Which payroll software is better PayEscape or Able Internet Payroll?

We compare them based on real user reviews, prices and what features they both offer.

PayEscape vs Able Internet Payroll Basics

PayEscape | Able Internet Payroll | |

| Software Website | PayEscape Website | Able Internet Payroll Website |

| Company Name | Payescape Limited | Able Internet Payroll Ltd |

| Target Company Size (Small, Medium and/or Enterprise) | Enterprise | Medium |

| Industry Focus | None | None |

PayEscape vs Able Internet Payroll Reviews

Wondering if PayEscape or Able Internet Payroll has better user reviews. We compared them below.

| PayEscape | Able Internet Payroll | |

| Listed On HMRC Website | Yes | Yes |

| Trustpilot Rating | 4.5 | No Rating |

| Number of Trustpilot Reviews | 41 | No Reviews |

| iPhone App Rating | No iPhone App | No iPhone App |

| Number of iPhone Reviews | No Reviews | No Reviews |

| Android App Rating | No Android App | No Android App |

| Number of Android Reviews | No Reviews | No Reviews |

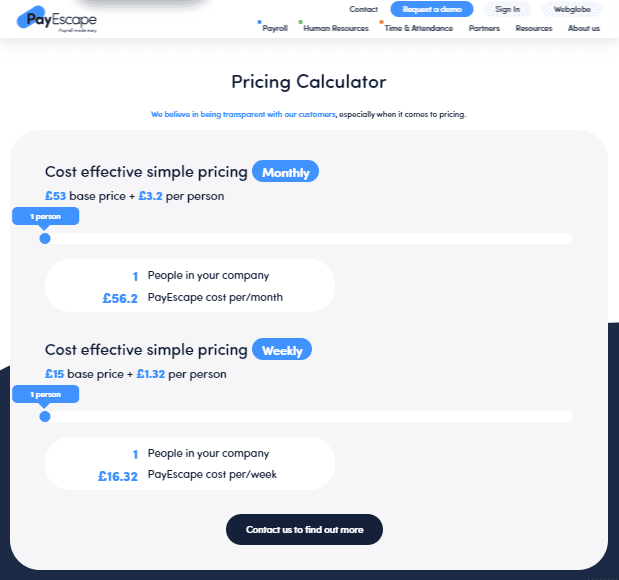

PayEscape vs Able Internet Payroll Prices

Which is cheaper PayEscape or Able Internet Payroll? Here are their prices compared.

