Corporate or corporation tax is a percentage of a company’s profits that it pays to the government. It is a major source of the cash that states and countries use to fund education, social services, defense, emergency units and much more.

However, corporate tax rates vary widely around the world and even within countries. For example, most American states charge a different local corporation tax on top of the federal rate of 21%. In the UK, the main rate is set at 25%, but small businesses with profits under £50,000 (US$38,550) pay just 19%.

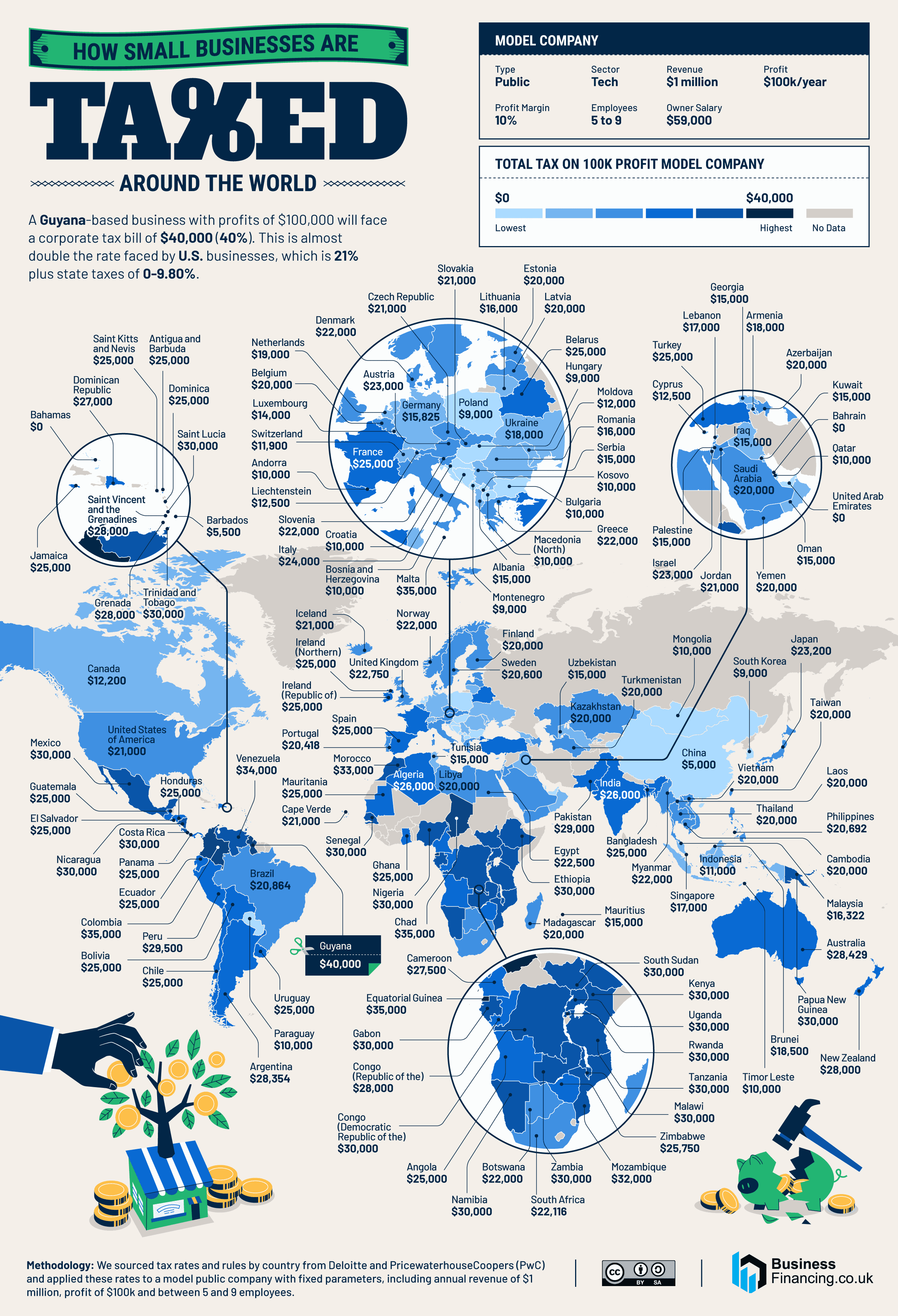

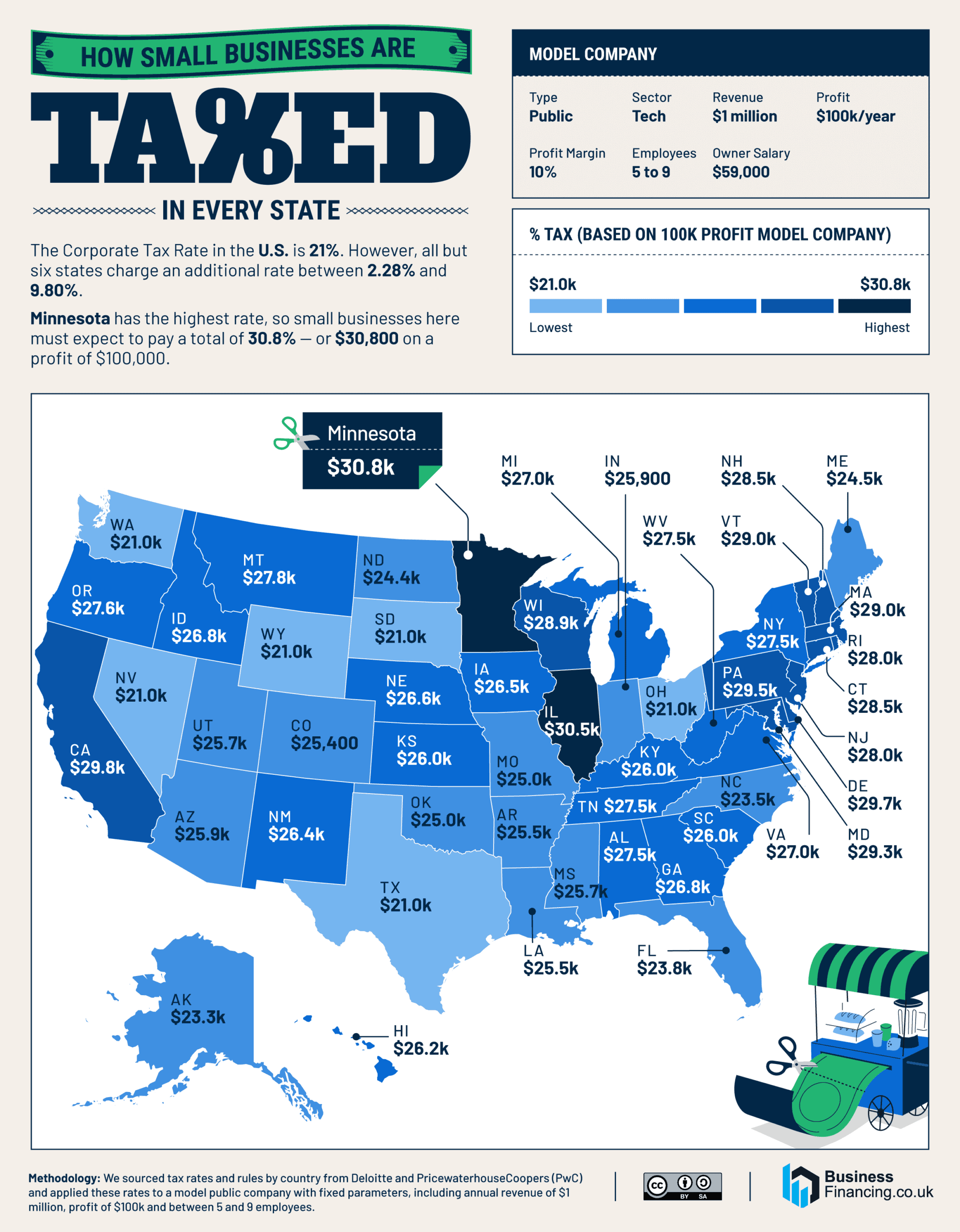

To find out how much corporate tax a small business will likely pay in every country and U.S. state, BusinessFinancing.co.uk designed a hypothetical company with fixed attributes (see What We Did) and applied every location’s tax rules to an imaginary profit margin of US$100,000.

What We Did

We applied tax rates and rules by country sourced from Deloitte and PricewaterhouseCoopers (PwC) to a model company with fixed parameters, including annual revenue of $1 million, profit of $100k and between five and nine employees. Using these parameters, we calculated the total amount of tax that would be paid by the model company in each country. We repeated this process for American states, combining the federal tax rate (21%) with state-specific corporation taxes.

Key Findings

- Guyana is the country with the highest tax rate for small businesses — with our model firm paying $40,000 on profits of $100,000.

- In the Bahamas, Bahrain and the United Arab Emirates, our model company would owe zero corporate tax on profits of $100,000.

- Small businesses in Minnesota pay more corporate tax than in any other state — facing a bill of $30,800 on $100,000 profit in our model scenario.

- Small businesses in six states face no state corporation tax on profits of $100,000: Nevada, Ohio, South Dakota, Texas, Washington and Wyoming.

