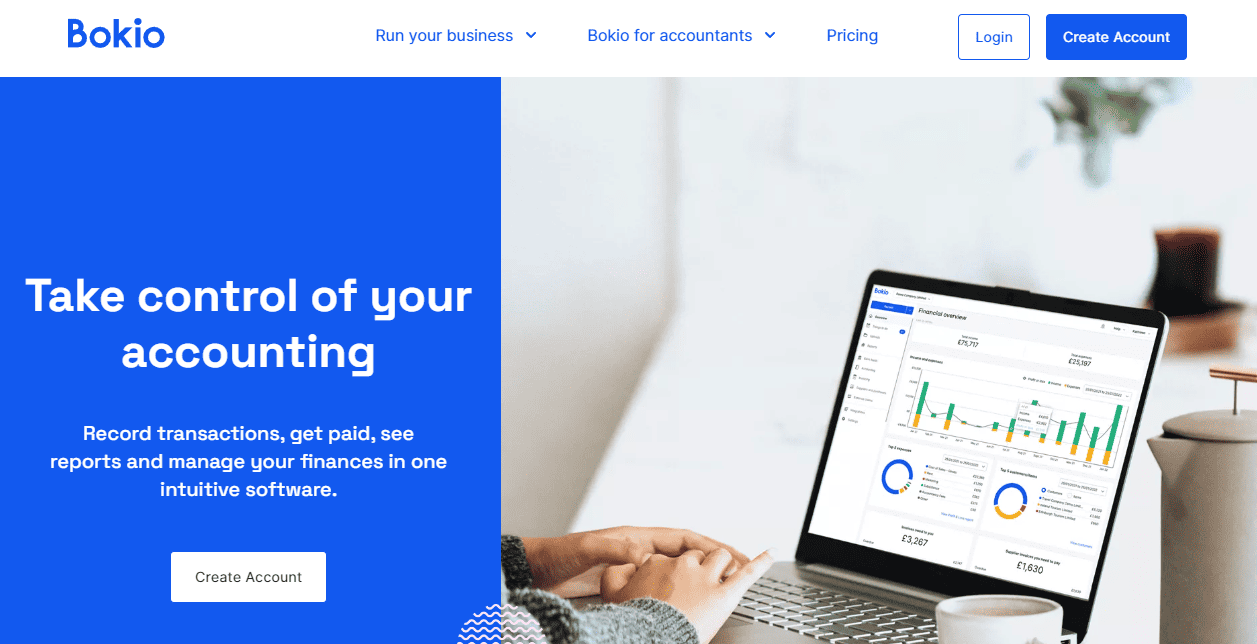

Which accounting software is better Bokio or APARI?

We compare them based on real user reviews, prices and what features they both offer.

Bokio vs APARI Basics

| Bokio | APARI | |

| Software Website | Bokio Website | APARI Website |

| HMRC MTD Status | Not Included | Not Included |

| Who Can Use It? | Businesses, Self-employed, and Accountants | Agents and businesses |

| HMRC Listed Features | Record keeping, simplified expenses and raising invoices | Self employed and landlord record keeping |

| Platforms | Web-based application | Cloud-based application: PC, Smartphone, Tablet, iPhone, Android |

Bokio vs APARI Reviews

Wondering if Bokio or APARI has better user reviews. We compared them below.

| Bokio | APARI | |

| Trustpilot Rating | 2 | 4.1 |

| Number of Trustpilot Reviews | 54 | 7 |

| iPhone App Rating | 3.4 | No Rating |

| Number of iPhone Reviews | 16 | No Reviews |

| Android App Rating | 3.5 | No Rating |

| Number of Android Reviews | 181 | No Reviews |

Bokio vs APARI Prices

Which is cheaper Bokio or APARI? Here are their prices compared.

Free Plans & Trials

| Bokio | APARI | |

| Free Plan? | Yes | No |

| Free Trial? | Yes | Yes |

| Free Trial Length? | 2 months | 30 Days |

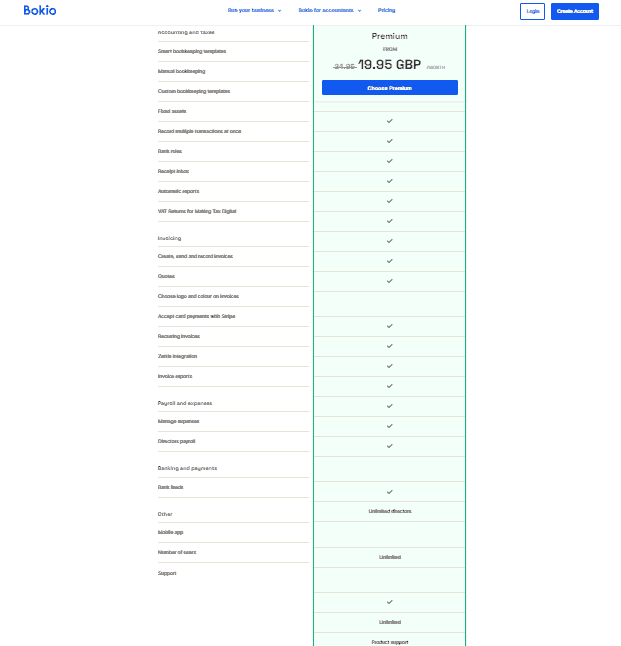

Paid Plan Prices

| Bokio | APARI | |

| Cheapest Plan Cost Per Month | £0.00 | £50.00 |

| Mid-Tier Plan Cost Per Month | £8.99 | NA |

| Top Plan Cost Per Month | £15.99 | NA |

Bokio vs APARI Features

Bokio Basic Features

- Manual accounting – Record your expenses and income.

- Invoicing – Create, send, track and record invoices with your accounting.

- Community – Get tips and share experiences with Bokio users in our community.

Bokio Software Integrations

- Stripe

- Zettle

APARI Basic Features

- Automated data capture from banks, letting agents and investment platforms.

- Tax compliant allocation & categorisation.

- One-click export or submit directly to HMRC.

APARI Software Integrations

Not Listed

Common Feature Comparison

| Bokio | APARI | |

| Payroll Software Integration | Yes | No |

| Track VAT | Yes | Yes |

| VAT Filing | Yes | Yes |

| Real-Time Financial Reports | Yes | No |

| Prepare Self Assessment | Yes | Yes |

| Income Tax Estimates | Yes | Yes |

| Manage Income & Expenses | Yes | No |

| Create Invoices | Yes | No |

| Forecast Cash Flow | Yes | No |

| Accept and Make Payments In Different Currencies | Yes | No |

| Employee Time Tracking | No | No |

| Projects | No | No |

| Bank Feed Integration | Yes | Yes |

| End of Year Filings | No | No |

| Capture Bills And Receipts | Yes | Yes |

| Bulk Reconcile Transactions | Yes | No |

| Track Inventory & Stock Levels | No | No |

| Bokio | APARI | |

| Pros |

|

|

| Cons |

|

|

More Comparisons

Bokio vs Debitoor

Bokio vs Dod-dle Corporation

Bokio vs FEXCO

Bokio vs Forbes Computer Systems Ltd

Bokio vs EasyBooks