Free Plans & Trials

| PayEscape | Able Internet Payroll | |

| Listed As Having Free Plan By HMRC? | No | No |

| Free Plan? | No | No |

| Free Trial? | No | Yes |

| Free Trial Length? | Not Applicable | 6 months |

Paid Plan Prices

| PayEscape | Able Internet Payroll | |

| Cheapest Plan Cost Per Month | £53.00 | £120.00 |

| Mid-Tier Plan Cost Per Month | NA | £120.00 |

| Top Plan Cost Per Month | NA | £120.00 |

PayEscape vs Able Internet Payroll Features

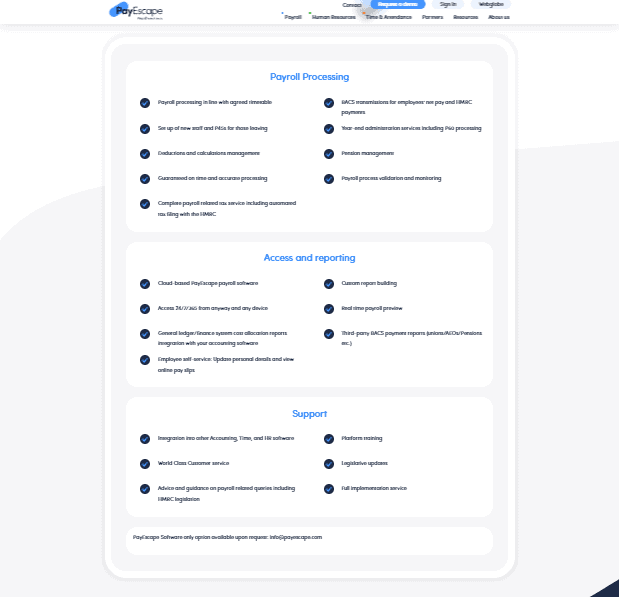

PayEscape Basic Features

- Payroll processing in line with agreed timetable

- BACS transmissions for employees’ net pay and HMRC payments

- Set up of new staff and P45s for those leaving

- Year-end administration services including P60 processing

- Deductions and calculations management

- Pension management

- Guaranteed on time and accurate processing

- Payroll process validation and monitoring

- Complete payroll related tax service including automated tax filing with the HMRC

- Cloud-based PayEscape payroll software

- Custom report building

- Access 24/7/365 from anyway and any device

- Real time payroll preview

- General ledger/finance system cost allocation reports integration with your accounting software

- Third-party BACS payment reports (unions/AEOs/Pensions etc.)

- Employee self-service: Update personal details and view online pay slips

- Integration into other Accounting, Time, and HR software

- Platform training

- World Class Customer service

- Legislative updates

- Advice and guidance on payroll related queries including HMRC legislation

- Full implementation service

PayEscape Software Integrations

- Xero

- Kashflow

- FreshBooks

- UKG

- Cezanne

- BambooHR

Able Internet Payroll Basic Features

- RTI Prices : The number of employees is counted by the number of P60s generated after you complete the Final FPS / Final EPS process at the end of the tax year. Our system will generate the P60 for all the employees you have employed during the tax year, including those who have left during the year and have received a P45 from your company. The Final FPS / Final EPS return is the same as the usual regular FPS / EPS return, except that you need to indicate that this is the Final FPS / Final EPS, that is all. Without completing the Final FPS / Final EPS you will not be able to move to the new tax year.

- When Do You Need to Pay for the Service? (Invoicing) : We will only invoice you and ask you to pay us once a year when you have done the Final FPS / Final EPS.

- Test Use is FREE : You may sign up before RTI starts and try out the RTI functions. Our Trial RTI does not allow you to e-file any RTI returns. However, you may migrate all your employees to the system and try out all the calculations without making any returns. At the end of the tax year you simply click on START NEW TAX year and tell us that your account was set up to try out our services and all the calculated data was just trial data, then we will move you to the new tax year without any charges.

Able Internet Payroll Software Integrations

Common Feature Comparison

| PayEscape | Able Internet Payroll | |

| Unlimited Payrolls | No | No |

| Automated Tax Filing and Payments | Yes | No |

| Live Customer Support | No | No |

| Ability To Manage Employee Benefits | Yes | No |

| Employee Access To Platform | Yes | No |

| Direct Deposit | No | No |

| Expense Reimbursement | Yes | No |

| Time Off Tracking | Yes | No |

| Handle Deductions From Pay | Yes | No |

| Debt Repayment From Pay | No | No |

| Employee Background Checks | No | No |

| Has An API | No | Yes |

| Create Payslip | Yes | Yes |

| Create P45 | Yes | Yes |

| Create P60 | Yes | Yes |

| Pay For Salaried Employees | Yes | Yes |

| Pay For Hourly Employees | Yes | Yes |

| Bonus / Incentive Pay | No | No |

| Pension Filing | Yes | Yes |

| Statutory Payments (E.g. Sick Pay, Maternity Pay, etc.) | No | Yes |

| Direct HMRC Submissions | Yes | Yes |

| RTI Compliant | Yes | Yes |

More Comparisons

PayEscape vs Accentra Payroll

PayEscape vs Acting Office

PayEscape vs FastTrack360

PayEscape vs Access Payroll

PayEscape vs Accu-Man Payroll