Capital on Tap is an online business credit card and loan provider, promising fast applications, a smart app, and low-interest rates. According to the Capital on Tap website, over £2 billion has been lent to 120,000 British businesses so far. Customers can use their physical card or access a credit limit through a business loan. Business rewards and Avios points are also available, depending on which card your business chooses.

Capital on Tap Business Loans & Finance

Business Credit Cards

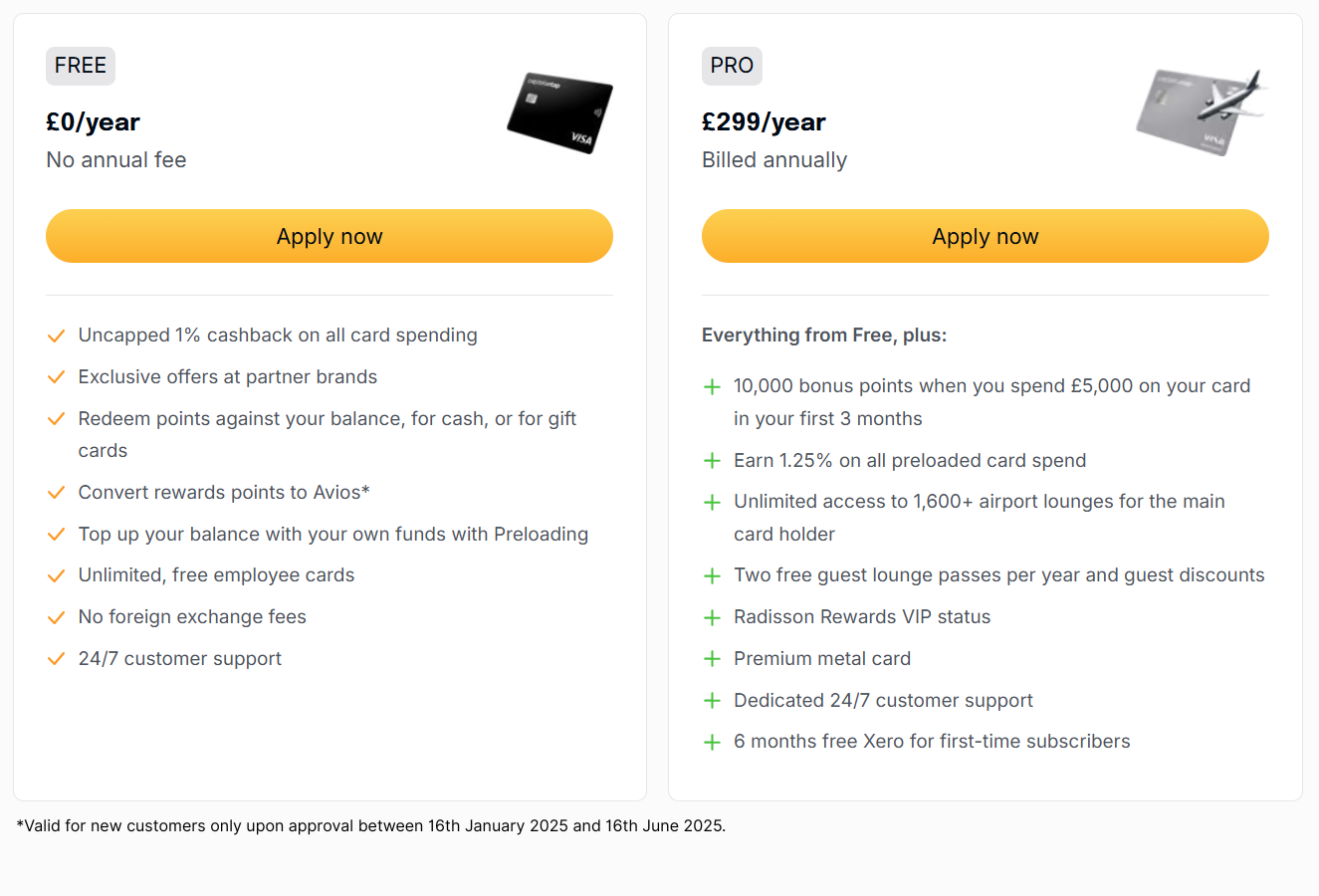

Capital on Tap is an online credit card provider. Customers can access their card limit, interest rates, and pending and past transactions on the online portal and app. There are two cards available, which limited companies are eligible for. Interest rates start from 13.6% APR (variable).

Business Credit Card

- Credit facility of up to £250,000

- Up to 42 days interest-free on card purchases

- No FX or ATM charges

- Unlimited free cards for employees

- Earn 1 point for every £1 of card spend

- Redeem 1 point for 1p (1% cashback)

- No annual fee or sign-up fee

Business Pro Card

- Credit facility of up to £250,000

- Up to 42 days interest-free on card purchases

- No FX or UK ATM charges

- Up to 20 free supplementary cards

- Earn 1 point for every £1 of card spend

- +10,000 bonus points when you spend £5,000 on your card in your first 3 months

- Unlimited access to 1,600+ airport lounges for the main card holder

- Earn 1.25% on all preloaded card spend

- Two free guest lounge passes per year and guest discounts

- £299 annual fee

Business Loans

Capital on Tap is currently not offering business loans but is supporting the government loans including the Bounce Back Loan (no longer available), Pay As You Grow repayment option for the Bounce Back Loan and the British Business Bank finance options.

Capital on Tap Reviews and Ratings

There are lots of positive reviews out there, on both Trustpilot and Google. 90% of Trustpilot reviewers rate Capital on Tap as ‘Excellent’. Overall, customers are very pleased with the speed and efficiency of the service, as well as the financial products on offer. There are a few critics, however, with some saying the app needs work and customer service is disappointingly lacking.

Google reviews are similarly positive, however, a few recent customers have commented that advertised interest rates can be too good to be true. Some customers have found they were charge interest twice with little explanation from the company.

Trustpilot – 4.8/5 (based on 9,120 reviews)

Google Reviews – 4.1/5 (based on 667 reviews)

Reviews.co.uk – no reviews

Smart Money People – 5/5 (based on 2 reviews)

Pros

- Pitched as a smarter, more modern credit card provider.

- Earn 1% cashback for free on all card spend.

- No FX or UK ATM fees

- Most reviews are positive.

Cons

- A few critical voices have had problems with interest charges.

Website: Capital on Tap Website