Wondering what a VAT invoice is and if you need to issue them? Then you’ll want to read this guide:

What Are VAT Invoices?

A business owner that is registered for Value Added Tax (VAT) must issue VAT invoices to their customers.

It not only helps them to establish their VAT liability on goods and services supplied but also allows VAT-registered customers to reclaim any VAT charged to them.

VAT invoices contain all the information prescribed by the UK’s VAT law. These must typically be issued within 30 days of the date of payment (if paid in advance) or date of supply of the service or goods.

The importance of a VAT invoice

VAT invoices are important for keeping track of a business’ financial records. It is crucial for business owners to keep a copy of every invoice issued, or make use of invoicing software where invoices can be stored.

Customers who receive VAT invoices should also keep these as evidence to recover the VAT incurred.

When do I register my business for VAT?

A business that has a taxable turnover of £85,000 or more over a 12-month period must be registered for VAT with HM Revenue and Customs (HMRC). You can also voluntarily register if your turnover is less than £85,000.

What To Include In A VAT Invoice

There are three types of VAT invoices that a VAT-registered business can use: full VAT, modified or simplified invoices.

Full VAT invoice

A full VAT invoice must include the following:

- The date of issue and the time of the supply

- A unique invoice number clearly visible

- The business name, address and VAT registration number

- The name and address of the person to whom the invoice is issued (the customer)

- A description of the goods or services

- The quantity of the goods or the extent of the services

- The VAT rate (standard, reduced or zero rate) and the amount payable without VAT for each good or service, in any currency

- The gross total excluding the VAT rate

- Any cash discount rates

- The total amount of VAT payable, expressed in sterling

- The unit price

- The prefered payment method

Modified VAT invoice

Modified VAT invoices can be used for retail supplies over £250. The VAT invoice requirements for a modified invoice are the same as for a full invoice, as well as the total amount including VAT.

Simplified VAT invoice

A simplified invoice can be used for retail supplies under £250 if a customer agrees to a simplified invoice, or if you are based in Northern Ireland and the customer is not from an EU member state.

Simplified VAT invoices must include:

- The business name, address and VAT registration number

- Unique invoice number

- The date and time of supply

- Description of the goods or services

- The VAT rate and amount payable (excluding and including VAT)

Invoicing Customers in EU Member States from Northern Ireland

The information for a valid VAT invoice above does not pertain to VAT-registered businesses in Northern Ireland issuing invoices to customers from EU member states.

Apart from the information to be included in a full invoice, these invoices must also include:

- The letters GB and the business’ VAT registration number

- The registration number of the customer, preceded by the alphabetical code that applies to the EU member state

- Reference to the means of cross-border transport

Issue A VAT Invoice Electronically

Invoices can be issued electronically when a customer agrees to it and where the security of the invoicing system can be ensured.

Issuing invoices electronically holds many benefits over paper invoices:

- Allows easier auditing

- Orders can be traced very easily

- Reduced need for storage of papers and files

- You can easily access all your documentation

- Improved cash flow

- More secure

Electronic VAT invoices must contain:

- A unique identifying number

- The tax point/time of supply

- The date of issue of the invoice

- Name, address and VAT number of the business

- Customer’s name and address

- Description of the goods or service

- Quantity or extent of goods or service

- Unit price

- Rate of VAT charged

- The amount payable, excluding VAT – any currency

- Rate of cash discount

- VAT chargeable – in sterling

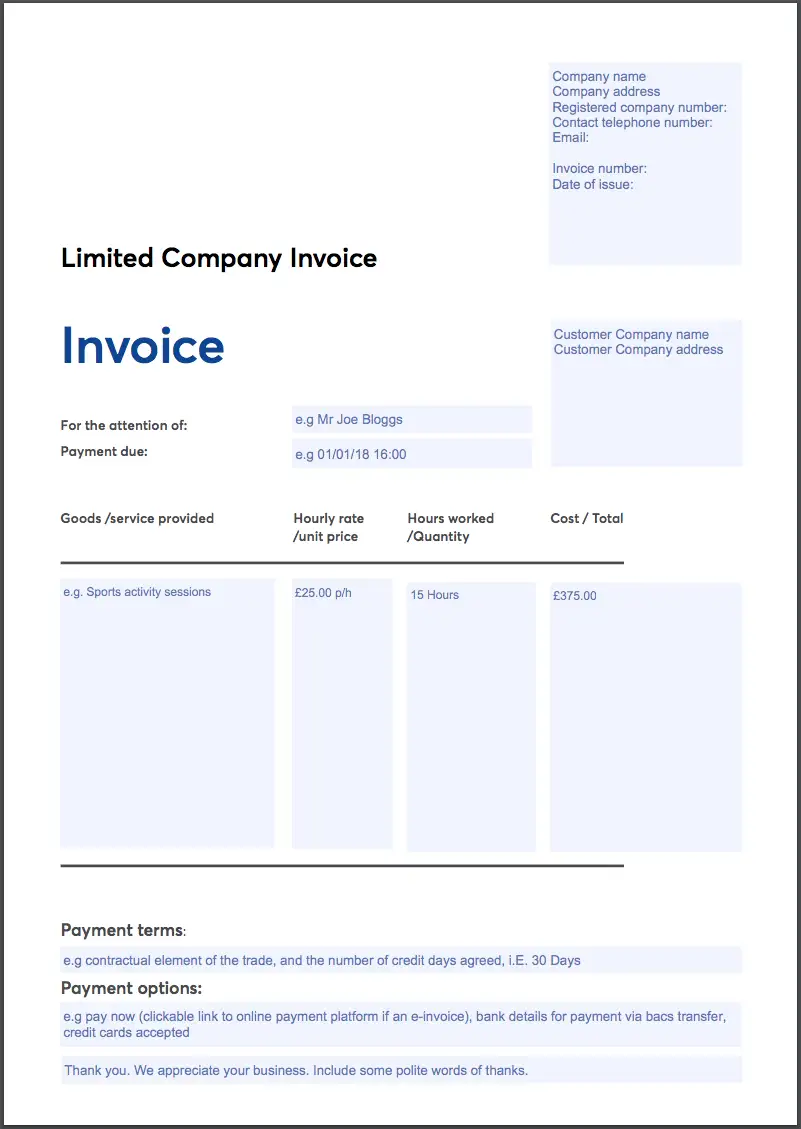

VAT Invoice Example Template

The following VAT invoice example template comes from GoCardless.

Final Thoughts

There is a lot of guidance regarding VAT invoicing available on the government’s website, however, it can be difficult to tackle as a first-time business over. That is why it is a great idea to hire a professional accounting service to help out.

Sources:

https://www.gov.uk/guidance/record-keeping-for-vat-notice-70021

https://www.gov.uk/guidance/vat-guide-notice-700#section16

https://www.freeagent.com/guides/invoicing/tips-vat-invoice/