Guyana Has World’s Highest Corporation Tax Rates

Our first map shows how much corporate tax our model company would need to pay on profits of $100,000 depending on where in the world it was based. Guyana charges a rate of 40% on the profits of commercial companies, which it defines as those that derive at least 75% of its gross income from goods it didn’t manufacture. For our model company, that would mean a bill of $40,000 on profits of $100,000. While this is the highest figure globally, small manufacturing and construction businesses may be eligible for a lower 25% rate.

Minnesota Businesses Pay Highest Corporate Tax

Minnesota has the highest corporate tax rate in the U.S., adding a further 9.80% to the federal rate of 21% to reach a bill of $30,800 on profits of $100,000. The Minnesota House Research Department notes that revenue levels on this tax can be highly “volatile”: “in fiscal year 2007 (an expansion year), revenues were $1.17 billion; by fiscal year 2010 (a recession year) they had dropped to $663 million (a reduction of 43 percent from 2007).”

South Dakota and Wyoming have no corporate tax; neither do Nevada, Ohio, Texas or Washington, which levy local gross receipts taxes instead.

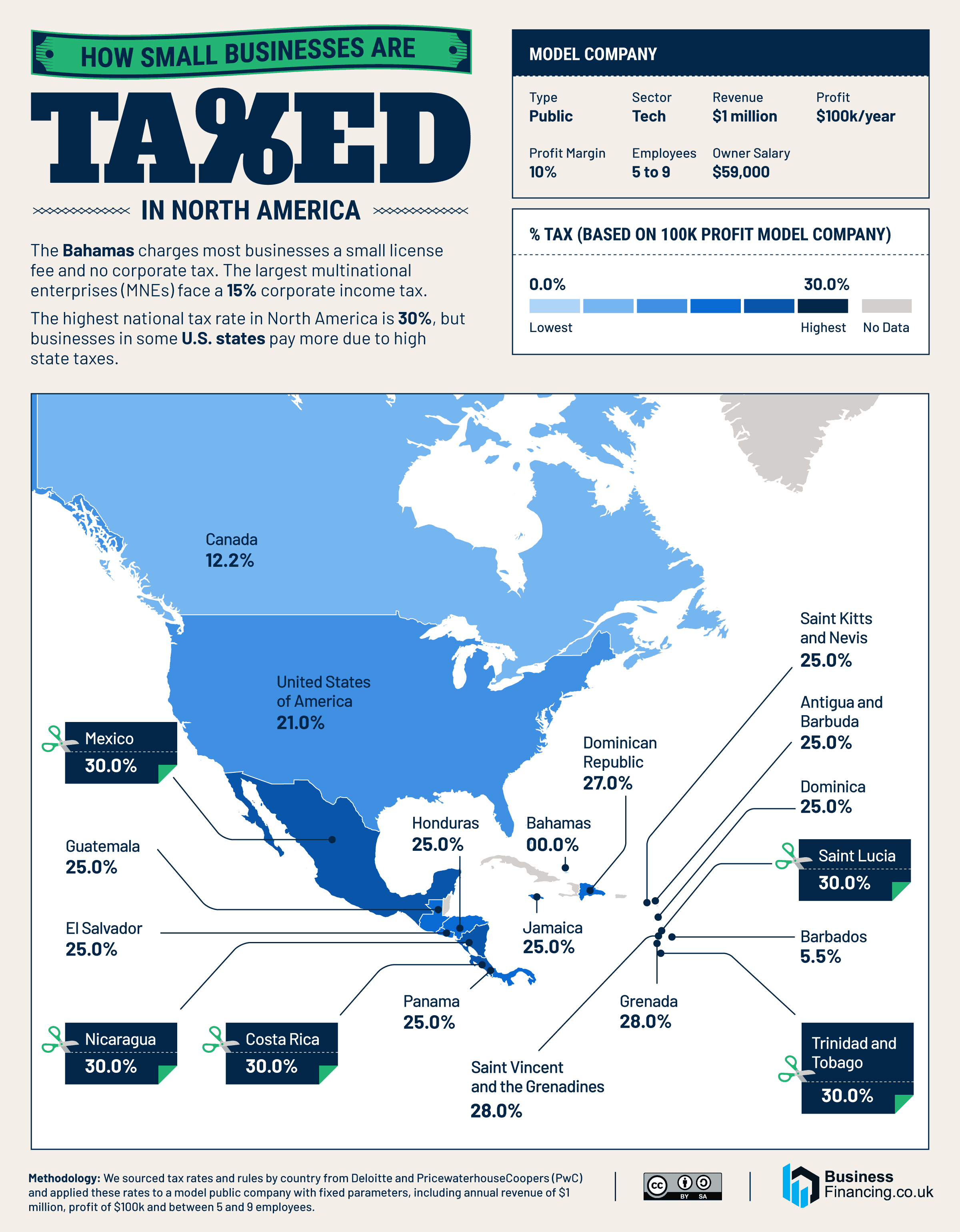

U.S. Corporate Taxes Among Lowest in Region

The U.S. maintains a federal corporation tax rate of 21%, although this is supplemented in all but six states by local corporate taxes. The 21% rate is among the lowest in North America. Still, U.S. businesses that operate internationally may find themselves facing steeper corporate taxes abroad as foreign economies adjust to the demands of higher tariffs. Domestically, only Canada, Barbados and the Bahamas have lower taxes. The latter has no income tax, inheritance tax or wealth tax at all.

