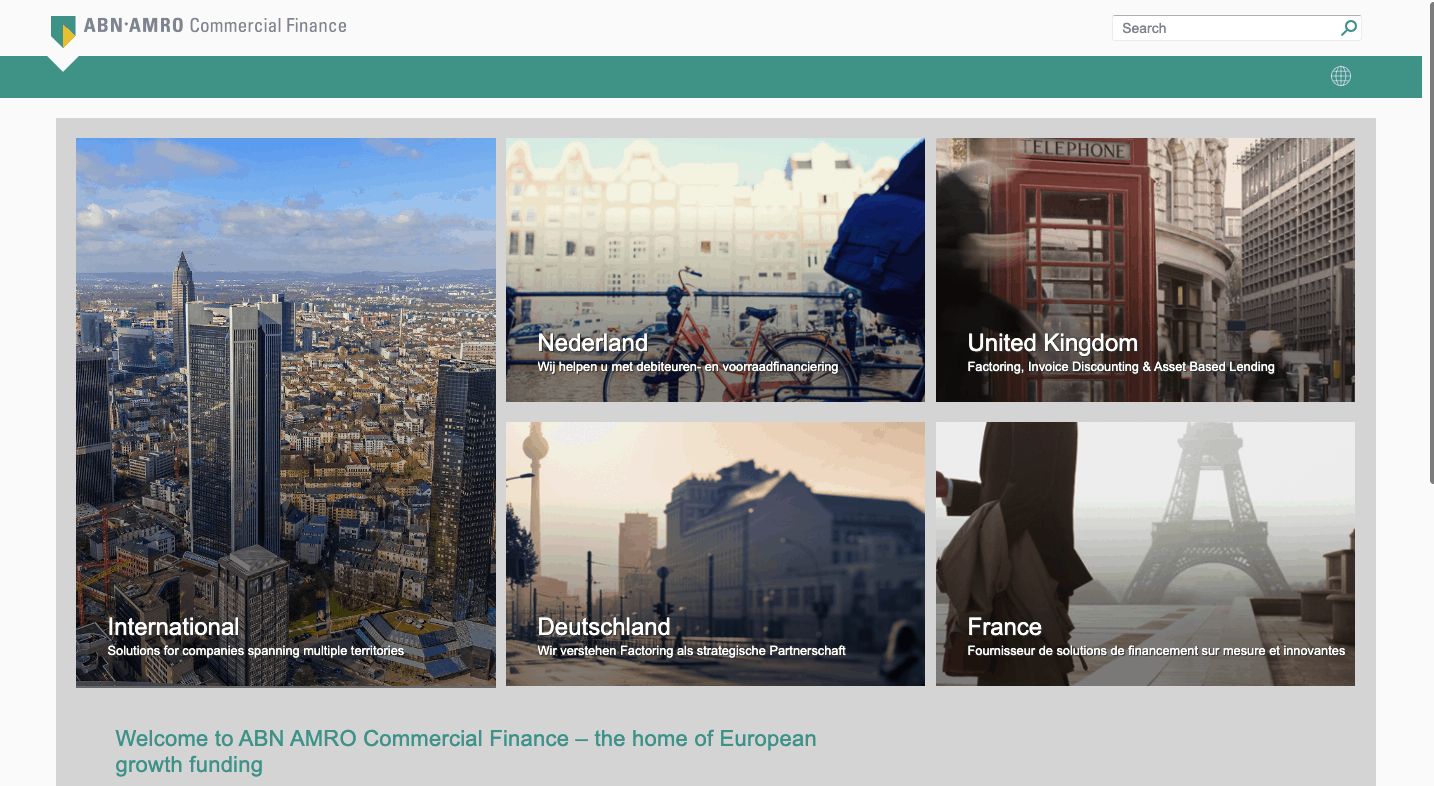

ABN AMRO Commercial Finance is “the home of European growth funding”. With presences in the UK, Germany, France, the Netherlands, and even further afield. ABN AMRO specialises in receivables finance – invoice factoring, invoice discounting, and asset-based lending. Part of ABN AMRO Group, one of the largest banks in the Netherlands, they work with companies of all sizes.

ABN AMRO Commercial Finance Loans & Funding

Asset-based lending

Raise from £50,000 to £50 million using existing invoices, assets, stock, property, and equipment as security. ABN AMRO also works with The Enterprise Finance Guarantee (EFG) in the UK, which is backed by the Government’s British Business Bank. This gives more established businesses the ability to raise up to £1.2 million.

Invoice finance

Get 90% of the value of your invoices upfront so you don’t have to wait for payment. The debt will be paid when the invoice is paid in full by your client.

ABN AMRO Commercial Finance Reviews and Ratings

There are no separate reviews for ABN AMRO Commercial Finance, just ABN AMRO Bank, so these reviews might not be representative of how the commercial finance part of the business operates in the UK.

Trustpilot reviews are critical, with many reporting customer service issues, delays, and admin errors. There are no live reviews on Google, Smart Money People or Reviews.co.uk.

Trustpilot – 1.2/5 (based on 677 reviews)

Google Reviews – no reviews

Reviews.co.uk – no reviews

Smart Money People – no reviews

Pros

- Range of funding options for different sized businesses with different assets and needs.

- International reputation with a presence in different European countries.

- Connected to Government-backed British Business Bank.

Cons

- Reviews for ABN AMRO generally are quite poor.

- Just asset-based finance available, which won’t suit every business.

Website: ABN AMRO Commercial Finance