This guide will explain why it’s important for accountants to remain objective when reporting on finances.

The Objectivity Principle in Accounting

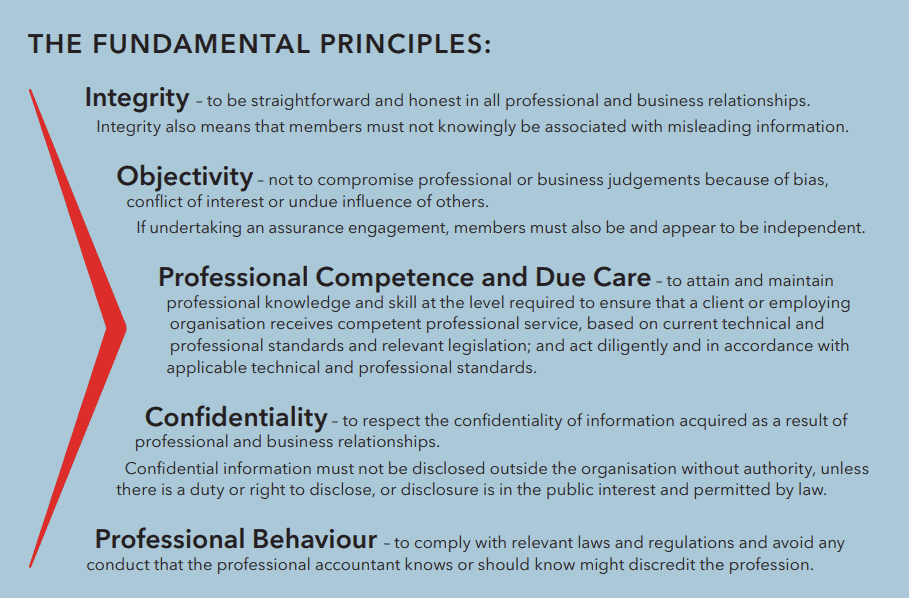

Source: The ICAEW Code of Ethics

Objectivity is one of the five main principles of ethical accounting. Alongside integrity, due care, confidentiality, and professional behaviour, objectivity serves as one of the five foundation pillars of professional accounting conduct.

The objectivity principle refers specifically to the fact that all financial statements should be objective in nature. By this, we mean that they can’t be devised as the result of bias or outsider influence. Internal and personal opinions should also not alter data in accounting. Financial statements should be accurate and reflective of true financial positions.

Accountants need to follow the Generally Accepted Accounting Principles (GAAP) body of accounting standards. Client and co-worker opinions should not stand in the way of this.

Why Solid Evidence is Important For Accounting Objectivity

Accountants need to wait for solid evidence to emerge before performing any accountancy duties. Not only should external opinion be avoided, but limited or dubious evidence should not be used to jump to conclusions. This way, financial reporting remains as objective and speculation-free as possible.

Why Objectivity is Important in Accounting

There are many reasons why the objectivity principle is considered one of the most vital of all accounting principles, such as:

It ensures transparency

Financial statements are made for co-workers, the management team, investors, and so on. The reason why financial statements are made is to boost financial transparency throughout the company. If these documents are not accurate, then transparency is lost.

For example, if a financial statement lies about the financial position of the company, investors will be misguided about how promising their investment is.

It boosts the trustworthiness of the company

A company becomes more trustworthy by continually delivering financial transparency. If investors are continually shown that the objectivity principle is followed, they may be more inclined to invest more. It may also boost further interest in your company from other investors.

On the other hand, misinformation could result in the company receiving a penalty for misrepresentation.

Conflict of interest is avoided

One member of management may wish that financial information could be altered to suit their own personal gain. Investors may wish that this same information could be altered in a different way to put them in a better position.

An accountant that follows the objectivity principle ensures their accounting information forgoes this conflict of interest altogether.

Better decisions are made

More promising decisions can be made based on reliable evidence. Constructing financial statements that are 100% objective paints a realistic picture of a company’s current financial standing. From this, management can make better decisions that will actually help the company.

Similarly, internal and external auditors can better analyze the company based on unbiased information.

Ensures continuity in the accounting department

Sometimes, you need to compare present financial statements with financial information from years gone by.

Continually producing financial statements that are unbiased paints an accurate picture of a company’s progress over the years.

Allows for accurate evaluation

By following the objective principle, accountants are recording the value of assets accurately. This ensures that management can sell the assets for an accurate price, and spends the correct amount of money replacing the assets.

Accountants should use fair value and historical cost to determine the worth of an asset when following the objectivity concept.

Disadvantages of the Objectivity Principle

The objectivity principle ensures accounting information is more accurate, so disadvantages are limited. However, it does mean that companies need to invest more money to ensure that adequate financial research and documentation take place. This will affect your profit margins somewhat.

Additionally, accounting rules change over time, so you’ll have to update your team’s understanding of the objectivity concept from time to time.

Final Thoughts

The objectivity principle ensures transparency, accuracy, and continuity. It serves as a foundation to allow better decisions to be made and conflicts of interest to be avoided.

If you’re preparing financial statements and you’d like to ensure that the objectivity concept is abided by, you should hire an accountant.

Sources:

https://khatabook.com/blog/objectivity-concept/

https://www.wallstreetmojo.com/objectivity-principle/

https://byjus.com/commerce/objectivity-concept-in-accounting/