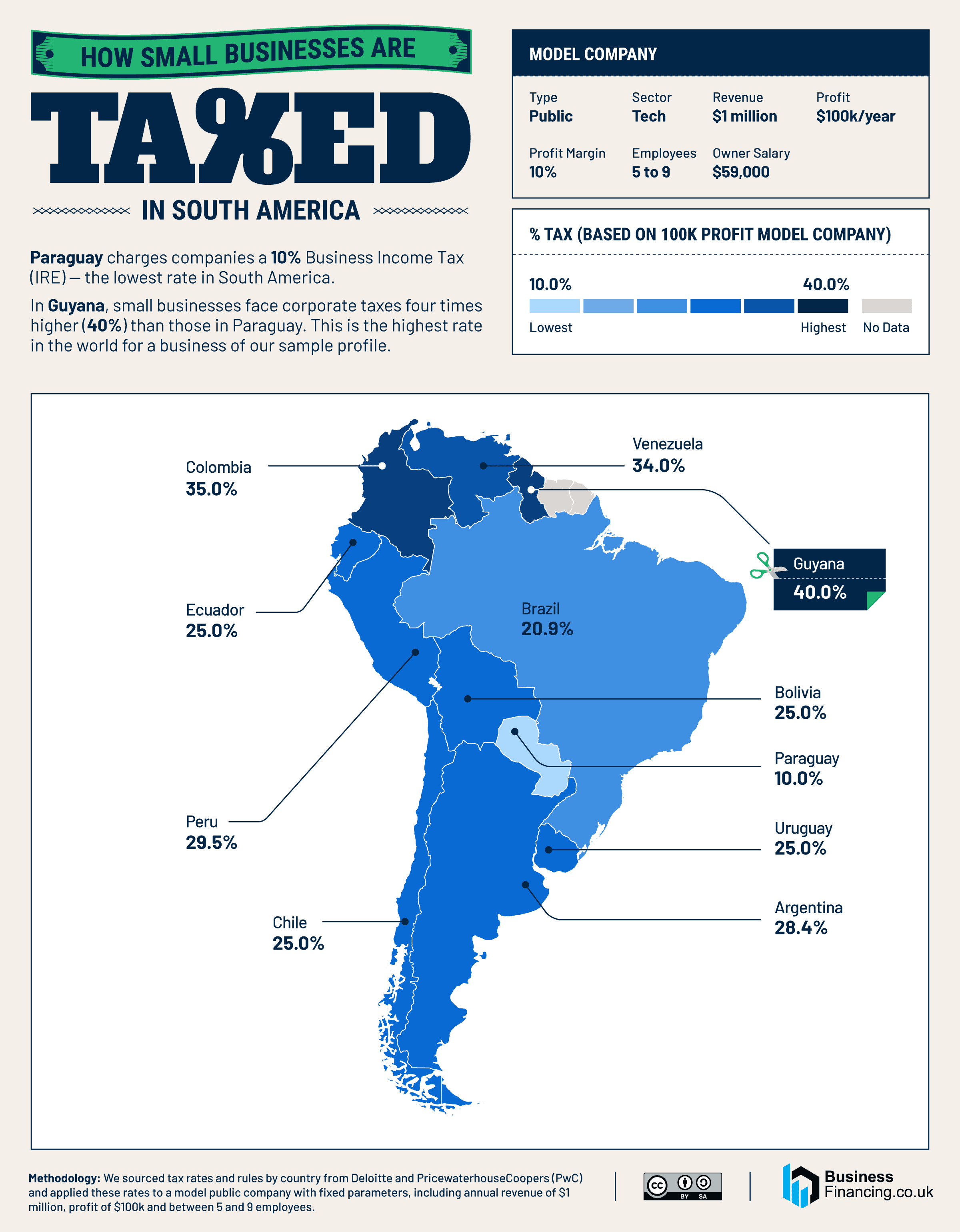

Paraguay’s Corporate Tax Rate Just 10%

Guyana has the highest corporate tax rates in South America and the world, charging 40% on profits of $100,000. The country is working to improve conditions as its economy expands fast in the wake of oil discoveries and investments by foreign firms. However, there are concerns that aggressive development of the newly identified oil resources will damage the local environment while offering a deal that’s lucrative for foreign investors ExxonMobil — but “abusive and exploitative” for the country. Meanwhile, Paraguay has the lowest domestic corporate tax in the region at 10% for businesses of all sizes.

