reimbursement | Yes | Yes |

| Time Off Tracking | Yes | Yes |

| Handle Deductions From Pay | Yes | Yes |

| Debt Repayment From Pay | No | Yes |

| Employee Background Checks | No | No |

| Has An API | No | Yes |

| Create Payslip | Yes | Yes |

| Create P45 | Yes | Yes |

| Create P60 | Yes | No |

| Pay For Salaried Employees | Yes | Yes |

| Pay For Hourly Employees | Yes | Yes |

| Bonus / Incentive Pay | No | No |

| Pension Filing | Yes | Yes |

| Statutory Payments (E.g. Sick Pay, Maternity Pay, etc.) | No | Yes |

| Direct HMRC Submissions | Yes | Yes |

| RTI Compliant | Yes | Yes |

More Comparisons

PayEscape vs mywage

PayEscape vs Equator HR

PayEscape vs Nexus Pay

PayEscape vs Octopaye Payroll

PayEscape vs Omni Payroll