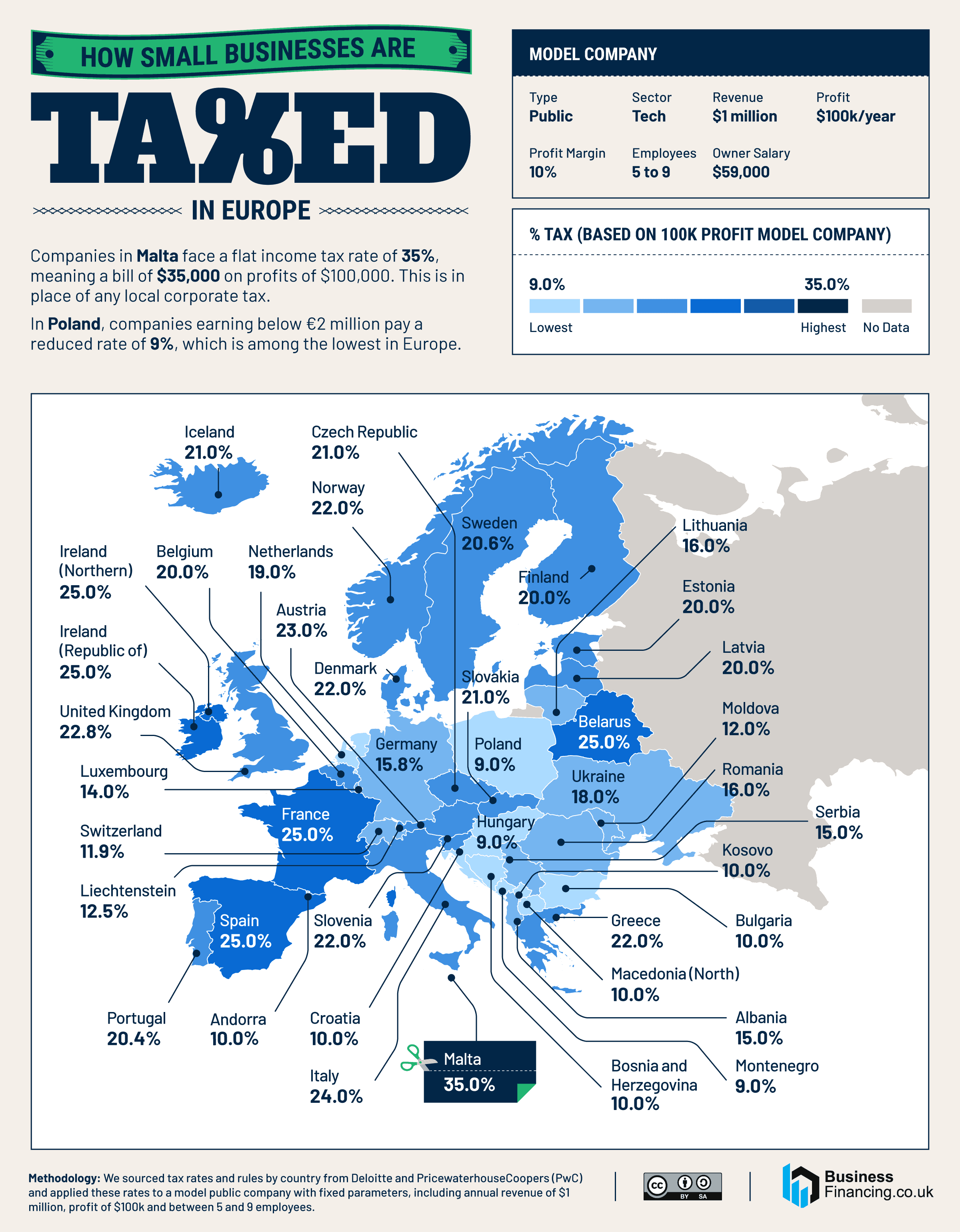

European Tax Haven Has Highest Corporate Taxes for Locals

Malta has the highest corporate tax rates in Europe for our hypothetical small business. The 35% rate on local businesses is particularly controversial since Malta offers rates as low as 5% for international companies — making it a tax haven or even a “pirate base for tax avoidance,” depending on your perspective.

In the UK, profits at this level are taxed at 22.75%, or $22,750 on profits of $100,000, due to the sliding scale on tax rates for companies with profits between £50,000 and £250,000.

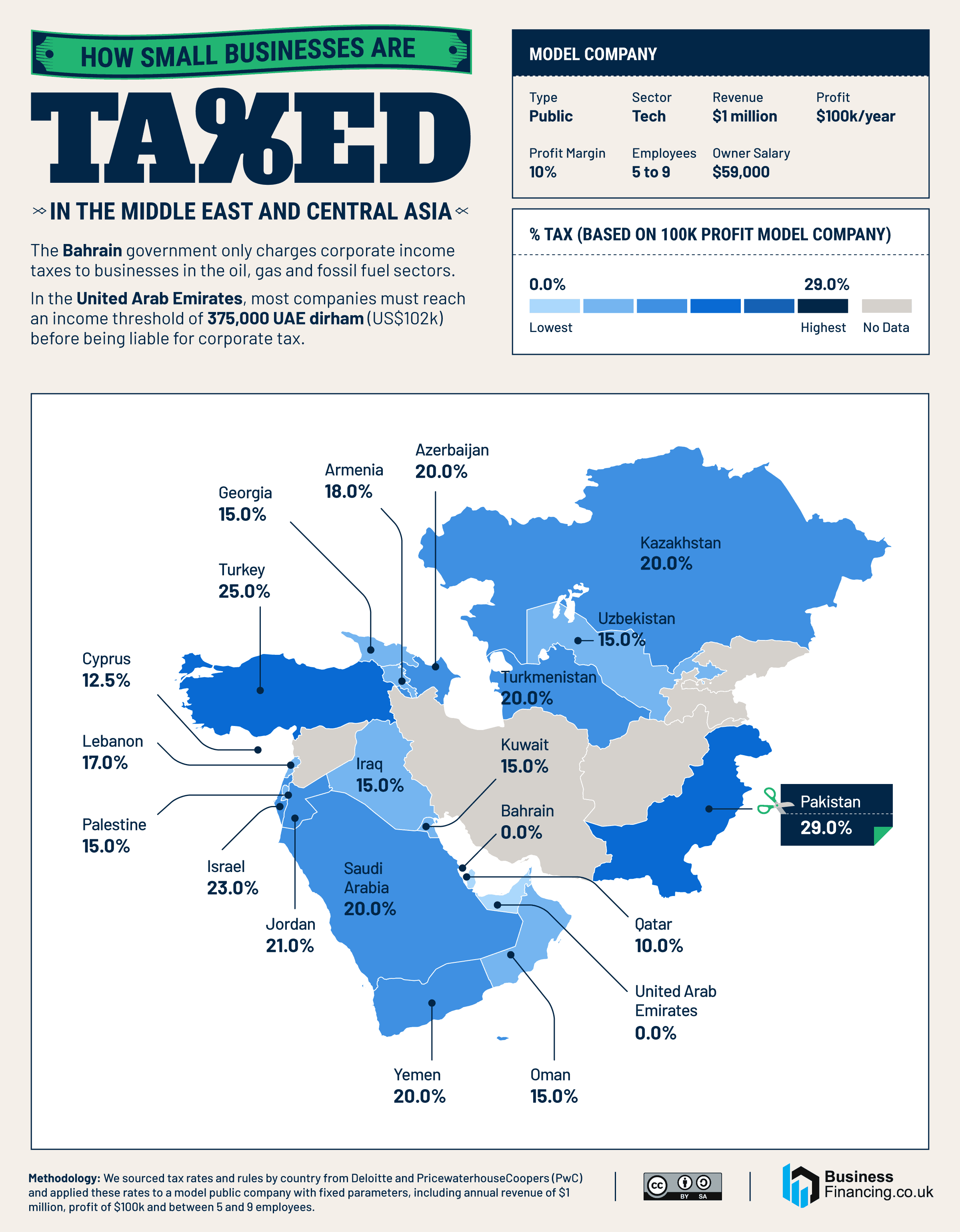

Zero Tax in Oil-Rich Middle Eastern States

Two Middle Eastern countries are among just three globally to maintain a 0% corporate tax rate applicable to our hypothetical small business: Bahrain and the United Arab Emirates (UAE). Since hitting oil in the 1960s, the UAE has instead funded the state through dividends and royalties from Emirates Investment Authority (EIA) investments. The country has recently introduced limited corporate taxes for some companies to comply with international standards regarding tax havens, but there is no personal income tax payable.

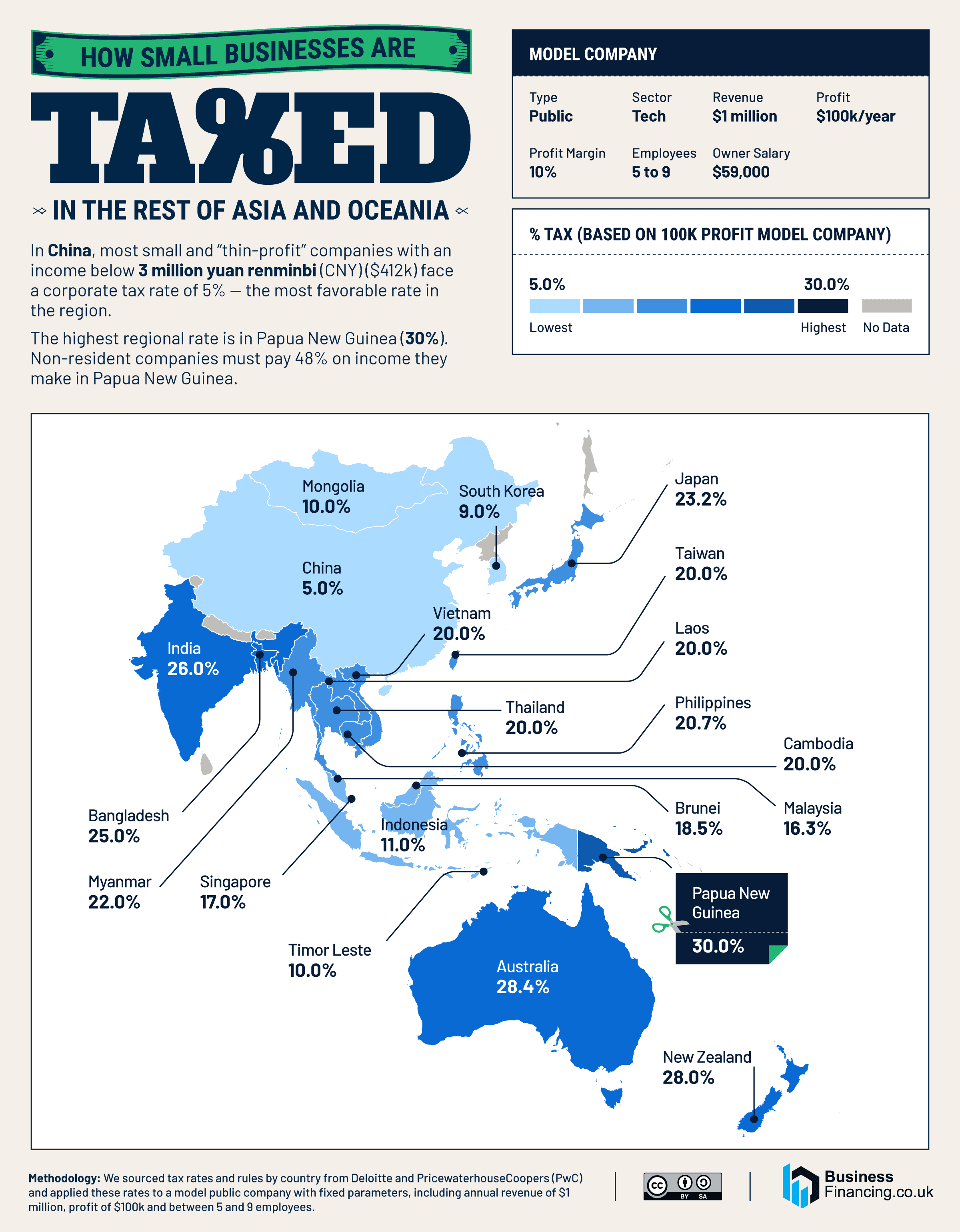

China Has World’s Fourth-Lowest Corporate Tax for Small Business

In China, the standard corporate tax rate is 25%. However, qualified companies with taxable income up to ¥3 million (CNY) (US$413,195) face a rate of just 5%, or $5,000 on profits of $100,000. Companies engaged in pollution prevention and control may also access lower tax rates. This 5% rate is the lowest in the region and the fourth lowest in the world, as applicable to our hypothetical company. China’s government introduced tax cuts, among other measures, to stimulate growth and investment in 2024 following a slowdown in the national economy.

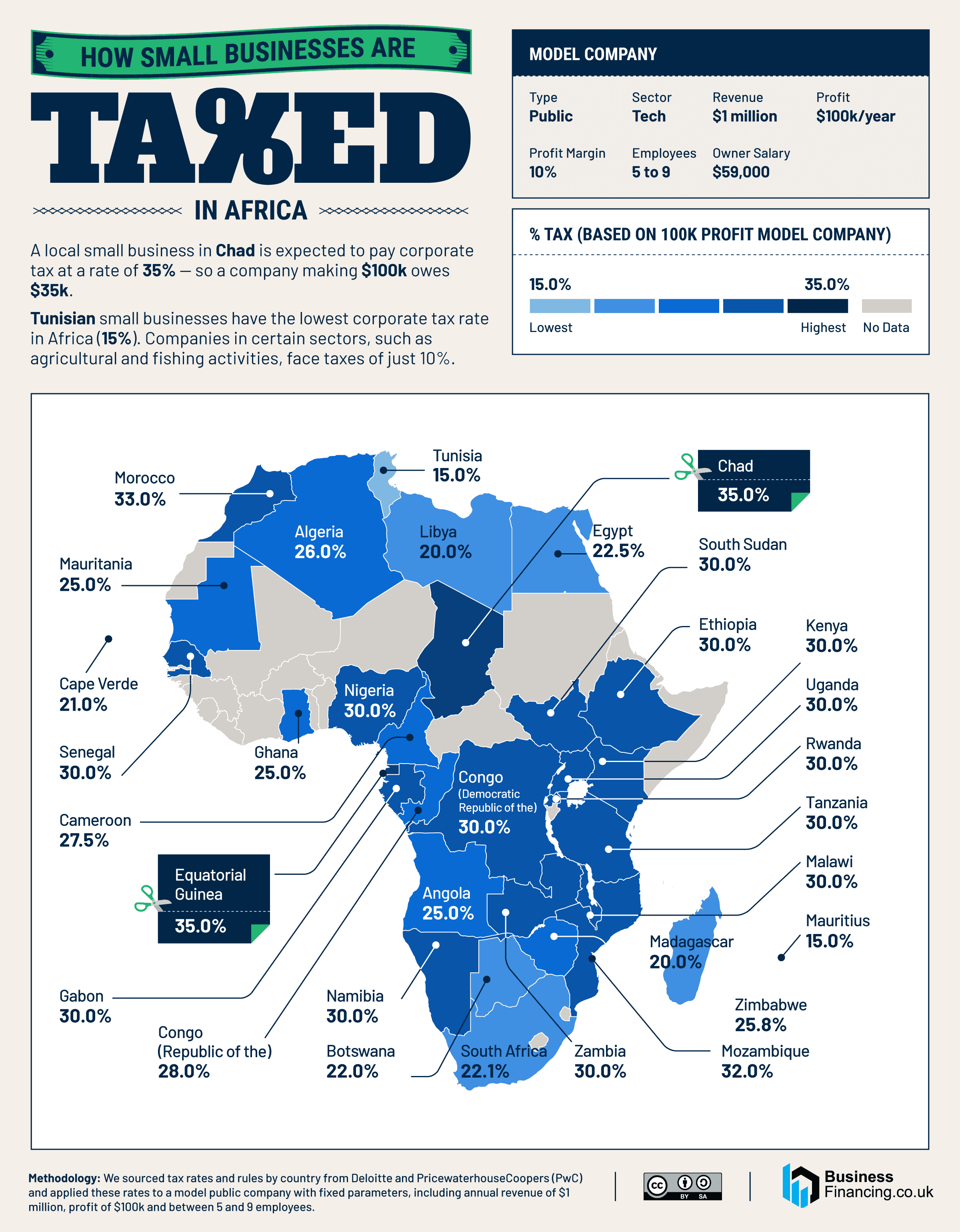

High Corporate Taxes Form Lion’s Share of Chad Revenue

The 35% corporate tax rate on all domestic businesses in Chad is among the highest in the world. The country has recently suffered through tight austerity measures following the economic crisis a decade ago. Corporate tax now accounts for around 61% of Chad’s entire tax revenue.

Tunisia has the joint lowest corporate tax applicable to our model company, at 15%. Some industries in Tunisia are subject to a 20% or 35% rate, while some companies carrying out community or socially aware activities may be eligible for a rate of just 10%.

The Point of Corporate Tax

Many big businesses find ways to avoid paying their share of corporate tax, and smaller business owners may balk at seeing their meager profits dwindling at the end of the tax year. As such, the usefulness of business tax like this is a matter of ongoing debate.

Studies have shown that temporarily cutting corporate income tax rates can boost innovation and productivity, and businesses may pass the cost of taxes on by underpaying workers while maintaining profit levels. However, a recent UK tax break designed by the Conservatives to boost corporate investment and productivity may cost the country £15-20 billion ($19.4–25.9 bn). In the UK, corporate tax accounts for around 9% of all taxes that are collected, according to the government. No matter how this figures up against other countries, it reinforces the fact that tax on corporate profits is an essential way of providing for the way of life for nations as a whole.

Methodology & Sources

To assess small business tax rates around the world, we sourced tax rates and rules by country from Deloitte and PricewaterhouseCoopers (PwC) and applied these rates to a model company with the following parameters:

- Type: Public

- Sector: Tech

- Revenue: $1 million

- Profit: $100k/year

- Profit Margin: 10%

- Employees: 5 to 9

- Owner Salary: $59,000

- Owned by a resident of the country or state in question

- Earns majority of revenue from business operations within the region.

Considering these parameters, we calculated the total amount of tax that would be paid by the model company in each country.

We repeated this process with every state in the United States, having considered the federal tax rate (21%) combined with the state-specific corporation taxes.

Data is correct as of February 2025.

Leave a Reply